In the fast-paced and dynamic world of financial markets, options trading has emerged as a potent tool for traders seeking to harness volatility and potentially amplify returns. Among the various options strategies, buying calls stands out as a versatile tactic that offers both upside potential and defined risk. Understanding the mechanics of buying calls and calculating the breakeven point is crucial for maximizing profits and minimizing losses.

Image: derivbinary.com

Delving into the Mechanics of Buying Calls

Essentially, buying a call option grants the holder the right, but not the obligation, to purchase an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The buyer of the call option pays a premium for this right, which represents the potential profit if the underlying asset’s price rises above the strike price.

When buying a call option, it’s imperative to consider the following factors:

- Strike Price: The price at which the underlying asset can be purchased.

- Expiration Date: The date on which the option expires.

- Premium: The price paid to acquire the call option.

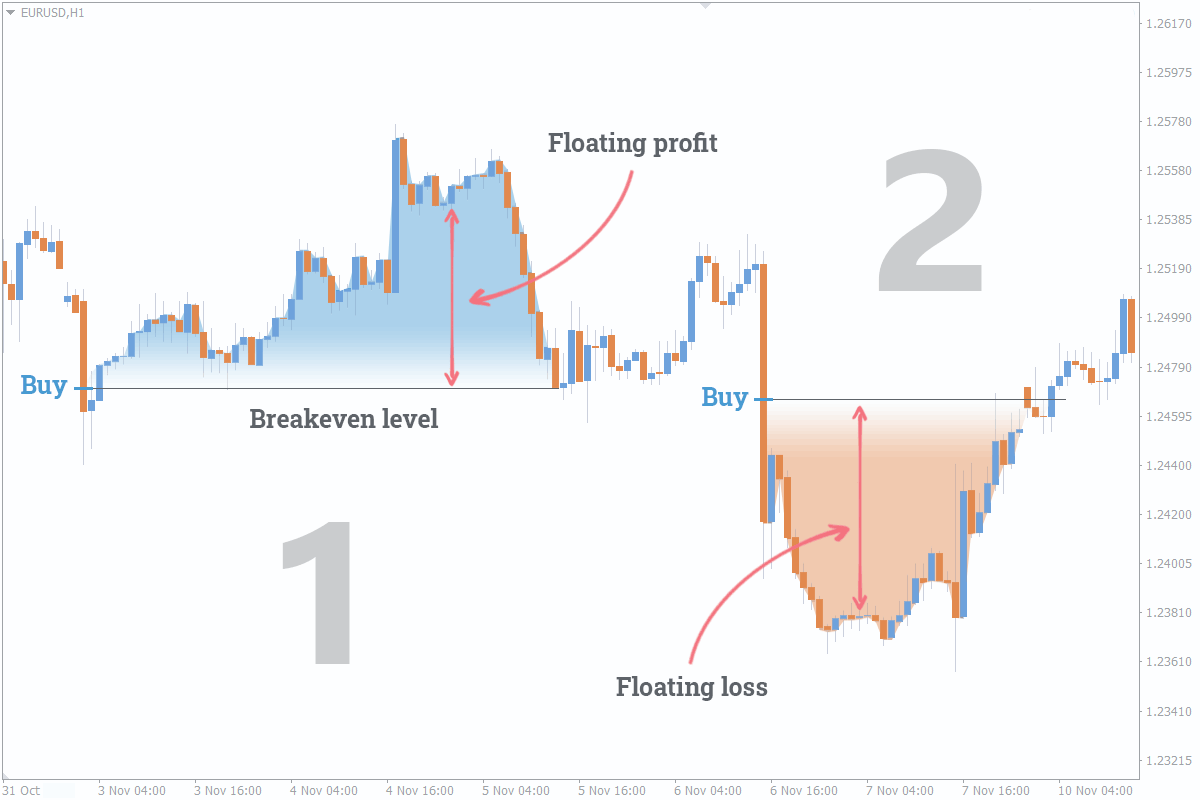

Breakeven Point: Striking a Balance

The breakeven point in options trading represents the price at which the underlying asset must reach to offset the premium paid for the call option. In other words, it’s the price at which the trader neither profits nor incurs a loss.

Calculating the breakeven point for buying a call option is straightforward:

Breakeven Point = Strike Price + Premium Paid

For instance, if you buy a call option with a strike price of $100 and pay a premium of $5, the breakeven point would be $105. To achieve profitability, the price of the underlying asset must rise above $105.

Navigating the Emotional Rollercoaster of Options Trading

Options trading can evoke a vast spectrum of emotions, from exhilaration to despair. It’s paramount to acknowledge and manage these emotions effectively to avoid impulsive decisions that could jeopardize your financial well-being.

Image: fxssi.com

Embracing Patience: The Cornerstone of Success

Unlike stocks, options have a finite lifespan. Exercising patience is essential to allow market forces to play out and reach the desired outcome. Avoid premature selling out of fear or greed.

Conquering Fear: A Pathway to Growth

Fear can be a debilitating force in the trading arena. However, by confronting and understanding the sources of your fear, you can unlock the potential to make rational decisions amidst market volatility.

Accepting Loss: An Integral Part of the Journey

Losses are an inevitable part of any trading endeavor. Instead of dwelling on them, embrace them as learning opportunities. Analyze the factors that contributed to the loss and use that knowledge to refine your future strategies.

Options Trading Buying Call Vs Breakeven Point

Image: www.patriotsoftware.com

Conclusion

Options trading presents both opportunities and risks. By fully comprehending the mechanics of buying calls and the concept of breakeven point, traders can harness the power of this versatile tool while mitigating potential losses. Remember, emotional control is paramount in navigating the ups and downs of options trading. By embracing patience, conquering fear, and accepting the inevitability of losses, you can enhance your trading acumen and increase your chances of success. Continue exploring the intricacies of options trading, seek knowledge from reputable sources, and never cease learning.