Embarking on the enticing realm of option trading through Moomoo is an exciting prospect, yet it demands careful preparation and adherence to specific guidelines. This comprehensive guide will illuminate the path toward obtaining approval from Moomoo for option trading, empowering you with the knowledge and strategies to navigate the application process seamlessly.

Image: thefinance.sg

Understanding Option Trading

Option trading involves the buying and selling of contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predefined price on a specified date. These contracts, known as options, offer investors the flexibility to capitalize on potential market movements while mitigating potential risks.

Moomoo’s Requirements

Moomoo, as a FINRA-member broker-dealer, imposes certain requirements on its clients seeking approval for option trading. These requirements are meticulously designed to ensure that clients possess the requisite knowledge and experience to engage in this complex financial instrument.

Applying for Option Trading Approval

The application process for obtaining approval from Moomoo for option trading is straightforward but requires meticulous attention to detail. Applicants must fulfill the following steps:

- Complete the Option Trading Application

- Submit supporting documentation (e.g., investment account statements, tax returns)

- Successfully pass the Options Knowledge Exam

- Receive approval from Moomoo’s Compliance Department

Image: thefipharmacist.com

Passing the Options Knowledge Exam

Moomoo’s Options Knowledge Exam assesses an applicant’s understanding of the fundamental concepts and risks associated with option trading. To prepare for the exam, applicants should diligently study the provided Study Guide and familiarize themselves with key terms, strategies, and market dynamics.

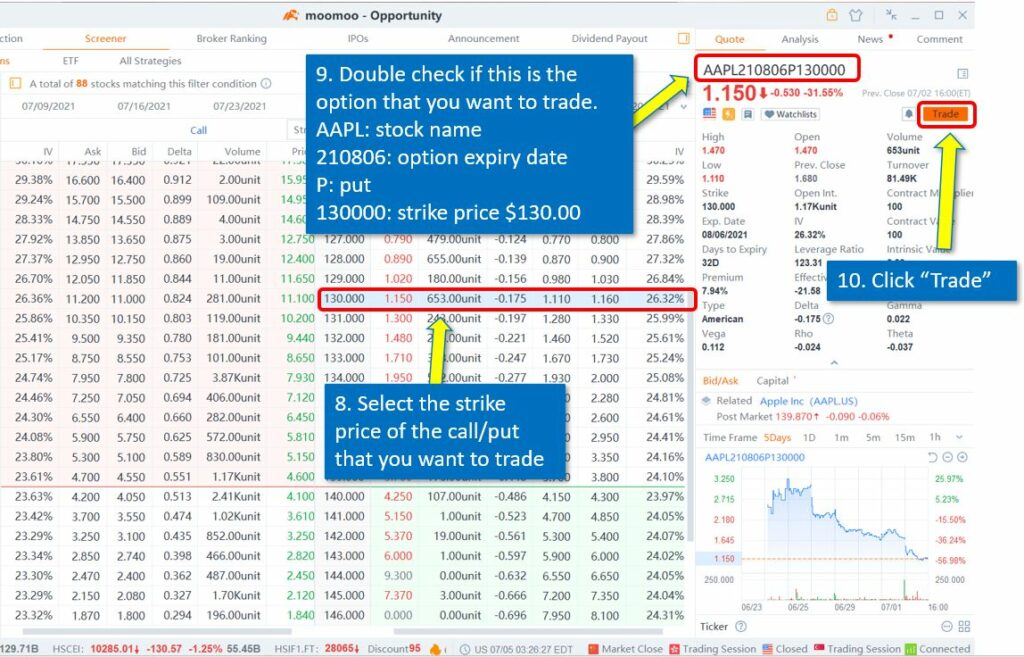

Moomoo’s Option Trading Features

Upon receiving approval from Moomoo, traders are granted access to a robust platform that empowers them to execute option trades. Moomoo’s advanced features include:

- Real-time market data and charting tools

- Advanced order types and risk management strategies

- Educational resources and support

Getting Started with Option Trading

Armed with the knowledge and approval from Moomoo, aspiring option traders are poised to embark on this exciting journey. However, it is crucial to proceed with caution and adhere to risk management principles:

- Start small, gradually increasing trading volume as confidence and experience grow

- Diversify portfolio by trading options on different underlying assets

- Continuously monitor market movements and adjust strategies accordingly

- Seek guidance from experienced traders or financial professionals as needed

FAQs: Obtaining Option Trading Approval on Moomoo

Q: What is the minimum account balance required to apply for option trading approval on Moomoo?

A: Moomoo does not specify a minimum account balance requirement for option trading approval. However, applicants should maintain a sufficient account balance to cover potential trading losses.

Q: How long does it typically take to get approved for option trading on Moomoo?

A: The processing time for option trading applications on Moomoo varies, but it typically takes 1-2 business days after submitting all required documents and passing the knowledge exam.

How To Get Approved On Moomoo For Option Trading

Image: prudentdreamer.com

Conclusion

Navigating the path to obtaining approval from Moomoo for option trading demands meticulous preparation and adherence to the broker’s requirements. By understanding the intricacies of option trading, familiarizing yourself with Moomoo’s process, and diligently applying our expert tips, you can embark on this exciting investment journey with confidence. Are you ready to unlock the potential of option trading with Moomoo?