Introduction

Options trading has become an increasingly popular investment strategy, and moomoo has emerged as a leading platform for this exciting financial instrument. With its user-friendly interface, low fees, and robust trading tools, moomoo empowers both seasoned traders and beginners to navigate the options market. In this comprehensive guide, we will explore moomoo options trading fees, providing insights into how they compare to industry standards and what you can expect when trading options on this platform.

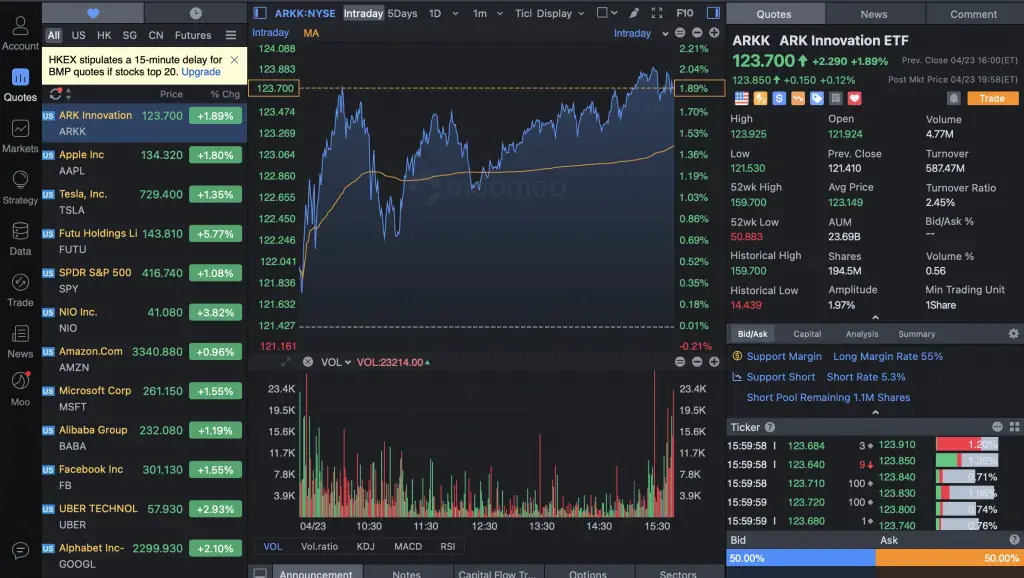

Image: thefipharmacist.com

Understanding moomoo Options Trading Fee Structure

moomoo employs a transparent and competitive fee structure for its options trading services. Here’s a breakdown of the key charges:

Contract Fee: For each options contract traded, moomoo charges a flat fee of $0.65 ($0.35 for first-time depositors). This fee is applicable to both buy and sell orders and remains constant regardless of the option’s strike price or expiration date.

Exercise Fee: If you decide to exercise your options, moomoo will levy an exercise fee of $0.15 per contract. This fee applies to both Call and Put option exercises.

Assignment Fee: When your option contracts are assigned (or you’re obligated to buy or sell the underlying asset), moomoo charges an assignment fee of $0.15 per contract.

moomoo Options Trading Fees: A Comparative Analysis

Now that you have a clear understanding of moomoo options trading fees, let’s compare them with industry standards to gauge their competitiveness.

Compared to other popular options trading platforms, moomoo’s contract fee of $0.65 is on the lower end of the spectrum. Many reputable brokers charge fees ranging from $0.75 to $1.00 per contract. moomoo’s exercise and assignment fees of $0.15 per contract are also highly competitive, matching or even undercutting industry benchmarks.

Tips for Minimizing moomoo Options Trading Fees

While moomoo’s options trading fees are relatively low, there are a few strategies you can employ to further minimize your expenses:

-

Take advantage of first-time depositor discounts: First-time depositors on moomoo enjoy a reduced contract fee of $0.35. If you’re new to options trading, consider opening an account with moomoo to take advantage of this cost-saving opportunity.

-

Trade multiple contracts at once: moomoo offers reduced contract fees when you trade multiple contracts of the same underlying stock or ETF. For example, trading five or more contracts of the same underlying security will lower the contract fee to $0.55 per contract.

-

Consider covered calls and cash-secured puts: These option strategies involve selling options while owning the underlying asset (covered calls) or holding cash in your account (cash-secured puts) as collateral. Since you’re selling options in these strategies, you’ll typically receive a net credit, which can offset the fees associated with the trade.

Image: derivfx.com

Moomoo Options Trading Fees

Image: www.youtube.com

Conclusion

moomoo’s options trading fees are competitive and transparent, offering traders a cost-effective way to participate in the options market. By understanding the fee structure and implementing the tips outlined in this guide, you can minimize your trading expenses and maximize your potential profits. Whether you’re an experienced options trader or just starting to explore this exciting financial instrument, moomoo’s user-friendly platform and low fees make it an ideal choice for investors of all levels.

Are you intrigued by the world of options trading? Don’t miss future updates and insights by signing up for our newsletter!