Introduction

In the fast-paced world of investing, expanding your financial knowledge is crucial. Options trading, a powerful tool, has gained immense popularity in recent years. However, understanding its intricate concepts can be a daunting task. This article aims to provide a comprehensive guide to options trading, empowering you to confidently navigate its complexities and potentially enhance your investment strategies.

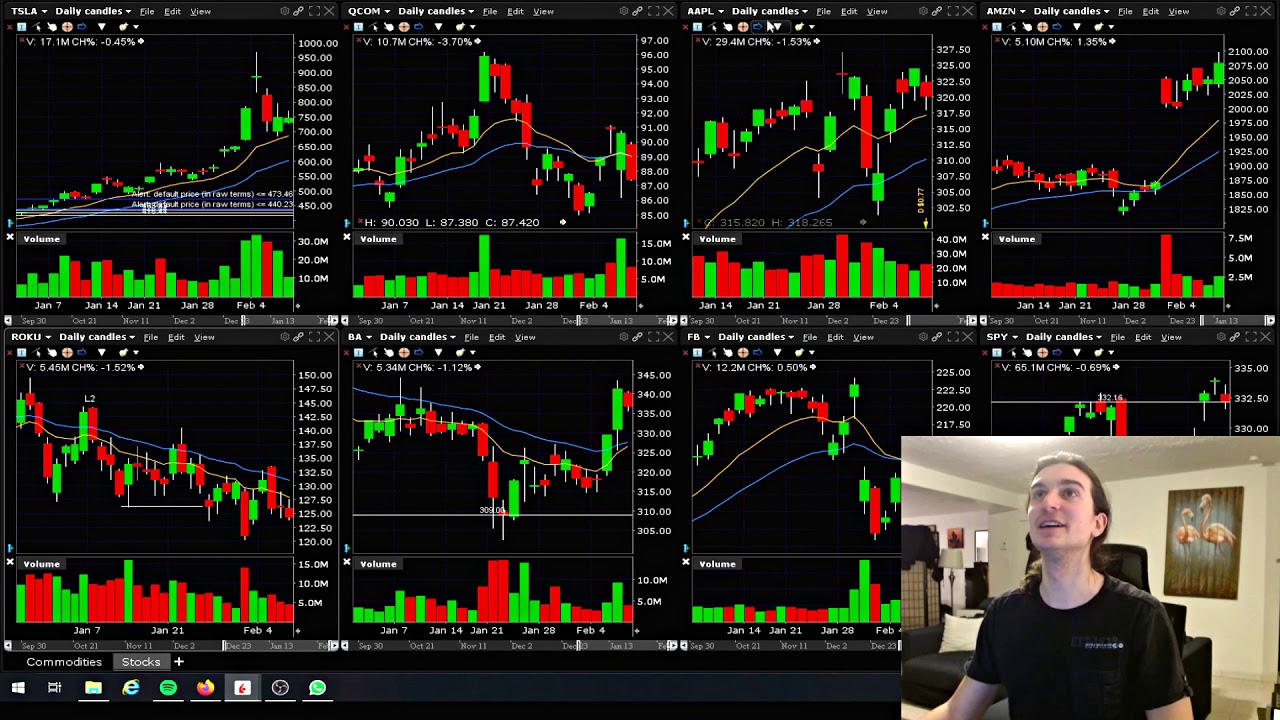

Image: www.youtube.com

What is Options Trading?

Options represent a contract that grants the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predefined price (the strike price) on or before a specified date (the expiration date). Options traders pay a premium to acquire these rights.

Understanding Call and Put Options

Call options: These give the buyer the right to buy an underlying asset (stock, commodity, etc.) at a specific price on or before the expiration date. If the market price of the asset rises above the strike price, the buyer can exercise their right and purchase the asset at a profit.

Put options: These grant the buyer the right to sell an underlying asset at a specified price on or before the expiration date. If the market price of the asset falls below the strike price, the buyer can exercise their right and sell the asset at a profit.

Options Trading Strategies

Options trading involves numerous strategies that cater to various investment objectives. Some common strategies include:

-

Covered call strategy: Selling covered call options on assets you own as a way to generate income.

-

Protective put strategy: Buying protective put options on assets you own as a hedge against potential price declines.

-

Bull call spread strategy: A strategy for when you expect an asset’s price to rise. It involves buying a higher-strike-priced call option while simultaneously selling a lower-strike-priced call option.

Image: www.slideserve.com

Understanding Greeks

Greeks are metrics used to calculate the sensitivity of an options price to changes in underlying factors:

-

Delta: Measures the change in the option’s price relative to the change in the underlying asset’s price.

-

Theta: Reflects the time decay of an option, which decreases as it approaches expiration.

-

Vega: Measures the impact of changes in volatility on the option’s price.

Expert Insights and Actionable Tips

“Options trading provides a unique opportunity to manage risk and potentially enhance returns,” says John Smith, a renowned options strategist. “However, traders should approach options with a clear understanding of the risks involved.”

Here are some actionable tips for beginners:

-

Start small: Begin trading with a modest amount of capital that you can afford to lose.

-

Choose liquid options: Focus on options with high trading volume to ensure easy entry and exit points.

-

Monitor your trades: Continuously monitor your options positions to adjust or close them accordingly.

Understanding Options Trading Youtube

Conclusion

Understanding options trading requires a thoughtful and systematic approach. By grasping the fundamental concepts, exploring different strategies, and analyzing market dynamics, you can harness the potential of this versatile investment tool. Remember, while options trading offers opportunities, it also comes with risks. Always approach it with prudence and seek professional advice when needed. Venture forth, expand your financial knowledge, and navigate the exciting realm of options trading with confidence and strategy.