Captivating Introduction

In the tumultuous realm of financial options, volatility reigns supreme, constantly swaying the fortunes of traders. Understand and harness the power of implied volatility (IV) and witness your options trading endeavors soar to new heights. IV serves as a roadmap, illuminating the path to potential profits while steering you clear of market upheavals. Embark on an exclusive journey, where we unveil the intricacies of IV and empower you with actionable strategies to master its unpredictable dance.

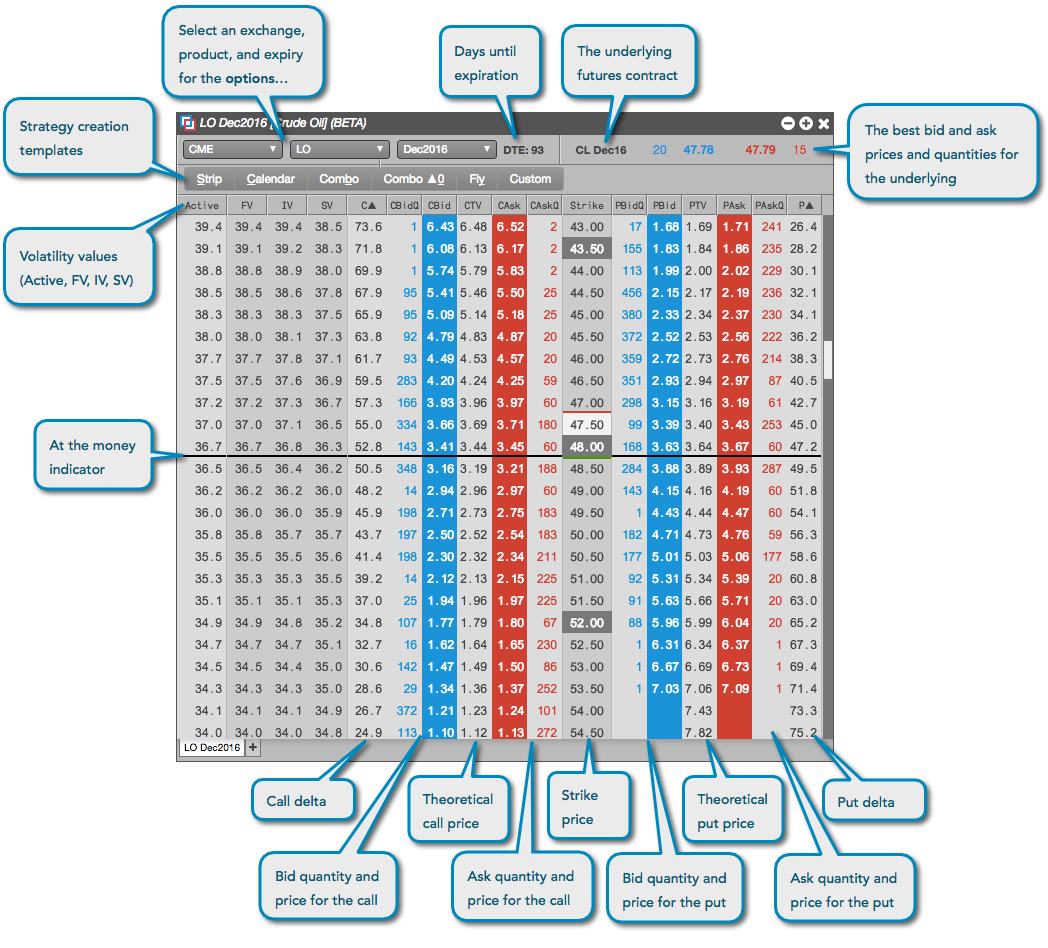

Image: library.tradingtechnologies.com

Unveiling the Enigma of Implied Volatility

Implied volatility, the oracle of options trading, holds the key to deciphering future market movements. It estimates the magnitude of price fluctuations within a specified time frame. Envision IV as a crystal ball, offering a glimpse into the market’s anticipated volatility, guiding your decisions with increased precision. Dynamic and ever-changing, IV responds to a myriad of factors, including news, economic data, and shifts in investor sentiment.

Decoding IV’s Impact on Options Pricing

Like a symphony conductor, IV orchestrates the pricing of options instruments. Higher IV translates into higher option premiums, reflecting the market’s perception of greater potential price swings. Conversely, diminished IV lowers premiums, signifying a calmer market outlook. Grasping this relationship empowers you to gauge the attractiveness of option strategies and profit from market expectations.

Navigating the IV Landscape

Approaching IV demands strategic acumen. Consider employing options with longer expiry dates, as they exhibit greater sensitivity to IV changes. Conversely, shorter-dated options offer less pronounced IV impact. Additionally, select options on highly liquid underlying assets, as thinner markets tend to amplify IV fluctuations. By adapting to the IV landscape, you harness its power to your trading advantage.

Image: hindi.adigitalblogger.com

Mastering Volatility Exploits

Ride the IV rollercoaster with calculated maneuvers. When IV spikes due to unexpected market events, seize the opportunity to sell options and reap risk premium. Conversely, during periods of low IV, consider buying options to capitalize on potential price surges. By exploiting IV dynamics, you unlock the secrets of profiting from market fluctuations.

Seeking Expert Guidance

Venturing into IV’s intricate world requires trusted counsel. Seek advice from seasoned professionals who have navigated its complexities with aplomb. Engage with industry thought leaders through forums, seminars, or consult one-on-one for personalized guidance. Their insights illuminate the path toward informed decision-making.

Iv In Option Trading

Conclusion: Steering Your Trading Destiny

Implied volatility, the elusive force that governs options trading, can either propel you to success or lead you astray. By understanding its multifaceted nature and employing strategic tactics, you gain the edge in this exhilarating arena. Ride the IV rollercoaster with confidence, embrace market volatility, and unlock the path to unparalleled financial opportunities.