Introduction

The world of finance offers a plethora of investment opportunities, each boasting its own set of risks and rewards. Among these options, the realm of options trading stands out as a potent tool for discerning investors seeking to maximize their returns while mitigating their exposure to market volatility. In this comprehensive guide, we will delve into the fascinating world of options trading with a specific focus on the tantalizing opportunities it presents within the context of the iconic fast-casual restaurant chain, Chipotle. Join us on this culinary adventure as we explore the potential rewards and risks associated with using options to harness the market’s movements in the restaurant sector.

Image: www.indigo9digital.com

Understanding Options: A Journey into Derivative Investments

Before our Chipotle saga, let us establish a firm grasp on the fundamentals of options trading. Simply put, options are financial contracts that bestow upon the holder the right, not the obligation, to buy or sell an underlying asset such as a stock, commodity, or currency at a predetermined price on or before a specified date. They empower investors with the flexibility to adapt their strategies to the ever-changing market landscape, allowing them to craft tailored investments that align with their risk tolerance and financial objectives.

Within the options market, two fundamental types of options prevail: calls and puts. Call options grant the holder the right to purchase the underlying asset at a predefined price known as the strike price, while put options afford the holder the right to sell the underlying asset at that same strike price. The option’s premium, or price, is influenced by a variety of factors, including the current market price of the underlying asset, the strike price, the time remaining until the option’s expiration date, and the volatility of the underlying asset.

The Chipotle Conundrum: A Case Study in Options Trading

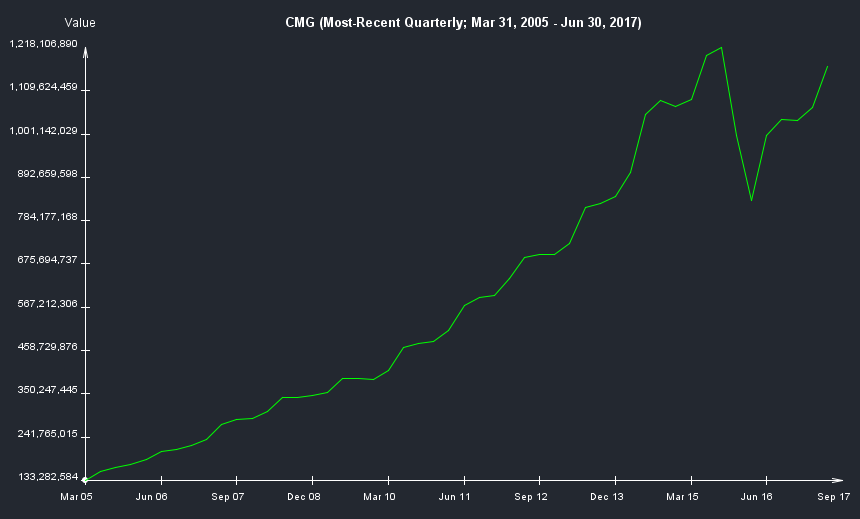

With these fundamental concepts firmly entrenched, let us embark on our culinary exploration by examining the tantalizing possibilities presented by options trading in the context of Chipotle, the beloved Mexican fast-casual restaurant chain. In 2023, Chipotle’s stock (CMG) has been subject to significant market fluctuations, presenting investors with an array of opportunities to utilize options to capitalize on these price movements.

Seizing Upswings: Call Options for a Savory Surge

For investors anticipating a surge in Chipotle’s share price, call options provide a compelling avenue to amplify their potential returns. By purchasing a call option, an investor secures the right to purchase CMG shares at the strike price on or before the option’s expiration date. If the market price of CMG exceeds the strike price, the investor can exercise their call option to purchase shares at the lower strike price, pocketing the difference.

Image: stockstreetblog.com

Quelling Downturns: Put Options for a Spicy Safeguard

Market downturns are an inevitable aspect of investing, and options trading offers investors instruments to mitigate their downside risk. Put options empower investors to capitalize on declines in an underlying asset’s price. In the case of Chipotle, if an investor anticipates a downturn in CMG’s share price, they could purchase a put option, giving them the right to sell CMG shares at the strike price on or before the option’s expiration date. Should CMG’s market price fall below the strike price, the investor can exercise their put option to sell shares at the higher strike price, profiting from the price differential.

Real-World Example: A Taste of Chipotle’s Market Movements

In March 2023, Chipotle’s stock price experienced a notable surge, reaching an intraday high of $1,700. An investor anticipating this upswing could have purchased a call option with a strike price of $1,650 and an expiration date of May 2023. If the investor’s prediction holds true and CMG’s share price closes above $1,650 on or before the expiration date, they can exercise their call option to purchase shares at $1,650, reaping potential profits from the difference between the market price and the strike price.

Maximizing Returns with Chipotle Options: A Culinary Masterclass

For a true culinary maestro in the world of options trading, certain key strategies emerge as essential ingredients for maximizing returns.

Timely Execution: The Art of Patience and Precision

Timing is of the essence in options trading, and knowing when to enter and exit trades is crucial to success. Investors must carefully consider the expiration date of their options, as their value decays over time. Striking a balance between allowing sufficient time for the option to appreciate in value while minimizing the erosion of its premium is paramount.

Selecting the Sauce: Choosing the Right Strike Price

Choosing the appropriate strike price is akin to selecting the perfect sauce to complement your Chipotle burrito. Too spicy (too far out of the money) and your trade may never materialize; too mild (too in the money) and your returns may be limited. Investors should carefully assess the current market price of the underlying asset and its historical volatility to determine an optimal strike price that aligns with their risk tolerance and profit objectives.

Gauging Heat: Assessing Volatility and Risk Management

Volatility is the spice that adds excitement to the options trading world, but it can also be a double-edged sword. Higher volatility can magnify potential returns, but it also amplifies the potential for losses. Investors must thoroughly evaluate the volatility of the underlying asset and adjust their strategies accordingly. Prudent risk management techniques, such as setting stop-loss orders and diversifying their portfolios, are essential to safeguarding their investments.

Options Trading On Chiptole

Image: seekingalpha.com

A Satisfying Conclusion: The Rewards and Risks of Chipotle Options

As with any culinary endeavor, options trading involves both rewards and risks. The allure of potentially amplifying returns and mitigating downside risk can be tantalizing, but investors must tread carefully, armed with a thorough understanding of the underlying mechanics and a robust risk management strategy.

Options trading with Chipotle offers investors a unique opportunity to add spice to their investment portfolios. By harnessing the right techniques and embracing a measured approach, investors can craft tailored investment strategies that align with their financial goals and risk tolerance. However, as with any investment endeavor, education, research, and a healthy dose of caution are indispensable ingredients for achieving success in the world of options trading.