Have you ever wondered why options sometimes have value even when they’re unlikely to be exercised? The answer lies in the concept of time value. In the world of options trading, understanding time value is crucial for unlocking the potential profits and mitigating risks associated with these versatile contracts.

Image: www.dreamgains.com

Time value, simply put, is the value attributed to an option solely because time has not yet elapsed. Options have an expiration date, and as that date approaches, the option’s time value gradually diminishes. This is because the option’s potential to gain or lose value is reduced with less time remaining to exercise it.

The Intrinsic Value and Time Value Equation

Every option contract has two components of value: intrinsic value and time value. Intrinsic value, as the name suggests, is the inherent value the option would have if it were exercised immediately. It is calculated by subtracting the strike price (the price at which the option can be exercised) from the underlying asset’s current price for a call option, or vice versa for a put option.

Time value, on the other hand, is the value assigned to the option based on the remaining time until its expiration. The longer the time until expiration, the greater the option’s potential to gain or lose value, and thus the higher its time value.

Factors Influencing Time Value

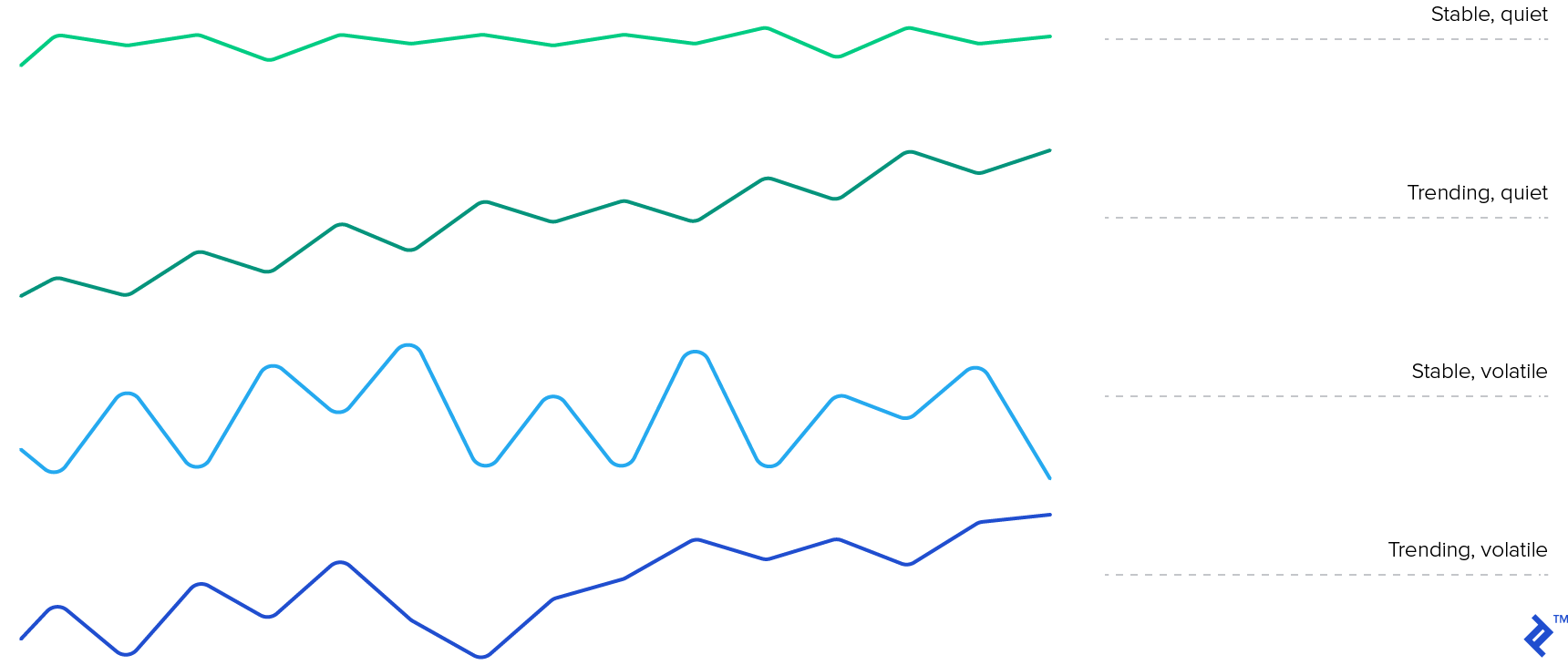

Several factors influence time value, including:

- Time to Expiration: As mentioned earlier, the closer an option is to expiration, the lower its time value.

- Volatility: High volatility in the underlying asset increases option time value, as it increases the probability of significant price movements that could render the option profitable.

- Interest Rates: Rising interest rates tend to decrease option time value, as they make holding cash more attractive compared to buying options.

- Short Interest: High short interest in the underlying asset can drive up option time value, as short sellers are often buying up options to hedge their positions.

Leveraging Time Value in Options Trading

Options traders can harness time value to their advantage in several ways:

- Time Decay: Holding an option until expiration allows its time value to erode, which can be used to profit from time decay strategies.

- Buying Options Early: Purchasing options with substantial time value can provide potential for higher returns than those bought closer to expiration.

- Selling Covered Calls: Selling covered calls on stocks you own can generate income from the time value of the options while limiting your exposure to potential losses.

The Emotional Nature of Time Value

Understanding time value is not only about grasping its technical aspects but also recognizing its emotional significance. Options contracts represent a gamble on future market conditions, and time value embodies the hopes and fears associated with that uncertainty. It is this emotional component that often drives market sentiment and influences option pricing.

Time value can amplify both the joy and despair of options trading. Successful traders learn to manage their emotions, recognizing that while time value can be a source of great profit, it can also be a relentless drain on their portfolio.

Conclusion

Time value is an integral element of options trading, offering both opportunities and risks to traders. By mastering this concept, investors can unlock the full potential of options and navigate the volatile waters of market uncertainty with greater confidence. Remember, time is not merely a measure of duration; it is currency in the world of options, and those who know how to manipulate it wield a formidable advantage.

:max_bytes(150000):strip_icc()/TheImportanceofTimeValueinOptionsTrading2_3-6a8bae9f6ab84187808cffecf5840515.png)

Image: www.investopedia.com

What Is Time Value In Options Trading

Image: www.fondazionealdorossi.org