A Journey Towards Informed Investment Decisions

The realm of financial trading can be both alluring and enigmatic, particularly when navigating the contrasting worlds of futures and options trading. Each instrument offers unique opportunities and distinct risks, inviting investors to embark on a journey of informed decision-making.

Image: www.pinterest.com

Demystifying Futures Contracts

Futures, like ethereal time capsules, represent legally binding agreements to buy or sell a specific underlying asset, such as a commodity, currency, or index, at a predetermined price on a predetermined date. These contracts act as hedges against future price fluctuations, offering protection to both buyers and sellers.

Unveiling Option Contracts

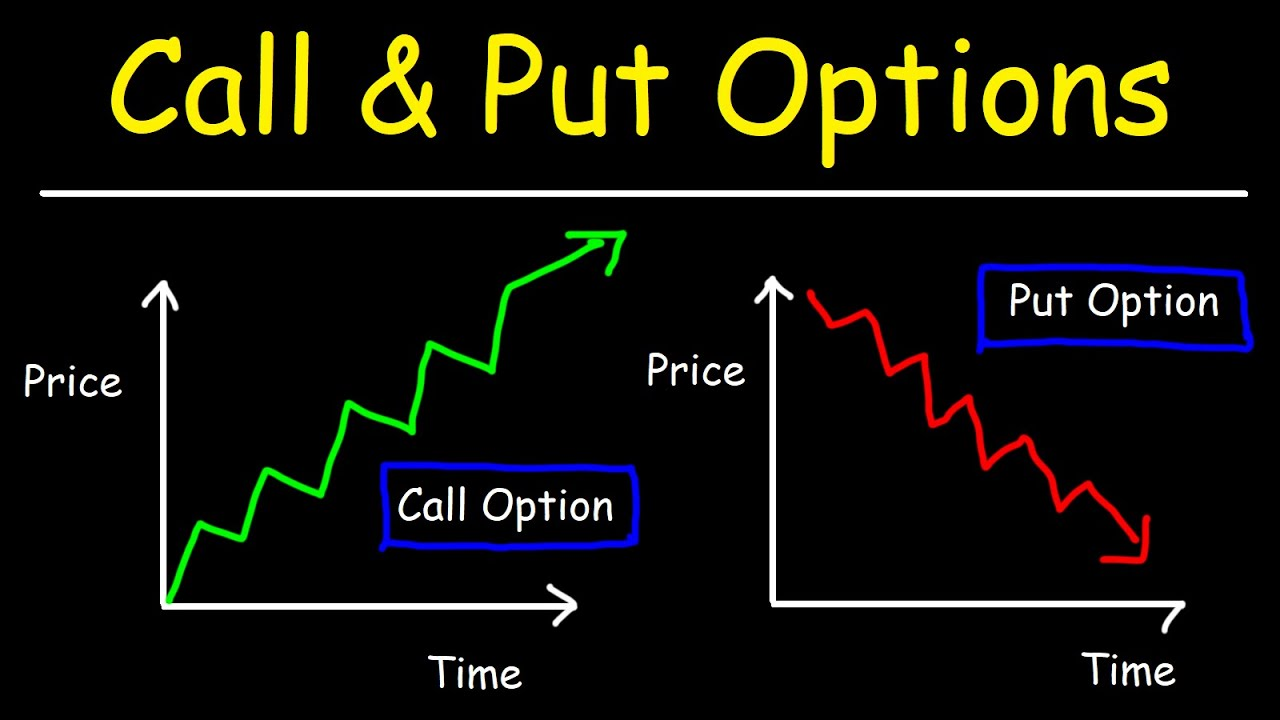

Options, on the other hand, grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price within a defined timeframe. Unlike futures, they offer flexibility and the potential for limited risk.

