Introduction: Unlock the Potential of Options Trading for Retirement Success

In the ever-evolving landscape of retirement planning, Fidelity IRA options trading has emerged as a powerful tool for savvy investors seeking to enhance their retirement savings and navigate market volatility. An in-depth understanding of options trading, coupled with the trusted platform of Fidelity, can empower you to create a tailored investment strategy that aligns with your financial goals and risk tolerance. This comprehensive guide will explore the intricacies of Fidelity IRA options trading, equipping you with the knowledge and strategies necessary to make informed investment decisions and maximize your retirement potential.

Image: bdteletalk.com

Fidelity IRA Options Trading: An Overview of Basic Concepts

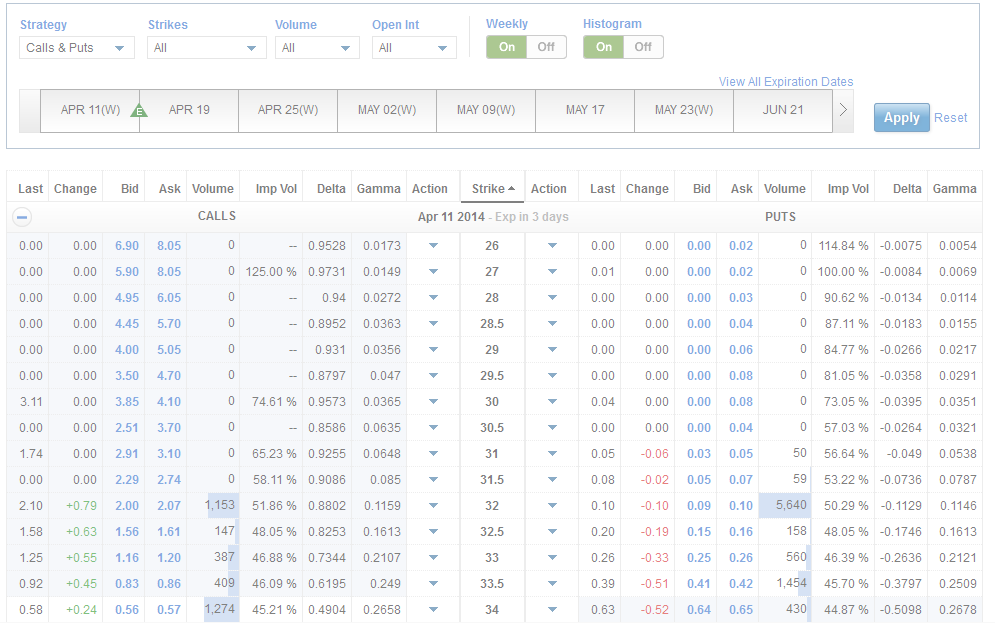

Options trading involves contracts that grant you the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price (strike price) on or before a certain date (expiration date). These contracts offer flexibility and leverage, enabling you to tailor your investments to various market conditions and fine-tune your risk-reward profile. By trading options through a Fidelity IRA, you can harness the tax-advantaged benefits of an IRA while leveraging the potential returns of options trading.

Mastering Options Strategies: A Journey Through Market Scenarios

The realm of options trading offers a diverse array of strategies, each designed to address specific market expectations and risk tolerances. These strategies can be broadly categorized into two primary types:

Bullish Strategies: Seizing Opportunities for Market Growth

Bullish strategies capitalize on optimistic market outlooks, aiming to profit from rising asset prices. Popular strategies include:

-

Call options: Grant the right to buy an asset at a specified price, allowing you to benefit from potential price increases.

-

Long call spreads: Involve purchasing a call option at a lower strike price and simultaneously selling another call option at a higher strike price, creating a defined profit range.

![Day Trade on Fidelity [2024]](https://www.ira-reviews.com/images/1/fidelity/ira/Fidelity-IRA-Account-Application.jpg)

Image: www.ira-reviews.com

Bearish Strategies: Mitigating Risks and Capitalizing on Downtrends

Bearish strategies seek to profit from market declines or hedge against potential losses. Key strategies include:

-

Put options: Grant the right to sell an asset at a specified price, enabling you to capitalize on falling prices.

-

Long put spreads: Involve purchasing a put option at a higher strike price and selling another put option at a lower strike price, creating a limited risk profile.

By understanding the nuances of these strategies and their suitability to different market scenarios, you can build a customized options trading strategy that aligns with your investment objectives.

Navigating Market Volatility with Options Trading: A Guide to Risk Management

Options trading, while offering the potential for enhanced returns, also carries inherent risks. Implementing effective risk management strategies is crucial for safeguarding your investments and ensuring long-term success. Here are key considerations:

-

Understand Options Greeks: These metrics measure the sensitivity of option prices to changes in underlying asset prices, volatility, interest rates, and time. By analyzing Greeks, you can gauge potential risks and make informed trading decisions.

-

Determine Implied Volatility: This metric reflects the market’s expectations of future price fluctuations. High implied volatility indicates potentially larger price swings and increased risk.

-

Set Stop-Loss Orders: These orders automatically sell your options at a predetermined price, limiting losses in adverse market conditions.

-

Diversify Your Portfolio: Spread your investments across various asset classes, including stocks, bonds, and options, to reduce overall portfolio risk.

By incorporating these risk management principles into your trading approach, you can mitigate potential losses and enhance your chances of long-term success in options trading.

Tax Implications of IRA Options Trading: A Guide to Maximizing Retirement Savings

Understanding the tax implications of options trading within an IRA is essential for maximizing your retirement savings. Here are key points to consider:

-

Tax-Deferred Growth: Options trading within an IRA offers tax-deferred growth, meaning that any profits are not subject to taxation until withdrawn in retirement.

-

Qualified Dividends: Dividends received from underlying stocks held in an IRA are also tax-deferred.

-

Capital Gains: When you sell an option for a profit, the gain is taxed as either short-term (ordinary income) or long-term (capital gains), depending on the holding period.

-

Required Minimum Distributions: Once you reach age 72, you must begin taking RMDs from your IRA, and any withdrawals, including options trading gains, will be subject to taxation.

By being aware of these tax implications and incorporating effective tax-saving strategies, you can optimize your retirement savings and minimize your tax burden.

Fidelity Ira Options Trading

Conclusion: Embarking on the Path to Retirement Success with Fidelity IRA Options Trading

Fidelity IRA options trading empowers you to unlock the potential of your retirement savings by offering a powerful tool for enhancing returns, managing risk, and optimizing tax benefits. By leveraging the comprehensive resources and expertise of Fidelity, you can navigate the world of options trading with confidence and make informed investment decisions that align with your financial goals. Embrace the opportunities presented by Fidelity IRA options trading, and embark on a journey toward a secure and prosperous retirement.