Introduction

Options trading has emerged as an increasingly popular avenue for investors seeking amplified returns. However, day trading options, where traders enter and exit positions within the same trading day, is subject to specific restrictions designed to ensure market stability and protect participants. Understanding these restrictions is crucial for any aspiring options day trader to minimize risks and optimize trading strategies.

Image: store.prologuebookshop.com

The primary restriction associated with options day trading is the Pattern Day Trader (PDT) rule, which applies to accounts with less than $25,000 in equity. Under this rule, day traders are limited to four round-trip trades per rolling five-business-day period. This limitation is intended to deter excessive and potentially destabilizing trading activity.

PDT Rule Implications

Traders who violate the PDT rule may face a variety of consequences. These include:

- Temporary suspension of account trading privileges

- Margin restrictions and trading limitations

- Potential regulatory scrutiny

It is important to note that the PDT rule is applicable regardless of the size or complexity of the trades. Therefore, even those engaging in small-scale options trading are subject to these restrictions.

Exemptions from PDT Rule

While the PDT rule applies to most day traders, there are certain exemptions for individuals who meet specific criteria. These include:

- Traders with a minimum account balance of $25,000

- Registered broker-dealers

- Commodity Trading Advisors (CTAs)

- Employees of futures commission merchants (FCMs)

Trading Strategies for PDT-Restricted Traders

Despite the PDT rule restrictions, there are still opportunities for day trading options within the permitted parameters. Some strategies include:

- Vertical Spreads: Involving the simultaneous purchase and sale of options with different strike prices and expiration dates. This reduces the upfront cost and potential risk involved.

- Time Spreads: Utilizing options with different expiration dates to capitalize on time decay or hedge against volatility fluctuations.

- Single-Leg Options: Trading a single option call or put, focusing on capturing specific market movements within the allowed trades.

- Close-to-the-Money Options: Limiting trades to options with strike prices near the current market price, providing increased flexibility in managing positions.

Image: www.hoteldacanoa.com.br

Risk Management and PDT Rule Compliance

Adhering to the PDT rule requires prudent risk management strategies. These include:

- Understanding Position Limits: Monitoring the number of open trades to avoid exceeding the permitted four round-trip trades.

- Managing Drawdowns: Establishing clear risk tolerance levels and exit strategies to limit potential losses.

- Monitoring Account Balance: Maintaining an adequate account balance to avoid falling below the $25,000 threshold and triggering PDT restrictions.

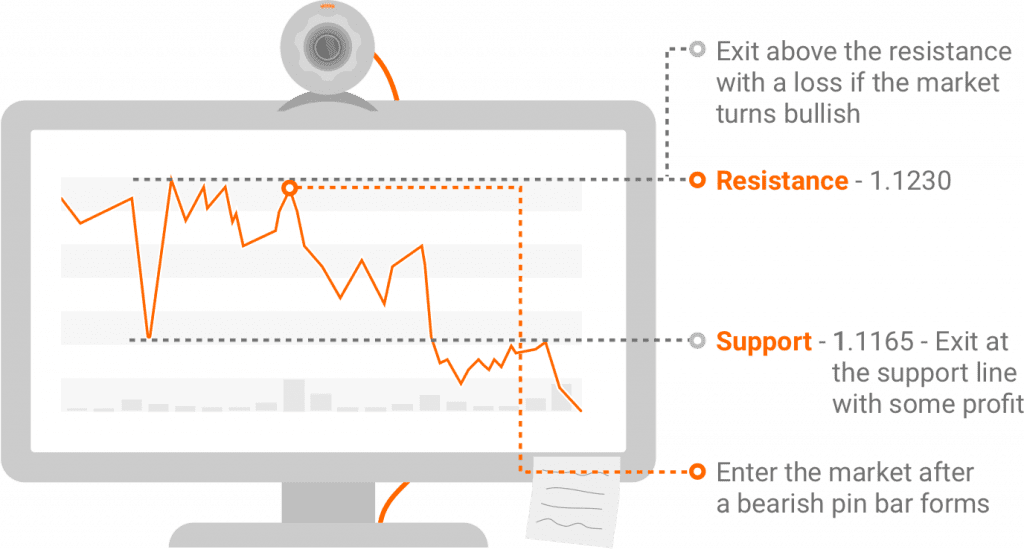

Options Day Trading Restrictions

Image: tradethatswing.com

Conclusion

Options day trading offers unique opportunities but comes with specific restrictions, particularly the PDT rule for traders with limited account balances. By understanding these restrictions, traders can develop tailored strategies that balance risk management with profit potential. Adhering to the PDT rule, embracing suitable trading strategies, and implementing sound risk control measures are essential for maximizing success while navigating options day trading restrictions.