Introduction

Embrace the dynamic world of options trading with Jim Samson’s revolutionary Option Trading System-60. Struggling to navigate the complexities of options trading? Jim Samson, a trading industry veteran, unveils a systematic approach to unlock the potential of options.

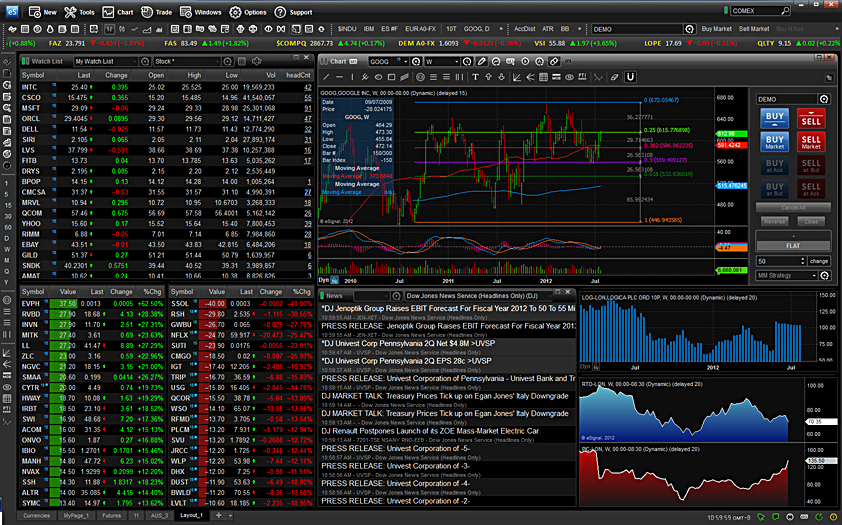

Image: niyudideh.web.fc2.com

Options, versatile financial instruments, enable traders to speculate on price movements without owning the underlying asset. System-60 empowers traders to craft tailored strategies, leverage market insights, and maximize profit potential in a structured manner. Dive into this guide to unravel the secrets of System-60 and elevate your options trading journey.

Understanding System-60: Historical Foundations

System-60 traces its roots to the Chicago Mercantile Exchange (CME) in the 1990s. Initially employed by floor traders, it gradually gained prominence among options traders seeking an edge in the fast-paced trading environment. The system consists of a set of precise trading rules, technical indicators, and risk management parameters that weave together a comprehensive framework for options trading.

Core Concepts of System-60

Unveiling the essence of System-60, we uncover its reliance on volatility and time decay, two fundamental forces shaping options pricing. Armed with an understanding of implied volatility (IV), traders can make informed decisions on premium pricing and potential profit margins. Additionally, System-60 emphasizes strict adherence to predefined trading rules, minimizing the impact of emotions and biases on trading decisions.

Practical Implementation of System-60

1. Market Selection:

Selecting appropriate markets is crucial for System-60’s success. Traders typically focus on liquid markets with ample trading volume to ensure efficient execution and price discovery.

2. Option Selection:

System-60 advocates for trading options with a specific range of time to expiration (TTE) and delta. By adhering to these parameters, traders aim to capitalize on time decay and favorable price movements.

3. Position Sizing and Risk Management:

Risk management is paramount in System-60. It prescribes meticulous position sizing based on account balance and risk tolerance. Traders must adhere to strict stop-loss levels to limit potential losses and safeguard their capital.

4. Technical Indicators:

System-60 incorporates a range of technical indicators to identify potential trading opportunities. These indicators provide objective signals based on price action and market momentum, assisting traders in making informed decisions.

5. Trading Psychology:

Embracing the principles of System-60 demands discipline and emotional control. Traders must remain unemotional and adhere to the predefined rules, avoiding impulsive decisions that could jeopardize their trading strategy.

Image: www.jimsamson.com

Advantages of Using System-60

1. Structured Approach:

System-60 provides a clear and structured approach to options trading, empowering traders with a framework for decision-making.

2. Reduced Emotional Bias:

By relying on predefined rules, System-60 minimizes the influence of emotional decision-making, helping traders avoid costly mistakes.

3. Enhanced Risk Management:

The system’s emphasis on strict position sizing and stop-loss levels aids in managing risk and preserving capital.

4. Consistency and Discipline:

Adhering to System-60 fosters consistency and discipline in trading, leading to potentially improved profitability in the long run.

Option Trading System-60 Jim Samson

Image: www.youtube.com

Conclusion

Embark on your options trading journey armed with the principles of Jim Samson’s System-60. By embracing its structured approach, leveraging technical indicators, and adhering to risk management guidelines, you can unlock the potential of options trading. Remember, mastering System-60 requires dedication, discipline, and a commitment to continuous learning. Embrace this trading system, refine your strategies, and seize the opportunities that the options market offers.