Introduction:

In the realm of options trading, navigating the intricacies of various strategies is paramount. Among them, the delta options trading strategy stands out as a versatile and potentially lucrative approach. Understanding the basics, advantages, and limitations of this strategy can empower traders to make informed decisions and maximize their profitability. This article delves deeply into the dynamics of the delta options trading strategy, exploring its historical roots, core concepts, and practical applications.

Image: www.youtube.com

Unveiling the Essence of Option Deltas:

The foundation of the delta options trading strategy lies in understanding option deltas, a measure of how much an option’s price changes in response to a one-dollar change in the underlying asset’s price. Deltas range from -1 to +1, capturing the full spectrum of option behaviors. Long call options carry positive deltas, indicating that they rise in value when the underlying asset appreciates. Short calls, on the contrary, possess negative deltas, reflecting their decline in worth as the underlying asset increases in price. Conversely, long put options have negative deltas, benefiting from a depreciation in the underlying asset’s value, while short puts display positive deltas.

Understanding the Power of Hedging through Delta Neutrality:

The essence of the delta options trading strategy lies in achieving delta neutrality, a delicate balance where the combined deltas of the options positions create a negligible net delta exposure. This strategic objective aims to mitigate the risks associated with underlying asset price fluctuations, effectively creating a hedged portfolio. By pairing an appropriate combination of long and short options with opposite deltas, traders can lock in their desired level of risk tolerance, safeguarding against significant losses.

Navigating the Strategy’s Execution:

Executing the delta options trading strategy requires a meticulous approach and careful consideration of market dynamics. Option traders must first identify an underlying asset with predictable price behavior and ample trading volume to support their trading endeavors. Once a suitable asset is chosen, the next step involves selecting a strike price aligned with the desired delta exposure. By strategically combining long and short options of different strike prices and expiries, traders can fine-tune the delta neutrality of their portfolio, tailoring it to their specific risk-reward profile.

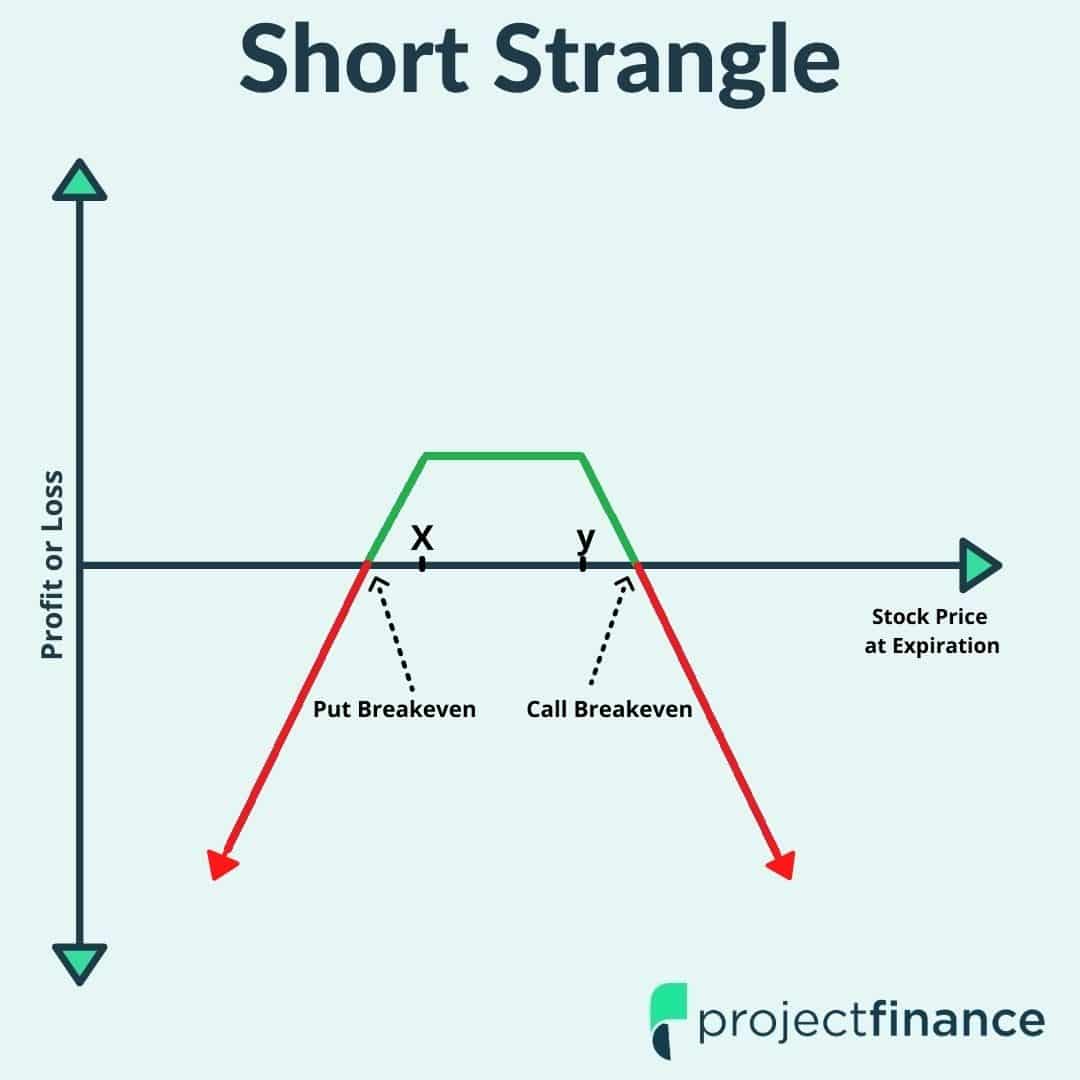

Image: www.projectfinance.com

Examples Illustrating the Strategy’s Application:

Example 1: Creating a delta-neutral hedge to protect against potential losses from an existing stock position.

Example 2: Employing a bullish delta options strategy to capture potential gains in an anticipated bull market.

Example 3: Using a neutral delta spread to capitalize on market volatility while simultaneously mitigating risk.

These examples showcase the versatility of the delta options trading strategy, highlighting its adaptability to various market scenarios.

Understanding the Drawbacks and Limitations:

While the delta options trading strategy offers numerous advantages, it is not immune to drawbacks. Like any trading strategy, it involves inherent risks that traders must acknowledge. Market volatility can significantly impact delta values, potentially disrupting the sought-after delta neutrality of the portfolio. Traders should also bear in mind that “Greeks,” including delta, are constantly changing, requiring constant monitoring and diligent risk management.

The Delta Options Trading Strategy

Image: www.sofi.com

Embracing Delta Options Trading for Success:

In the hands of experienced and knowledgeable traders, the delta options trading strategy can be a powerful tool for managing risk, enhancing returns, and navigating the ever-changing financial markets. However, it is important to remember that successful implementation requires a thorough understanding of option dynamics and risk management principles. By embracing calculated decision-making, continuous learning, and a pragmatic approach, traders can unlock the full potential of the delta options trading strategy, unlocking consistent profitability within the realm of options trading.