Introduction

When it comes to investing your hard-earned money, there are two main strategies to choose from: options trading and long-term investing. Both approaches offer the potential for financial gain, but they involve different levels of risk and reward. In this comprehensive guide, we’ll delve into the nuances of options trading and long-term investing to help you make an informed decision about which strategy aligns best with your financial goals and risk tolerance.

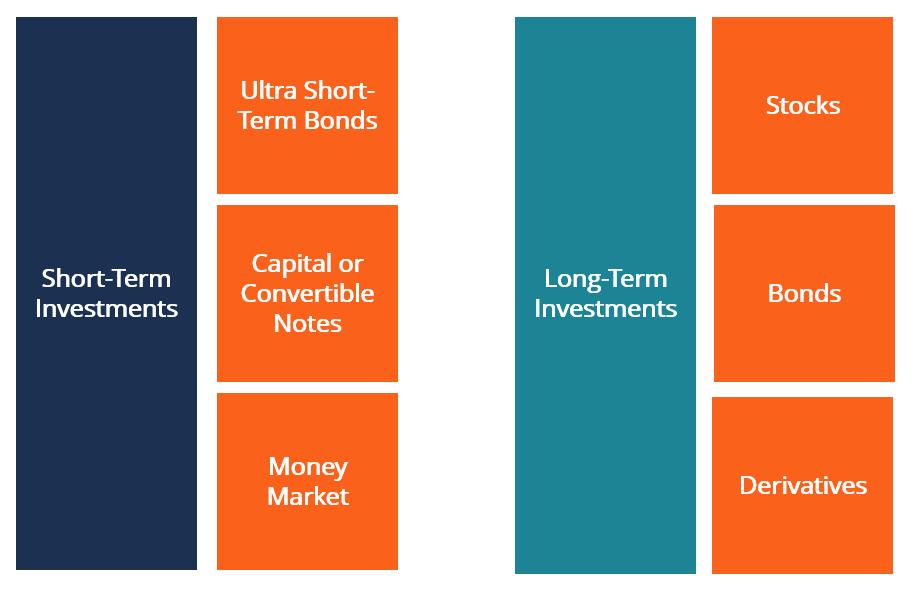

Image: kenyanwallstreet.com

Understanding Options Trading

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Unlike stocks or bonds, options do not represent ownership in the underlying asset. Instead, they provide the buyer with leverage, allowing them to control a large number of shares with a relatively small investment.

There are two main types of options: calls and puts. Calls grant the buyer the right to buy the underlying asset, while puts provide the right to sell. The price at which the option can be exercised is called the strike price. The date on which the option expires is known as the expiration date.

Benefits of Options Trading

- Leverage: Options provide leverage, allowing investors to control a larger number of shares with a smaller investment compared to buying the underlying asset outright.

- Flexibility: Options offer flexibility as they provide various strategies to meet different investment goals, such as speculating on price movements, hedging against risks, or generating income.

- Potential for High Returns: Options have the potential to generate high returns, especially in volatile markets where the underlying asset experiences significant price fluctuations.

Risks of Options Trading

- High Risk: Options trading carries significant risk as options can lose value quickly, resulting in potential losses for investors.

- Complexity: Options trading can be complex and requires a thorough understanding of market dynamics and option pricing models.

- Time Sensitivity: Options have an expiration date, so investors need to carefully manage their positions and make timely decisions to avoid losing the value of their investment.

Image: www.youtube.com

Options Trading Vs Long Term Investing

Image: www.youtube.com

Understanding Long-Term Investing