As global economies navigate the transition towards net-zero greenhouse gas emissions, the trading of carbon offsets is emerging as a pivotal instrument in the fight against climate change. Carbon options trading, a derivative market specific to the carbon industry, offers businesses and investors a flexible and effective solution for managing their carbon commitments.

Image: www.urbangreencouncil.org

What is Carbon Options Trading?

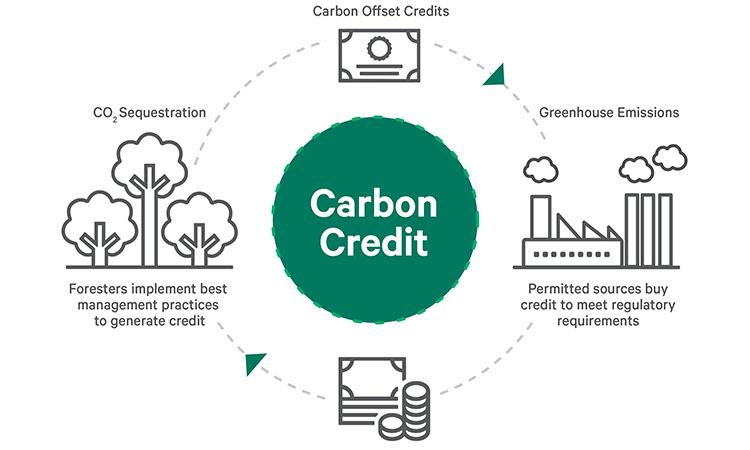

Carbon options are financial contracts that grant the holder the right, but not the obligation, to buy or sell carbon credits at a prespecified price and date. These credits, certified reductions in carbon dioxide or equivalent greenhouse gas emissions, are traded in regulated markets to enable corporations and governments to meet their emissions reduction targets.

By participating in carbon options trading, entities can gain exposure to the emissions allowance market while mitigating potential financial risks. The holder of an option can choose to exercise their right to buy or sell, depending on whether the price of carbon credits in the spot market is favorable compared to the option’s price.

Key Benefits and Applications

Carbon options trading offers numerous benefits to participants, including:

- Price Risk Hedging: Businesses with fluctuating carbon emissions can effectively manage price volatility by using options to secure future credits at specific prices.

- Emissions Flexibility: Options provide a flexible mechanism for companies to adjust their carbon footprints over time, allowing them to fine-tune their emissions strategies.

- Financial Leveraging: Options trading enables investors to amplify their exposure to the carbon market relative to their capital outlay, potentially generating higher returns.

Developing Market Landscape

The carbon options market is still in its early stages of development but is rapidly evolving to meet evolving needs. Exchanges around the world, such as the ICE Futures U.S. and the European Climate Exchange, offer standardized carbon options contracts. The volume of traded options is expanding, particularly in markets with well-established emissions trading programs, such as the EU Emissions Trading System.

Image: www.davy.ie

How to Participate in Carbon Options Trading

Participation in carbon options trading requires an understanding of market fundamentals and regulatory frameworks. Seek guidance from qualified professionals, such as authorized brokers or financial advisors, before making any trades.

Thoroughly research market conditions, including the historical price volatility of carbon credits, the projected demand for emissions reductions, and the evolving regulatory environment.

Strategic investment in carbon options can complement an overall climate mitigation strategy, offering businesses and investors opportunities to manage their carbon footprint and capitalize on the growing demand for emissions reductions.

Carbon Options Trading

Image: www.eco-business.com

Conclusion

Carbon options trading is poised to play an increasingly significant role in the transition to a low-carbon economy. By providing customizable risk management solutions and opportunities for market participation, options facilitate proactive emissions management and unlock investment opportunities in the emerging carbon market. As companies and investors seek innovative solutions to meet their sustainability goals, carbon options trading is a valuable tool to navigate the evolving landscape.