Introduction

For any trader venturing into the thrilling world of options trading, understanding and effectively navigating trading fees is essential. As one of the leading trading platforms, Moomoo offers a varied range of options trading services. Consequently, comprehending the Moomoo options trading fee structure is crucial for maximizing profit potential. This comprehensive guide delves into the intricacies of Moomoo’s fee structure, exploring each component in detail to equip traders with the knowledge and strategies necessary to enhance their trading decisions.

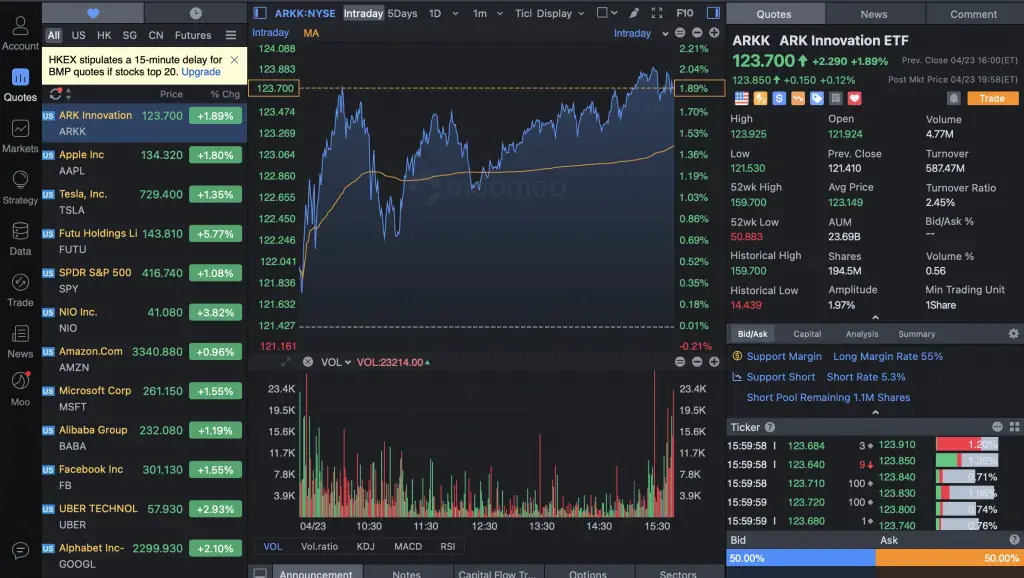

Image: sgstockmarketinvestor.com

Moomoo Options Trading Fee Structure

At its core, Moomoo’s options trading fee structure consists of distinct components:

Commission Fees

- Per-contract commission fee: When opening or closing an options contract, traders are charged a flat fee per contract traded. Moomoo’s per-contract commission fee stands at $0.65, aligning with the industry standard. By promoting a transparent and competitive commission structure, Moomoo empowers traders with greater cost predictability, enabling them to plan their trading strategies effectively.

Option Contract Fees

- Options premium: The options premium, also known as the contract price, represents the payment made by the buyer to the seller to acquire the right to buy or sell the underlying asset at a specified price. This premium incorporates both intrinsic value and time value. It’s crucial to factor in the options premium when calculating the potential profit or loss resulting from an options trade.

Image: thefipharmacist.com

Exercise and Assignment Fees

-

Exercise fee: Exercising an option contract, transforming it into an actual purchase or sale of the underlying asset, incurs an exercise fee. Moomoo charges a $0.65 exercise fee per contract, ensuring transparency and consistency in transaction costs. Understanding the exercise fee allows traders to make informed decisions regarding option exercise strategies, weighing the potential rewards against the associated costs.

-

Assignment fee: In the event that an option contract is assigned, meaning the buyer exercises their right to purchase or sell the underlying asset, the seller is subject to an assignment fee. Moomoo’s assignment fee aligns with the industry standard at $0.15 per contract. Traders holding short option positions need to be aware of potential assignment fees, as they can impact their profit or loss calculations.

Other Fees

- Regulatory fees: Options trading is subject to various regulatory fees imposed by exchanges and regulatory bodies. These fees, typically minimal, cover the costs associated with ensuring market integrity and transparency. Moomoo incorporates these fees into its overall pricing structure, providing traders with a comprehensive view of their trading expenses.

Factors Influencing Moomoo Options Trading Fees

Several factors influence the calculation of options trading fees on the Moomoo platform:

-

Number of contracts traded: The total number of contracts traded directly impacts the overall commission fee incurred. Traders executing large volume trades may benefit from negotiating lower per-contract commission rates with Moomoo.

-

Option type: The type of option traded, whether a call or a put, can affect the per-contract commission fee. Certain options types may carry different fee structures, so traders should be aware of these variations when selecting their trading strategies.

-

Expiration date: Options with shorter expiration periods tend to have higher implied volatility, which can lead to higher options premiums. Consequently, traders may encounter higher fees when trading short-term options contracts.

-

Underlying asset: The underlying asset associated with the options contract, such as stocks, indices, or commodities, can influence the overall trading fees. Options on more volatile underlying assets may command higher premiums and, therefore, incur higher fees.

Strategies to Optimize Options Trading Fees

To optimize options trading fees on the Moomoo platform, consider implementing the following strategies:

-

Negotiate commission rates: Traders with substantial trading volume may have the leverage to negotiate lower per-contract commission rates with Moomoo. By engaging in discussions with the platform, traders can potentially reduce their overall trading costs.

-

Choose longer-term options: Opting for options contracts with longer expiration dates generally results in lower implied volatility and, consequently, lower options premiums. This strategy can help minimize the impact of trading fees on overall profitability.

-

Consider trading index options: Index options, such as those based on the S&P 500 or Nasdaq 100, often have lower premiums compared to individual stock options. By focusing on index options, traders can potentially reduce their trading fees while maintaining exposure to broader market trends.

-

Utilize limit orders: When placing trades, consider using limit orders instead of market orders. Limit orders allow traders to specify the maximum or minimum price they are willing to pay or receive, potentially resulting in more favorable execution prices and reduced fees.

Moomoo Options Trading Fee

Conclusion

Understanding and effectively navigating the Moomoo options trading fee structure is paramount for maximizing profit potential in options trading. By dissecting each component of the fee structure, traders gain a comprehensive understanding of their costs and can make informed decisions that align with their trading strategies. Optimizing trading fees through strategic techniques empowers traders to enhance their profitability and achieve greater success in the dynamic and rewarding world of options trading.