Introduction

Image: efinancemanagement.com

Are you a voyager yearning to navigate the uncharted waters of financial trading? If so, prepare to encounter two formidable instruments that have shaped the destiny of countless investors: futures and options. In this captivating expedition, we’ll embark on an exhilarating quest to unravel the enigma of these financial titans, unraveling their intricate mechanisms and unlocking their immense potential.

Demystifying Futures: A Window into the Future of Prices

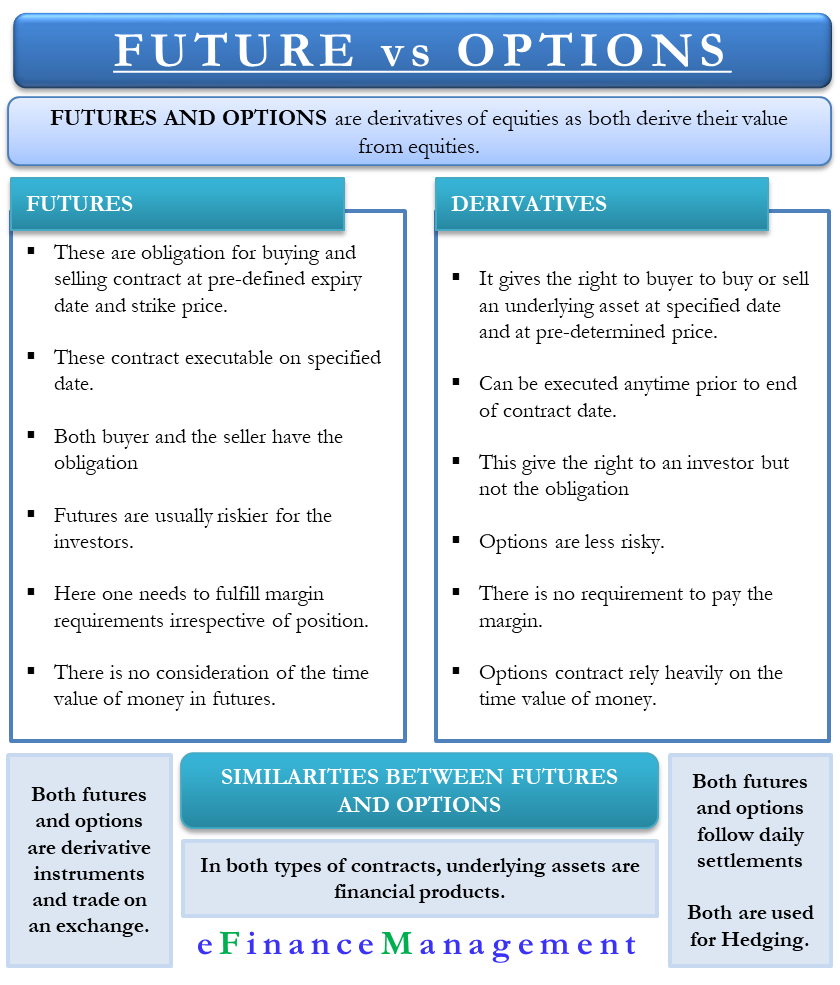

Envision a scenario where you could secure the price of a commodity today, regardless of the fluctuations of tomorrow. Futures contracts grant you this extraordinary ability. They are binding agreements to buy or sell a specified quantity of an underlying asset, such as commodities (e.g., oil, wheat), currencies, and stock indices, at a predetermined price on a future date.

The allure of futures lies in their ability to manage risk. Suppose you’re a grain farmer concerned about plummeting prices. By selling futures contracts, you’ll lock in today’s lucrative price, ensuring a stable income even if the market takes a downturn.

Unveiling Options: A Symphony of Rights and Obligations

Imagine a secretive dance, where you wield the power to exercise a choice but remain unbound by obligation. Options contracts embody this captivating dance, granting you the right, not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

The key differentiator between futures and options lies in the concept of obligation. Futures contracts are legally binding, meaning you are obligated to fulfill the terms of the agreement. Options, on the other hand, offer flexibility. You can choose to exercise your right to buy or sell, but you are not compelled to do so. This flexibility comes at a price, as options contracts typically cost less than futures contracts.

Expert Insights: Navigating the Labyrinth with Clarity

Delving into the realm of futures and options may seem daunting, but with the guiding light of experts, the path ahead becomes illuminated. John Hull, a renowned authority in derivatives, emphasizes the importance of understanding the underlying asset and its price behavior. He counsels, “Know what you’re trading, and why.”

Similarly, Mark Kamstra, a veteran futures and options trader, advises traders to develop a comprehensive trading plan. “Discipline is key,” he affirms. “Without a plan, emotions can cloud your judgment.”

Unleashing the Potential: Actionable Tips for Success

As you embark on your trading journey, heed these actionable tips to maximize your potential:

-

Conduct Thorough Research: Immerse yourself in the intricacies of the underlying assets, market conditions, and trading strategies.

-

Manage Risk: Remember, futures and options trading carries inherent risk. Utilize hedging strategies, such as stop-loss orders, to protect your capital.

-

Stay Updated: The financial landscape is constantly evolving. Stay abreast of news, market trends, and technological advancements to stay ahead of the curve.

Conclusion: Embracing the Power of Futures and Options

Futures and options are powerful tools that can empower you to manage risk, speculate on future prices, and generate passive income. By unraveling their enigma, you’ll unlock a world of financial possibilities. Embrace the excitement of trading, but remember to tread carefully, guided by knowledge, discipline, and a thirst for continuous learning. May your journey be filled with profitable ventures and the exhilaration that comes from navigating the intricate dance of financial markets.

Image: www.ig.com

What Are Futures And Options In Trading