Introduction

Image: ournifty.com

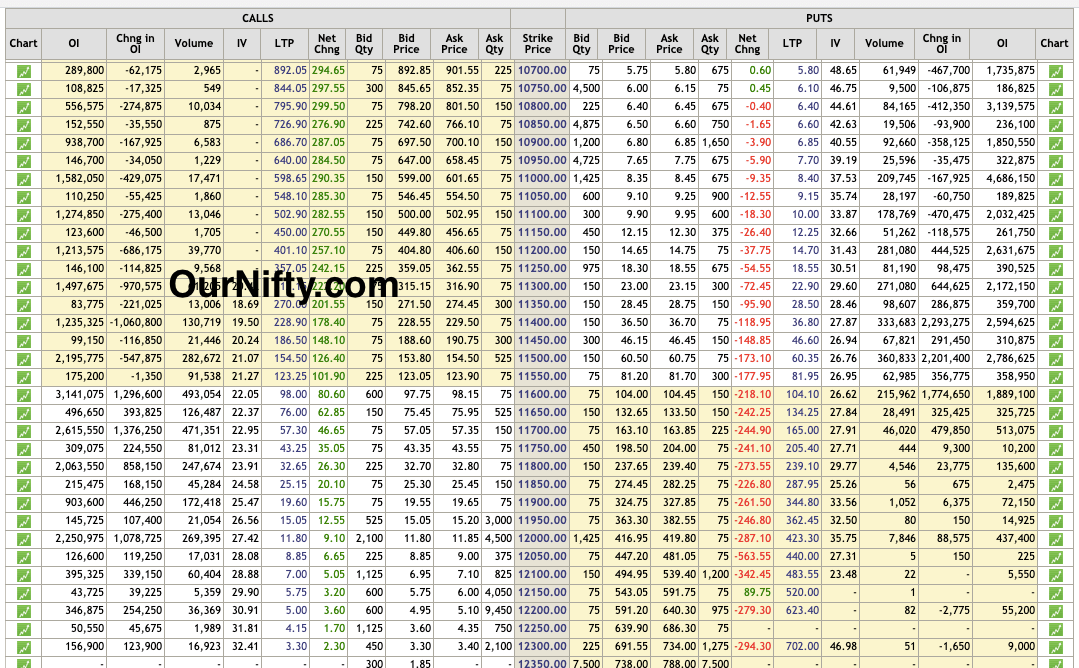

In the realm of finance, options trading offers the potential for substantial gains. Among the various financial instruments available, Nifty options emerge as a versatile and lucrative option for investors seeking exposure to the Indian stock market. With the right blend of knowledge and execution, investors can navigate the intricacies of Nifty option trading and unlock remarkable returns. This comprehensive guide will unveil the secrets of Nifty option trading techniques, empowering you with the strategies and insights necessary to succeed in this dynamic market.

Understanding Nifty Options

Nifty options represent contracts that provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset, which is the Nifty 50 index. These contracts come with a specified expiry date, representing the last day on which the options can be exercised. Understanding the strike price, the price at which the underlying asset can be traded, and the premium, the price paid to acquire the option, is fundamental to successful trading.

Prevalent Nifty Option Trading Techniques

The Nifty option market offers an array of trading techniques, each catering to varying risk appetites and return objectives. Some of the widely adopted techniques include:

-

Bull Call Spread: This strategy involves buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price. The aim is to profit from a moderate increase in the underlying asset’s value.

-

Bear Put Spread: Conversely, this technique involves buying a put option at a higher strike price and selling a put option at a lower strike price. It benefits from a moderate decline in the underlying asset’s value.

-

Straddle: Straddle options involve buying both a call and a put option at the same strike price. This strategy aims to capture significant price movements in either direction.

-

Strangle: Similar to a straddle, a strangle involves buying both a call and a put option, but the strike prices are placed wider apart. It is designed for situations with higher volatility.

-

Iron Condor: This combination strategy involves buying an out-of-the-money call and put option while simultaneously selling an at-the-money call and put option. Iron condors seek to profit from a moderate and controlled movement in the underlying asset’s value.

Expert Insights

Renowned investment experts acknowledge the potential of Nifty option trading but emphasize prudent risk management. “Option trading can amplify both gains and losses,” warns Mr. Ashish Kacholia, a seasoned equity market expert. “Thorough research and strategic trading decisions are crucial to avoid excessive risks.”

Ms. Riddhi Desai, a renowned fund manager, advises beginners to start with “simple strategies like covered calls and cash-secured put

Image: in.tradingview.com

Nifty Option Trading Techniques

https://youtube.com/watch?v=l-sUzvGsIDQ