A Tale of Missed Opportunities

I vividly recall a time when I overlooked the importance of IV rank while trading options. I stumbled upon a stock with historically high implied volatility (IV), expecting substantial profits from the sale of call options. To my dismay, the stock price barely budged, and my options expired virtually worthless. That’s when I discovered the crucial role of IV rank in options trading.

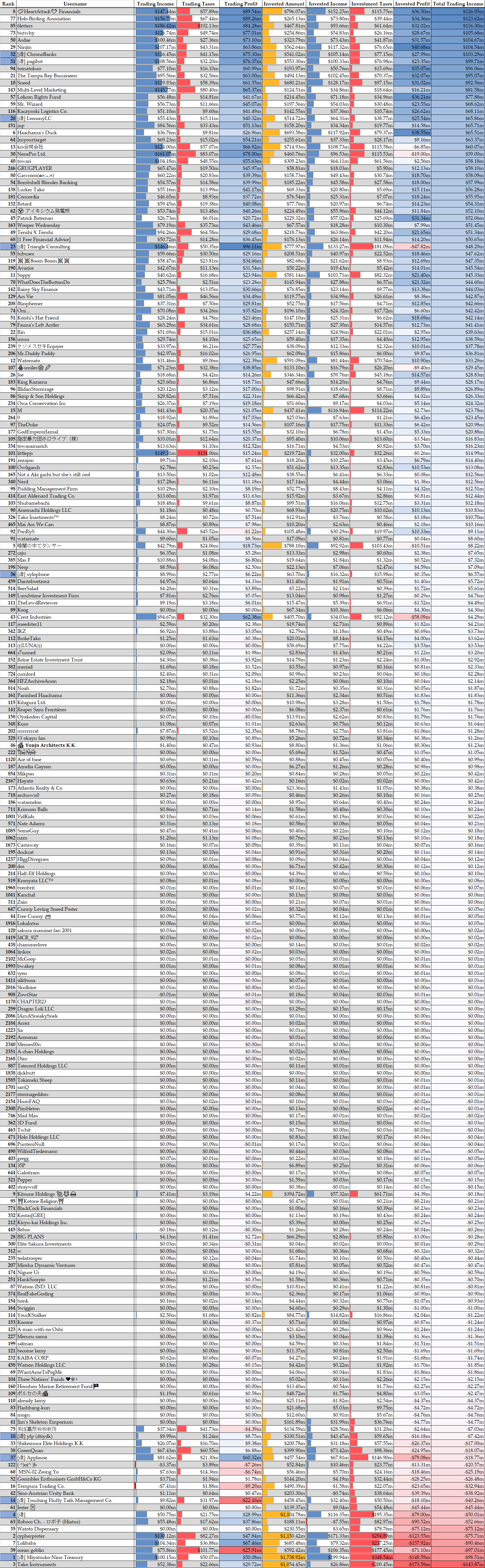

Image: rentry.co

IV Rank: A Key Indicator

IV rank measures the implied volatility of an option relative to other options on the same underlying security. A high IV rank indicates that the market expects the stock to experience significant price movements, while a low IV rank implies less volatility. Understanding IV rank is essential because options with higher IV ranks often command higher premiums, resulting in potentially inflated returns if the stock price moves in the anticipated direction.

Understanding IV Rank Calculation

IV rank is typically calculated by dividing the option’s IV by the average IV of all options on the same underlying security at a specific expiration date. The result is expressed as a percentage, ranging from 0 to 100. Options with IV ranks close to 100 are considered to have high IV, while those with IV ranks near 0 have low IV.

Trading Strategies Utilizing IV Rank

Traders can leverage IV rank to implement various trading strategies:

-

High IV Rank Trades: Sell options with high IV ranks to capitalize on elevated volatility and potentially earn substantial premiums.

-

Low IV Rank Trades: Purchase options with low IV ranks to benefit from potential increases in volatility and reduced option premiums.

-

IV Rank Spreads: Create spreads by buying and selling options with different IV ranks on the same underlying security. These strategies can generate income regardless of the direction of the underlying stock.

Image: www.pinterest.co.uk

Stay Informed and Adapt

The IV landscape is constantly evolving, influenced by factors such as news events, earnings announcements, and economic conditions. Staying updated with the latest market developments and news sources is crucial for successful IV rank trading. Forums and social media platforms can also be valuable resources for insights and updates.

Expert Advice

To enhance your IV rank trading success, consider these expert tips:

-

Use Options Chains: Utilize options chains to compare IV ranks and identify potential trading opportunities.

-

Consider Expiration Dates: Factor in option expiration dates when assessing IV ranks, as IV tends to decay closer to expiration.

-

Monitor Market News: Pay attention to market news and economic data that could impact IV levels.

Frequently Asked Questions (FAQs)

Q: Why is IV rank important in options trading?

A: IV rank helps traders gauge the market’s expectations of future price movements, enabling them to optimize their option strategies.

Q: How do I determine the IV rank of an option?

A: divide the option’s IV by the average IV of all options on the same underlying security at a specific expiration date.

Q: Which is more profitable, high or low IV rank trades?

A: Both strategies can be profitable depending on market conditions. High IV rank trades can yield high premiums, while low IV rank trades benefit from potential volatility increases.

Trading Iv Rank With Options

Image: www.warriortrading.com

Conclusion

Trading IV rank with options requires a comprehensive understanding of the topic. By incorporating IV rank analysis into your trading decisions, you can increase your chances of profiting from options strategies. Stay informed, adapt to market dynamics, and leverage expert advice to enhance your IV rank trading success. Remember, trading options involves inherent risk, so it’s crucial to trade only within your means and seek professional advice if needed.

Would you like to delve deeper into the intriguing world of options trading and IV rank strategies? Your feedback and questions are highly valued; feel free to connect with me. Together, let’s embark on a journey of knowledge and potential trading success!