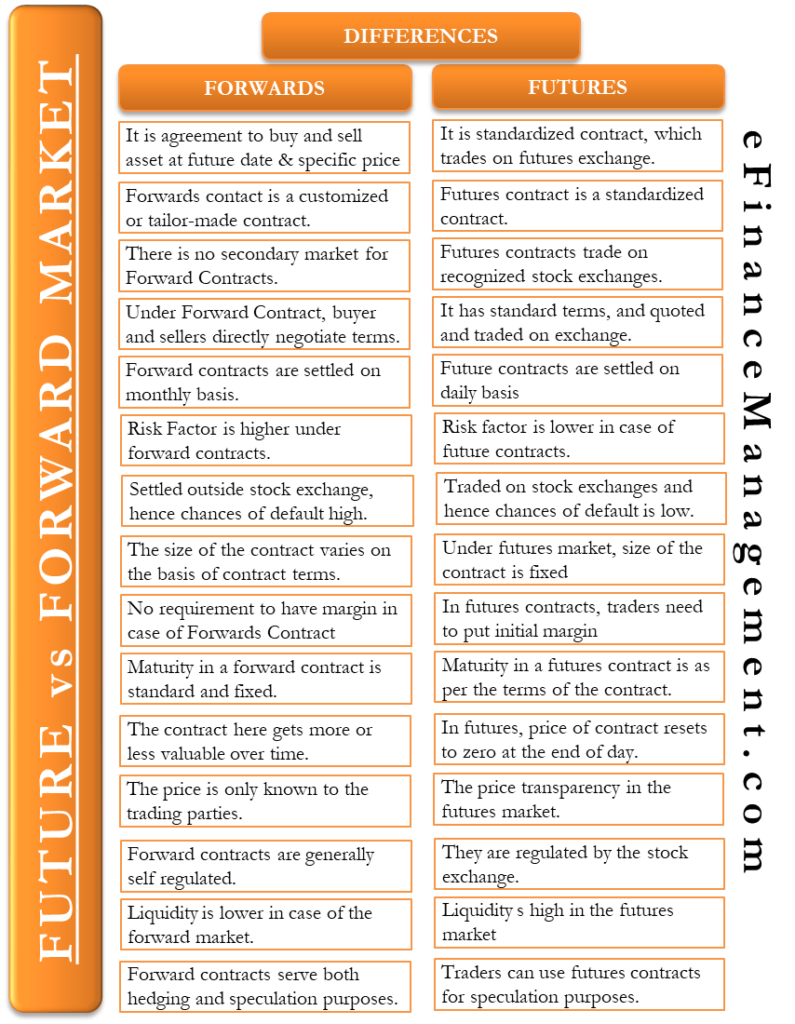

Navigating the Differences

The fundamental difference between futures and options lies in their inherent obligations. Futures contracts legally bind both parties to the transaction, while options grant the buyer the optionality to exercise their rights. This disparity in obligation directly impacts the risk profile of each instrument.

Image: efinancemanagement.com

The Crucible of Hedging

Futures contracts, with their binding nature, are primarily employed for hedging purposes. Businesses, for instance, can use futures to safeguard against adverse price movements of their raw materials or finished products.

The Allure of Speculation

Options, with their inherent flexibility, appeal to both hedgers and speculators. Speculators, seeking to capitalize on price movements, can employ options to bet on future market directions with limited risk.

Choosing Your Path: A Compass for Prudent Investing

Selecting between futures and options trading hinges upon individual risk tolerance, investment objectives, and market conditions. However, understanding the distinctive characteristics of each instrument empowers investors to make informed choices, optimizing their potential for success.

Expert Insights: Illuminating the Path

Acclaimed finance expert, Dr. Mark Williams, underscores the importance of learning the intricacies of both futures and options trading. “A thorough understanding of these instruments allows investors to navigate market fluctuations with greater confidence,” he advises.

Actionable Tips: Lighting the Lamp of Success

-

Seek mentorship from experienced traders to glean invaluable insights.

-

Practice simulated trading to hone your skills without risking real capital.

-

Continuously educate yourself by attending workshops, reading industry publications, and networking with professionals.

Future Vs Option Trading

Image: tradewithmarketmoves.com

A Clear Horizon: The Promise of Informed Investment Decisions

By delving into the nuances of futures vs. options trading, investors gain the clarity and confidence required to make informed decisions. Embracing a thirst for knowledge and a prudent approach, they embark on a journey towards financial empowerment, unlocking a world of opportunities in the vibrant marketplace.