Are you ready to venture beyond the familiar walls of stocks and bonds and embrace the exciting world of options trading? Enter Chipotle options trading, a fascinating realm where you can harness the power of leverage and strategic decision-making to potentially multiply your returns. In this comprehensive guide, we’ll navigate the ins and outs of Chipotle options trading, empowering you with the knowledge and confidence to make informed investment decisions.

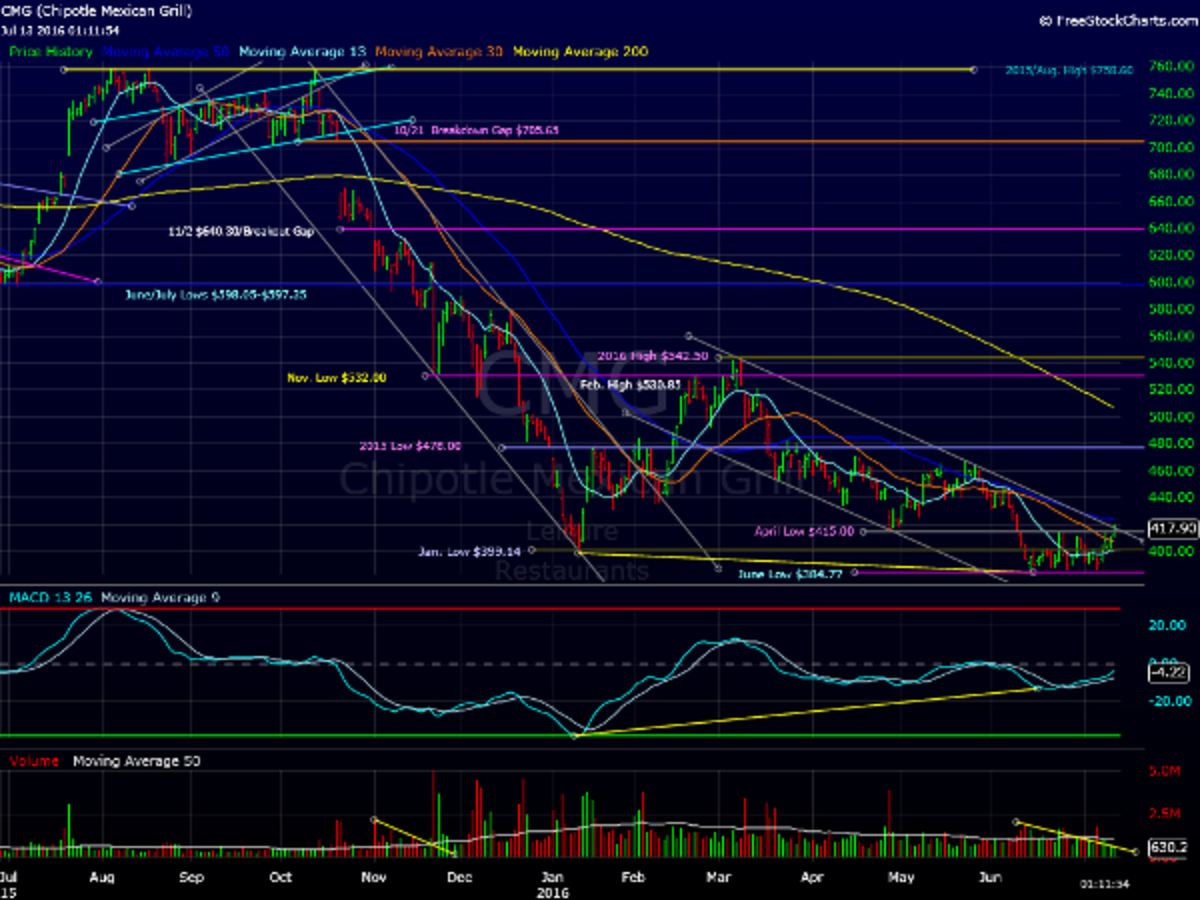

Image: www.thestreet.com

Unleashing the Potential of Chipotle Options Trading

At its core, Chipotle options trading grants you the right, but not the obligation, to buy or sell a specific number of Chipotle shares at a predetermined price on a specified date. This flexibility opens up a vast landscape of opportunities for savvy traders seeking to capitalize on market fluctuations. You can deploy a range of strategies, from bullish to bearish, to align with your investment outlook and risk tolerance.

