In the enigmatic realm of options trading, where predictions hold sway and fortunes can be made or lost, implied volatility (IV) reigns supreme. It’s a metric that whispers secrets of future market sentiment, a crystal ball that tantalizes traders with the promise of unlocking hidden opportunities.

Image: www.pinterest.com

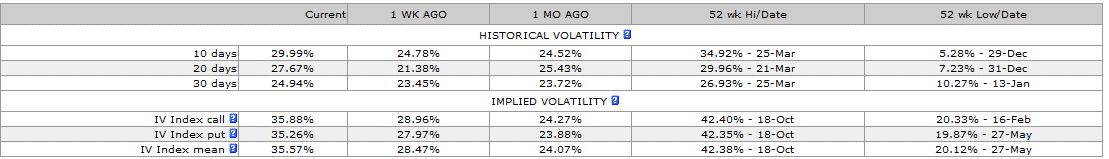

IV is the market’s prediction of the future range of price movements for an underlying asset. It’s a number, expressed as a percentage, that reflects the volatility expected over a specific period. Higher IV indicates higher expected volatility, while lower IV suggests a calmer market. Understanding IV is crucial for options traders who seek to navigate the market’s ebbs and flows with precision.

Delving into the Essence of IV

At its core, IV represents the collective wisdom of the market participants. It’s a reflection of their collective expectations, fears, and hopes regarding the future movement of an asset. When traders believe the market will be tumultuous, IV rises. Conversely, when tranquility is anticipated, IV subsides.

IV also incorporates historical price data into its calculation. This means that past volatility patterns can influence current IV levels. However, it’s important to remember that IV is not a historical measure but rather a forward-looking assessment. It’s not about what has happened but what the market anticipates will happen.

IV’s Impact on Option Premiums

The relationship between IV and option premiums is intertwined. Higher IV leads to higher premiums, as the market demands compensation for the perceived increased risk. Lower IV results in lower premiums, as the perceived risk is lower.

This relationship is critical for options traders to grasp. It means that IV plays a significant role in determining the cost of options. Understanding IV can help traders make informed decisions about whether an option is over or underpriced, providing a valuable edge in the competitive landscape of options trading.

Trading Strategies that Leverage IV

Skilled options traders leverage IV to their advantage, implementing strategies that exploit IV’s dynamic nature. One common strategy is to sell options when IV is high and buy them back when IV is low. This strategy, known as volatility selling, capitalizes on the tendency for IV to regress towards its mean over time.

Another strategy involves trading options with different IV profiles. For example, an options trader might buy an option with high IV if they expect volatility to rise further. Conversely, they might sell an option with low IV if they anticipate volatility to decline.

Image: optionstradingiq.com

Implied Volatility In Options Trading

Mastering IV: A Path to Success

Mastering IV is not a simple undertaking. It requires a thorough understanding of the factors that influence IV and how it interacts with other market dynamics. However, for traders who dedicate the time and effort to gaining proficiency in IV, the rewards can be substantial.

By understanding IV, traders can improve their option pricing decisions, identify trading opportunities, and navigate the ever-changing market landscape with greater confidence. In the high-stakes world of options trading, IV is not just a concept; it’s a guiding star, leading traders towards the path of success.