In the intricate realm of financial markets, where risk and reward intertwine, options trading emerges as a sophisticated strategy that empowers investors to navigate volatility, enhance returns, and hedge against potential losses. Understanding the nuances of security options trading is paramount for savvy investors seeking to maximize their financial acumen and navigate the ever-evolving market landscape.

Image: www.financeorange.com

Delving into Security Options Trading: A Primer

Security options, succinctly defined, represent contracts that grant buyers the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, bond, or commodity, at a predetermined price (strike price) within a specified time frame (expiration date). These contracts serve as valuable tools for investors to speculate on the future price movements of underlying assets, manage risk, and generate income through premium payments.

The significance of security options trading extends beyond its versatility. They provide a potent means for investors to enhance their returns, particularly in volatile markets. By understanding the dynamics of supply and demand, and skillfully maneuvering strike prices and expiration dates, investors can potentially profit from both upward and downward price movements, unlocking opportunities for diversification and risk mitigation.

Navigating the Options Trading Landscape: A Comprehensive Guide

To fully comprehend security options trading, investors must embark on a journey through its multifaceted dimensions. This entails delving into the history of options, grasping the fundamental concepts that underpin their functioning, and recognizing the practical applications that make them an indispensable tool in the financial toolkit.

A Glimpse into the Past: The Historical Evolution of Options

Options trading has its roots in ancient Greece, where rudimentary forms of these contracts were employed in commodity trading. Over the centuries, options gradually gained traction, with Amsterdam emerging as a significant hub for options trading in the 17th century. The invention of standardized options in the 20th century marked a pivotal moment, revolutionizing options trading and facilitating accessibility for a broader range of investors.

Image: www.paybito.com

Unveiling the Cornerstones of Options Trading: Fundamental Concepts

The intricate world of options trading rests upon several fundamental concepts that serve as the building blocks of this dynamic financial instrument. Grasping these concepts is pivotal to harnessing the potential of options trading effectively.

- Call Option: A contract that grants the buyer the right to purchase an underlying asset at a predetermined price within a specified time frame.

- Put Option: A contract that grants the buyer the right to sell an underlying asset at a predetermined price within a specified time frame.

- Strike Price: The price at which the buyer can buy or sell the underlying asset as per the terms of the option contract.

- Expiration Date: The date on which the option contract expires, rendering it void if unexercised.

- Premium: The price paid by the buyer to the seller for the option contract, representing the cost of acquiring the right to buy or sell the underlying asset.

Real-World Applications: Unveiling the Potential of Options Trading

The versatility of security options trading extends to diverse applications in the financial markets. Investors employ these contracts to pursue a myriad of financial objectives, ranging from speculative ventures to risk management strategies.

- Speculation: Options provide investors with the opportunity to capitalize on anticipated price movements of underlying assets, enabling them to profit from both bullish and bearish market scenarios.

- Hedging: Options serve as a powerful tool for managing risk, allowing investors to protect their portfolios from potential losses in the event of adverse price movements.

- Income Generation: Options trading offers avenues for investors to generate income through premium payments, either by selling options contracts or employing strategies such as covered calls.

Contemporary Trends and Advancements in Security Options Trading

The landscape of security options trading is continuously evolving, propelled by technological advancements and innovation. These trends are shaping the way investors approach options trading, enhancing efficiency, transparency, and accessibility.

- Electronic Trading Platforms: Electronic trading platforms have revolutionized options trading, providing investors with real-time access to market data, streamlined order execution, and enhanced liquidity.

- Algorithmic Trading: The advent of algorithmic trading has introduced sophisticated software programs that automate options trading strategies, enabling investors to execute complex trades with precision and speed.

- Mobile Trading: The proliferation of mobile trading applications has democratized access to options trading, empowering investors to manage their portfolios conveniently from anywhere, at any time.

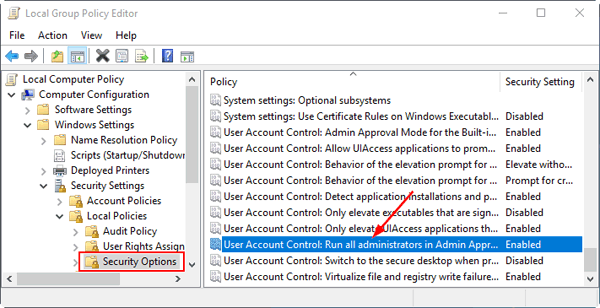

Security Options Trading

Image: www.top-password.com

Conclusion: Empowering Investors through Security Options Trading

Security options trading represents a powerful financial tool that empowers investors to navigate market volatility, enhance returns, and manage risk. By delving into the intricacies of options trading, investors can unlock a world of financial opportunities, harnessing the potential to maximize their returns and mitigate potential losses. In today’s dynamic financial landscape, security options trading has become an indispensable tool for savvy investors seeking to navigate the complexities of the markets and achieve their financial aspirations.