Grasping the Fundamentals of Chipotle Options Trading

To master Chipotle options trading, it’s imperative to comprehend its fundamental principles. First, delve into the concepts of call and put options. Call options empower you to purchase Chipotle shares at the strike price, while put options grant you the right to sell shares at the strike price. The strike price itself represents the agreed-upon price for the transaction.

Next, understand the significance of expiration dates. Chipotle options have predefined expiration periods, and it’s crucial to exercise or liquidate your options before their expiry to reap any potential profits. Failure to do so will result in the expiration of your options, rendering them worthless.

Navigating the Chipotle Options Trading Landscape

-

Assess Your Risk Tolerance: Before embarking on Chipotle options trading, meticulously evaluate your risk tolerance. Options can amplify both gains and losses, so it’s essential to trade within your comfort zone.

-

Research and Analyze: Conduct thorough research on Chipotle, its industry, and market trends. This will equip you with the insights necessary to make well-informed trading decisions.

-

Choose the Right Strategy: Explore the myriad of Chipotle options trading strategies, from simple to complex. Select the strategy that aligns with your investment objectives and risk appetite.

-

Manage Your Trades: Once you’ve executed a trade, actively monitor its performance and adjust your strategy as market conditions evolve.

-

Seek Professional Advice: If navigating the complexities of Chipotle options trading overwhelms you, consider consulting with a qualified financial advisor. Their expertise can guide you towards informed decisions.

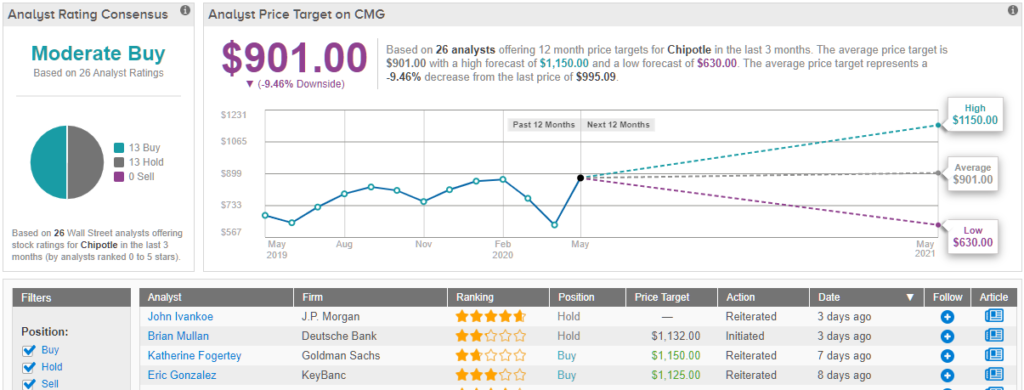

Image: www.marketbeat.com

Unveiling the Allure of Chipotle Options Trading

-

Enhanced Return Potential: Options trading offers the potential for significant returns, far exceeding the returns on traditional stock investments.

-

Flexibility and Versatility: Options provide immense flexibility, allowing you to tailor your strategies to various market scenarios and investment goals.

-

Hedging and Risk Management: Options can serve as powerful hedging tools, enabling you to mitigate risks and protect your portfolio from market downturns.

Chipotle Options Trading

Image: www.tipranks.com

Conclusion

Embracing Chipotle options trading expands your investment horizons, empowering you to explore a world of limitless possibilities. By equipping yourself with the knowledge and mindset of a strategic trader, you can seize the opportunities presented by Chipotle options trading and potentially elevate your financial future. However, remember to approach options trading with informed decision-making, risk management, and a commitment to continuous learning.