Navigating the World of Options Trading: Tips and Insights

In the realm of finance, options trading stands out as a captivating and multifaceted discipline. Offering investors the potential for both lucrative returns and calculated risks, understanding options trading strategies is paramount to unlocking its full potential. This comprehensive blog aims to demystify the intricacies of options trading, providing you with the tools and knowledge to craft winning strategies.

Image: www.projectfinance.com

Options Trading 101: A Historical Perspective

The origins of options trading can be traced back to the 17th century, with the first documented options contract attributed to the Dutch. These early contracts were primarily used for agricultural commodities, allowing farmers to hedge against price fluctuations. Over time, options trading evolved and expanded into various financial instruments, becoming an integral part of modern financial markets.

Unveiling the Essence of Options Trading

At its core, options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Unlike futures contracts, which obligate the holder to buy or sell the asset, options confer flexibility and allow for strategic decision-making.

Breaking Down Options Terminology: Calls and Puts Explained

In the options trading arena, two primary types of contracts exist: calls and puts. Call options provide the holder with the right to buy the underlying asset, while put options grant the right to sell it. Understanding the distinction between these two contracts is crucial for formulating effective trading strategies.

Image: www.pinterest.com

Calls: Betting on Asset Appreciation

When an investor believes that the price of an underlying asset will increase, they may choose to purchase a call option. If their prediction holds true, the call option’s value will rise, allowing them to exercise their right to buy the asset at a favorable price and potentially profit from the price appreciation.

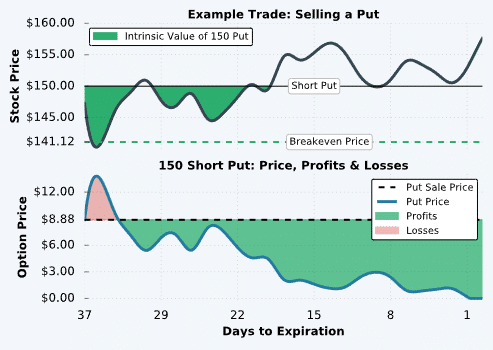

Puts: Capitalizing on Asset Depreciation

Conversely, if an investor anticipates a decline in the underlying asset’s price, they may opt for a put option. Put options allow the holder to sell the asset at a predetermined price, even if the market price has fallen below that level. This strategy enables investors to hedge against potential losses or profit from market downturns.

Options Trading Strategies: Unveiling the Multifaceted Landscape

Crafting winning options trading strategies requires a nuanced understanding of the available strategies and their respective risks and rewards. Some of the most common options trading strategies include:

- Covered Call Strategy: Selling a call option against a stock that the trader already owns, generating additional income while limiting downside risk.

- Cash-Secured Put Strategy: Selling a put option while holding cash equal to the exercise price, potentially acquiring the underlying asset at a discounted price if the price falls.

- Bull Call Spread: Buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price to capitalize on an expected rise in the underlying asset’s price.

- Bear Put Spread: Selling a put option at a lower strike price and buying a put option at a higher strike price to profit from an anticipated decline in the underlying asset’s price.

The Evolving Landscape of Options Trading: Embracing Innovations and Industry Trends

The world of options trading is constantly evolving, with new strategies and technologies emerging to meet the demands of modern investors. Staying abreast of these trends is crucial for traders looking to maximize their success. Some recent innovations and industry trends include:

- Algo Trading: Utilizing sophisticated algorithms to automate options trading strategies, increasing efficiency and reducing execution time.

- Machine Learning: Employing machine learning models to analyze historical data and predict future price movements, enhancing decision-making.

- Options Market Making: Providing liquidity and facilitating trades in options markets, creating opportunities for arbitrage and proprietary trading strategies.

Expert Insights and Trading Tips: Unlocking Success in Options Trading

To navigate the world of options trading effectively, consider the following expert tips and insights:

- Define a Trading Strategy: Establish well-defined trading strategies that align with your risk tolerance and financial goals before entering the market.

- Manage Risk Prudently: Options trading involves inherent risk. Implement proper risk management techniques, such as position sizing and stop-loss orders, to mitigate potential losses.

- Leverage Education and Practice: Continuously educate yourself about options trading concepts, strategies, and market trends. Practice strategies using paper trading or simulated accounts to gain experience before investing real capital.

- Seek Professional Guidance: Consider seeking guidance from a qualified financial advisor or broker who specializes in options trading to gain insights and avoid costly mistakes.

Frequently Asked Questions: Demystifying Options Trading

Q: What is the difference between a call option and a put option?

A: Call options grant the holder the right to buy an underlying asset, while put options confer the right to sell the asset.

Q: What is an option premium?

A: The price paid for an options contract to acquire the rights it offers.

Q: Can I lose more money than I invested in options trading?

A: Yes, it is possible to lose more money than invested if options strategies are employed with leverage or improper risk management.

Conclusion: Embracing the Power of Options Trading

Options trading opens up a world of opportunities for investors seeking to enhance their returns and navigate market volatility. By understanding the intricacies of options terminology, crafting winning strategies, and staying informed about industry trends, you can unlock the potential of options trading.

We invite you to explore the vast resources available on our platform, where you can learn more about options trading concepts, strategies, and market insights. Join the community of passionate traders sharing knowledge and experiences, empowering you to make informed decisions and achieve your financial objectives.

Options Trading Strategies Blog

Image: www.asktraders.com

Call to Action: Are You Ready to Explore the World of Options Trading?

Are you eager to delve deeper into the world of options trading? Whether you’re an experienced trader or just starting your journey, we invite you to embrace this exciting opportunity. Discover the power of options trading strategies and unlock the potential for financial success today!