Introduction

In the fast-paced world of financial markets, day trading offers the tantalizing potential for profit. Among the various options available to day traders, SPX options stand out as a compelling choice, even for those with limited capital. This comprehensive guide will delve into the intricacies of day trading SPX options with $100, unlocking the secrets to maximize returns while mitigating risks.

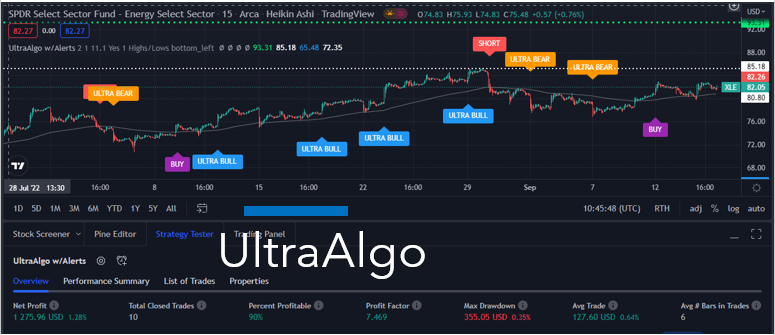

Image: www.ultraalgo.com

Understanding SPX Options

The Standard & Poor’s 500 index (SPX) serves as the underlying asset for SPX options. These contracts provide traders with the right, but not the obligation, to buy (call options) or sell (put options) a specific number of shares of the entire S&P 500 index at a predetermined price (strike price) on a specified expiration date.

Why SPX Options for $100?

For novice traders starting with limited capital, SPX options with $100 offer a key advantage: low cost. Each SPX option contract represents 100 shares of the underlying index. With a $100 premium, traders can gain exposure to the price fluctuations of the S&P 500 without investing a substantial amount of capital.

Strategies for Day Trading SPX Options

-

Scalping: Scalpers aim to profit from small price movements by entering and exiting trades within minutes or even seconds. This strategy requires a keen eye for price action and the ability to identify short-term trends.

-

Range Trading: Range traders capitalize on price fluctuations within defined upper and lower boundaries. By buying at support levels and selling at resistance levels, they seek to capture consistent profits.

-

Day Trading with Volatility: Volatility in the stock market presents both risks and opportunities. Day traders can utilize volatility to their advantage by selling options when implied volatility (IV) is high and buying options during periods of low IV.

Image: www.youtube.com

Risk Management

Day trading SPX options can be rewarding, but it’s essential to prioritize risk management. Set clear stop-loss orders to limit potential losses in adverse market conditions. Additionally, avoid overleveraging and stick to a well-defined trading plan to minimize risks.

Day Trading Spdr Options With 100

Image: tradeproacademy.com

Conclusion

Day trading SPX options with $100 is a viable strategy for traders seeking to capitalize on short-term price movements in the S&P 500 index. By understanding the basics of SPX options and implementing effective trading strategies, traders can unlock the potential for profit while managing risks. Embark on your day trading journey with knowledge and a plan to maximize your chances of success.