Introduction

As a seasoned options trader, I’ve witnessed firsthand the profound impact that implied volatility (IV) has on option pricing. It’s akin to a chameleon, constantly changing its hues to reflect the market’s perception of future price fluctuations. Understanding the intricate relationship between IV and option pricing is paramount to maximizing your trading success.

Image: www.ydeho.com

To shed light on this dynamic, let’s delve into the nature of IV and its role in shaping option premiums.

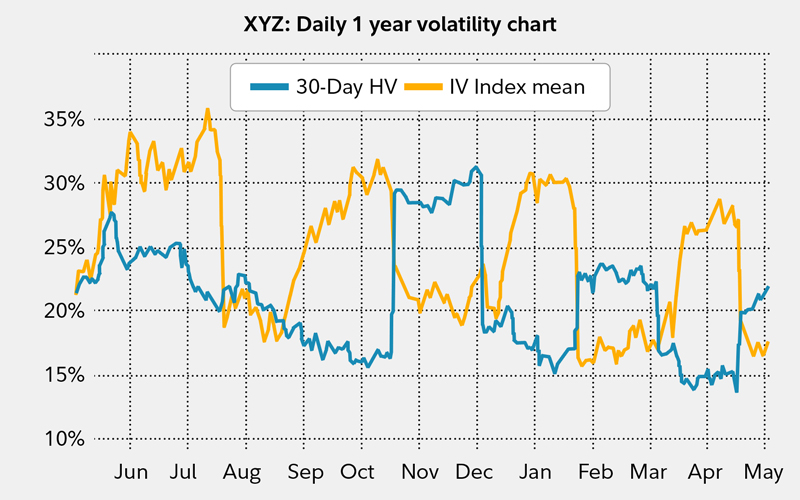

Implied Volatility: The Market’s Crystal Ball

Implied volatility, a forward-looking metric, represents the market’s anticipation of an underlying asset’s price volatility over a specific period. It’s derived from option pricing models and incorporates factors like historical volatility, news events, economic data, and investor sentiment.

A high IV suggests that the market anticipates significant price swings, while a low IV implies a more stable environment. It serves as a crucial input for pricing options, influencing both their premiums and time value.

The Delicate Balance: IV and Option Premiums

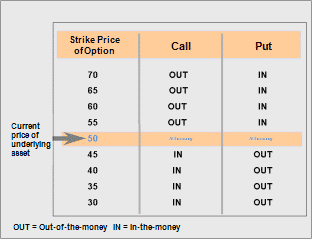

The relationship between IV and option premiums is intricate and nonlinear. As IV rises, so do option premiums, especially for out-of-the-money (OTM) options whose value is primarily derived from time value. This is because higher IV indicates a greater likelihood of the option expiring in the money, thus increasing its potential profitability.

Conversely, when IV decreases, option premiums tend to fall. In-the-money (ITM) options, which have intrinsic value, may experience less of a premium decline compared to OTM options, as their value is less sensitive to IV changes.

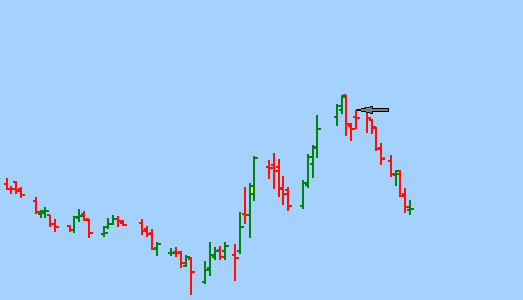

Timing Your Trades: Capitalizing on IV Fluctuations

Seasoned options traders capitalize on IV fluctuations to enhance their profitability. By identifying periods of elevated IV, they can purchase OTM options at a premium that is likely to increase if the underlying asset’s volatility materializes as anticipated. Alternatively, selling options at high IV levels can yield significant returns if volatility subsides, allowing the options to expire worthless.

Recognizing periods of low IV, on the other hand, provides opportunities to acquire ITM options at a relatively lower cost and benefit from their potential increase in value as the underlying asset’s price appreciates.

Image: www.asktraders.com

Expert Tips and Advice

• Consider IV before entering option trades: Assess IV levels and their potential impact on option premiums to make informed trading decisions.

• Utilize IV-adjusted option pricing models: These models incorporate IV into their calculations, providing more accurate estimates of option premiums.

• Monitor IV closely: Stay abreast of factors influencing IV, such as news events and economic data, to adjust your trading strategy accordingly.

Frequently Asked Questions (FAQs)

Q: How can I calculate IV?

A: IV is typically calculated using complex mathematical formulas based on option pricing models like the Black-Scholes model.

Q: What’s the difference between historical volatility and implied volatility?

A: Historical volatility measures past price fluctuations, while IV reflects the market’s expectations for future volatility.

Trading Options How Change In Iv Affects Option Price

Image: optionstradingiq.com

Conclusion

Implied volatility is a multifaceted and dynamic force that plays a pivotal role in option pricing. Comprehending its impact on option premiums and incorporating it into your trading strategy are essential for optimizing your success in the options market. By harnessing the insights provided in this article, you can navigate the often-unpredictable waters of IV fluctuations and reap the rewards of informed option trading.

Is trading options affected by implied volatility an intriguing topic for you? Share your thoughts and let’s delve deeper into this fascinating realm of market dynamics.