Introduction

In the realm of financial markets, options trading offers a tantalizing opportunity to speculate on the potential price fluctuations of underlying assets. Among the myriad of options available, buying calls stands out as a potent strategy for those seeking to tap into the upside potential of stocks, indices, or other assets. This guide delves into the intricate world of buying calls, empowering you with the knowledge and strategies to navigate the options landscape.

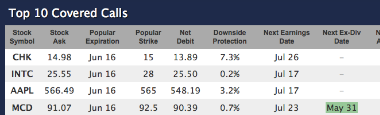

Image: www.borntosell.com

Buying a call option grants the holder the right, but not the obligation, to purchase the underlying asset at a predetermined price (known as the strike price) by a specific date (the expiration date). This flexibility offers traders the potential for substantial gains if the underlying asset’s price rises above the strike price before expiration. However, if the asset’s price remains below the strike price, the call option will expire worthless, resulting in a loss of the premium paid for the option.

Understanding Call Options

Call options are characterized by two key components: the strike price and the expiration date. The strike price represents the price at which the holder can exercise their right to purchase the underlying asset, while the expiration date determines how long the option will remain valid. Traders can choose from a range of strike prices and expiration dates to tailor their options strategies to their specific risk tolerance and market outlook.

The premium paid for a call option reflects the market’s assessment of the likelihood that the asset’s price will rise above the strike price by the expiration date. Factors such as the asset’s volatility, time to expiration, interest rates, and market sentiment contribute to the pricing of call options.

Benefits and Risks of Buying Calls

Buying calls offers several potential benefits for traders:

- Limited risk: Unlike owning the underlying asset, buying calls limits the potential loss to the premium paid for the option.

- Asymmetric payoff: Call options provide the opportunity for unlimited profits if the asset’s price rises significantly.

- Leverage: Options trading provides leverage, allowing traders to potentially amplify their gains compared to investing directly in the underlying asset.

However, buying calls also involves certain risks:

- Premium decay: The value of an option decays as it approaches its expiration date, especially if the underlying asset’s price remains below the strike price.

- Time decay: The closer an option gets to its expiration date, the less time value it has, which can reduce its overall value.

- Implied volatility risk: The premium paid for a call option is influenced by implied volatility, which is the market’s expectation of future price fluctuations. If implied volatility decreases, the value of the call option may also decline.

Strategies for Buying Calls

Traders employ various strategies when buying call options to maximize their profit potential while managing risk:

- Deep ITM calls: Deep in-the-money call options have a strike price well below the current market price of the underlying asset. These options have a higher probability of being exercised and a lower risk-reward ratio.

- Near-the-money (NTM) calls: With a strike price close to the current market price, NTM call options offer a balance between potential reward and risk.

- Out-of-the-money (OTM) calls: OTM call options have a strike price significantly above the current market price. They offer the potential for substantial gains if the asset’s price increases significantly, but also carry higher risk.

- Long call spread: This strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price and the same expiration date. The maximum profit is limited and the risk is defined.

Image: sites.psu.edu

Options Trading Buying Calls

Image: www.call-options.com

Conclusion

Buying calls is a versatile options trading strategy that empowers traders to profit from rising asset prices while limiting their risk. Understanding the intricacies of call options, the factors influencing their pricing, and employing effective strategies are crucial for successful implementation. By leveraging the insights provided in this comprehensive guide, traders can navigate the options market with confidence, seeking opportunities for substantial gains. Remember to conduct thorough research, manage risk prudently, and continuously refine your strategies to optimize outcomes in the dynamic options landscape.