Embark on an enlightening journey into the captivating world of futures and options trading, where financial possibilities unfold before your eyes. As we delve into the depths of this intricate domain, we will unravel the complexities, unlocking the secrets that empower prudent investors. Join us as we embark on this enriching exploration, illuminating the path towards informed decision-making in the dynamic financial landscape.

Image: efinancemanagement.com

What is Futures and Options Trading?

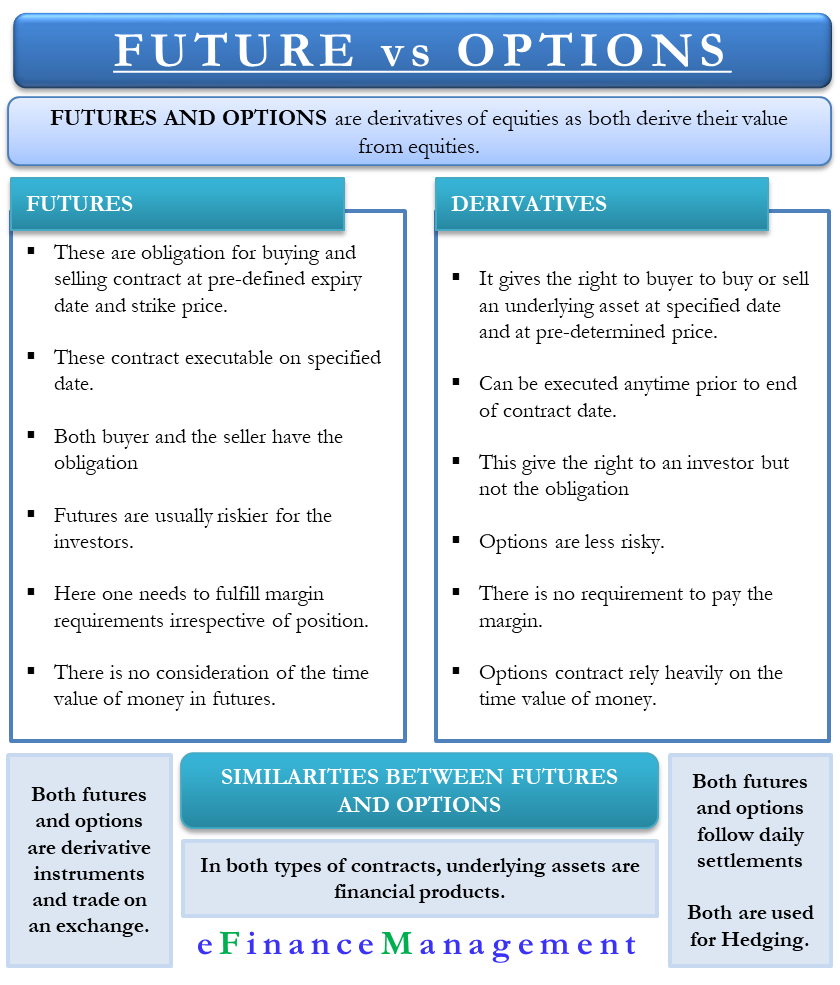

Futures and options trading offer a unique avenue for savvy investors to capitalize on potential market movements. Futures contracts, in essence, represent an agreement to purchase or sell an underlying asset at a predetermined price on a future date. On the other hand, options contracts bestow the right, but not the obligation, to buy or sell an underlying asset at a specified price until a certain date. These financial instruments provide an array of strategies, enabling traders to hedge against risk, speculate on price fluctuations, or leverage market insights for lucrative returns.

Understanding the Mechanics of Futures Trading

Delving into futures trading unveils a world of opportunity, but it’s imperative to grasp its fundamental mechanics. When you enter a futures contract, you essentially commit to buying or selling a specific quantity of an underlying asset at a preset price on a stipulated future date. Futures contracts are standardized agreements traded on designated exchanges, ensuring transparency and liquidity. By engaging in futures trading, you gain the ability to lock in a price today for a transaction that will be executed at a later date, providing risk management and potential profit opportunities.

Options Trading: Unlocking Flexibility and Market Insight

Options trading empowers investors with a versatile tool to capitalize on market movements while mitigating potential losses. Unlike futures contracts, options provide the flexibility to execute a trade only if it aligns with your market outlook. By purchasing an option, you acquire the right, not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specific date. This flexibility allows you to tailor your strategy, defining your risk tolerance and maximizing profit potential.

Image: learn.financestrategists.com

Leveraging Futures and Options for Informed Trading

Armed with a thorough understanding of futures and options trading, you can harness these instruments to pursue prudent investment goals. Futures contracts provide an effective means of locking in prices, hedging against risk, and profiting from anticipated price movements. Options, on the other hand, offer enhanced flexibility and the ability to speculate on market volatility. By combining these tools strategically, you can craft a personalized investment approach that aligns with your financial objectives.

Expert Insights: Navigating the Complexities of Futures and Options

To further enrich your knowledge, we sought counsel from renowned experts in the field of futures and options trading. Their insights illuminate the intricacies of these markets, providing invaluable guidance for aspiring traders.

“Futures and options trading empowers investors to proactively manage risk and seize market opportunities,” emphasizes Dr. Mark Harper, a seasoned financial analyst. “By embracing these instruments, traders can enhance their portfolio diversification and potentially achieve superior returns.”

Echoing this sentiment, Ms. Jane Miller, a veteran options strategist, adds, “Options provide immense flexibility, allowing traders to tailor their strategies to suit their risk tolerance and market outlook. This flexibility empowers them to navigate market fluctuations with greater precision.”

Futures And Options Trading Basics

Empowering Traders: Practical Tips for Success

Harnessing the knowledge gleaned from expert insights, we present practical tips to empower your futures and options trading endeavors.

-

Plan Strategically: Before venturing into these markets, forge a well-defined trading plan outlining your goals, risk tolerance, and trading approach.

-

Manage Risk Prudently: Risk management is paramount. Employ stop-loss orders to mitigate potential losses and establish clear profit targets.

-

Monitor Market Trends: Stay abreast of market trends, economic data, and geopolitical events that may influence asset prices.

-

Continuous Learning: Embark on a continuous learning journey to stay informed about industry best practices and new trading strategies.

In conclusion, futures and options trading provide a powerful arsenal for discerning investors who seek to harness market movements to their advantage. Embracing these versatile tools, you can navigate the financial landscape with greater confidence and poise. By judiciously employing futures and options, you empower yourself to make informed decisions, manage risk, and unlock the potential for financial growth.