Have you ever fantasized about harnessing the tantalizing profit potential of options trading, yet been disheartened by margin requirements? Allow us to introduce you to the liberating world of cash account options trading, an accessible gateway to options strategies, devoid of margin’s clutches.

Image: tradingforexguide.com

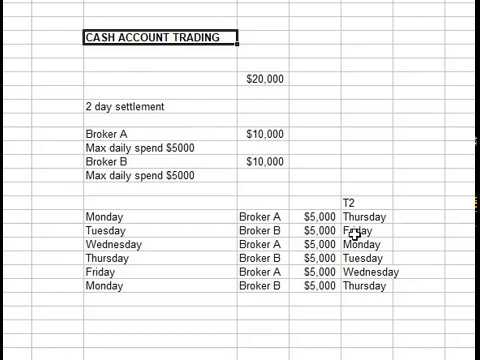

A cash account is essentially a brokerage account that requires you to have sufficient funds to cover trades before executing them. Unlike margin trading, which allows you to borrow money to increase your buying power, cash account trading demands that you trade only with funds you already possess. This may sound limiting at first, but it instills a disciplined approach, minimizing financial risk and fostering long-term success.

Understanding the Mechanics

Cash account options trading involves two fundamental concepts: premium payment and settlement. When purchasing an option, you pay a premium, which represents the cost of acquiring that contract. This premium is instantly deducted from your account balance, ensuring you have sufficient funds for the trade.

Settlement occurs at the option’s expiration date. If the option is exercised, you will either receive or deliver the underlying asset as per the terms of the contract. Alternatively, if the option expires unexercised, it becomes worthless, and your premium payment becomes a non-recoverable expense.

Trading Strategies

Cash account options trading empowers you with a wide array of strategies to leverage market dynamics and potentially generate profits. Some popular strategies include:

– Buying Calls: Acquiring calls grants you the right to purchase the underlying asset at a predetermined strike price by the set expiration date. When the asset’s price rises above the strike price, the call option gains value, enabling you to profit by exercising the option or selling it at a higher price.

– Selling Calls (Covered): Holding the underlying asset and selling call options against it is known as selling covered calls. This strategy generates income by receiving option premiums while maintaining exposure to potential price appreciation of the underlying asset.

– Buying Puts: Buying puts provides the right to sell the underlying asset at a predetermined strike price by the expiration date. This strategy protects your portfolio or hedges against downward price movements by allowing you to sell the asset at a predefined price, limiting your losses.

Pros and Cons

Like any financial endeavor, cash account options trading has advantages and disadvantages:

Pros:

- No margin requirements, mitigating risk and preventing margin calls

- Suitable for conservative or risk-averse investors seeking limited exposure

- Requires initial funding only, preventing excessive leverage

- Discipline-oriented, promoting responsible trading practices

Cons:

- Lower potential returns compared to margin trading

- May limit complex strategies that rely on leverage

- Opportunity cost of not having access to additional trading capital

Image: theintactone.com

Trading Options In A Cash Account

Conclusion

Cash account options trading presents a compelling avenue for traders seeking exposure to options without the constraints of margin requirements. By adhering to disciplined trading practices, understanding market dynamics, and selecting appropriate strategies, you can harness the potential of this exhilarating market with confidence. Remember, while trading options can be a lucrative endeavor, it’s crucial to manage risk prudently and invest within your financial means. Immerse yourself in further exploration, refine your knowledge, and embrace the world of cash account options trading, where opportunity awaits.