In the realm of financial markets, where opportunities intertwine with risks, options trading has emerged as a potent tool for savvy investors seeking enhanced returns and risk management strategies. Embark on a captivating journey as we delve into the fundamentals of options basics, empowering you to navigate this exciting financial landscape with confidence and clarity.

Image: www.markettradersdaily.com

Defining Options and Their Significance

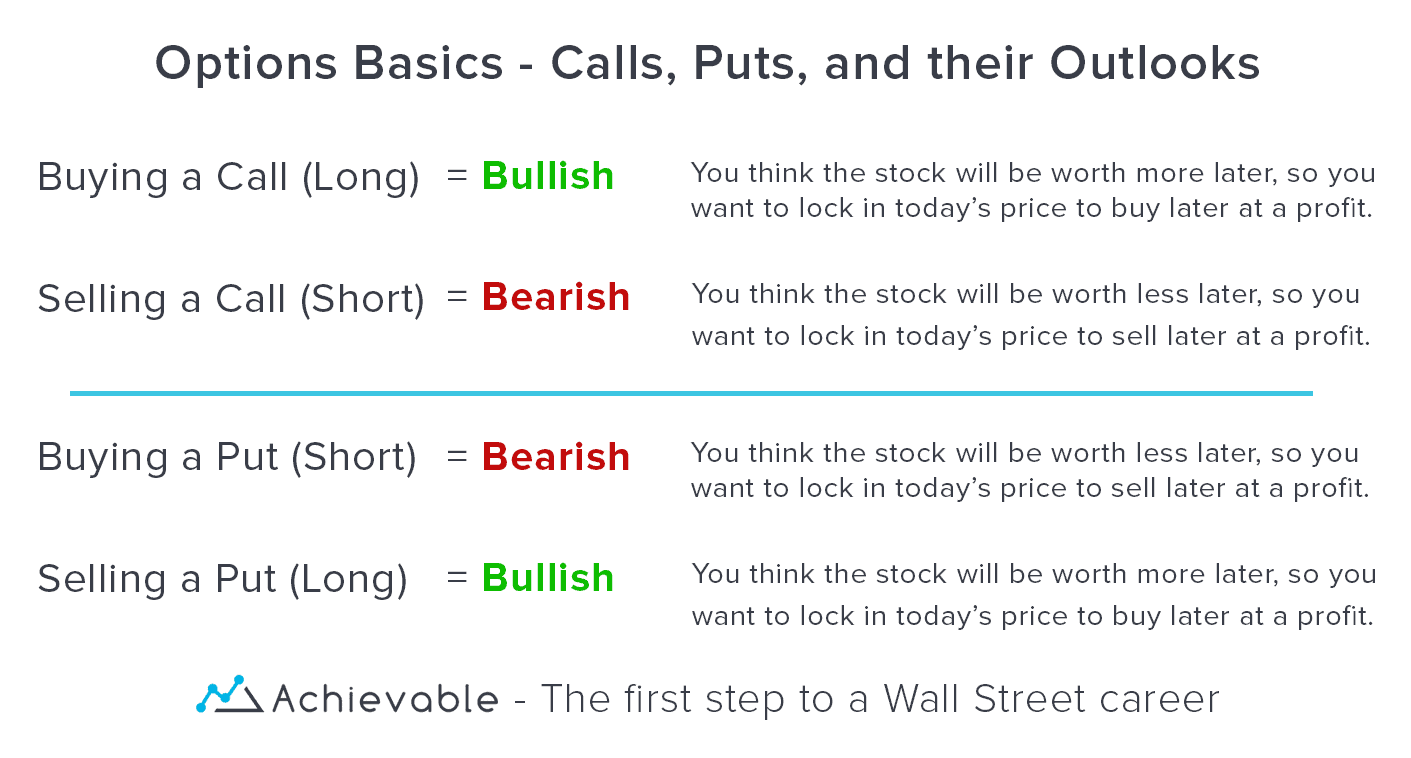

Options, simply put, are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This unique characteristic distinguishes options from other investment vehicles, offering flexibility and the potential for substantial profits.

Options trading plays a crucial role in various financial strategies, including but not limited to:

-

Enhancing Returns: Options can be used as levers to amplify returns, particularly in volatile markets. By employing leverage effectively, investors can potentially multiply their profits.

-

Risk Mitigation: Options serve as hedging tools, allowing investors to protect existing investments against potential losses. By skillfully navigating the options market, investors can mitigate downside risks and safeguard their portfolios.

Understanding Options Terminology and Key Concepts

To embark on the path of options trading, a clear understanding of fundamental concepts is imperative. Let’s decipher the essential terminology:

-

Call Option: Grants the buyer the right to buy the underlying asset at the strike price before the expiration date.

-

Put Option: Entitles the buyer to sell the underlying asset at the strike price before the expiration date.

-

Strike Price: The predetermined price at which the underlying asset can be bought (call) or sold (put).

-

Expiration Date: The specific date on which the option contract expires and becomes worthless.

-

Intrinsic Value: The inherent value of an option, calculated as the difference between the underlying asset’s price and the strike price.

-

Time Value: The portion of an option’s price attributed to the time remaining until expiration.

Options Trading Strategies: Unlocking Potential

The world of options trading offers a plethora of strategies tailored to diverse investor objectives. Here are a few commonly employed approaches:

– Covered Call: Selling a call option against an existing position in the underlying asset to generate additional income or hedge against potential losses.

– Cash-Secured Put: Selling a put option while holding sufficient cash to purchase the underlying asset should the option be exercised, offering downside protection and premium income.

– Naked Option: Trading an option without holding the underlying asset, carrying higher risk but potentially greater rewards.

- Collar Strategy: Combining a covered call with a protective put, creating a limited profit potential but also limiting potential losses.

Image: www.pinterest.com

Navigating Risk and Mastering Options Basics Trading

While options trading presents exciting opportunities, it’s critical to recognize and manage the inherent risks. Here are some prudent guidelines:

-

Educate Yourself: Acquire comprehensive knowledge about options trading concepts, strategies, and risk management techniques.

-

Start Small: Begin with small trades to gain practical experience and build confidence gradually.

-

Manage Risk: Employ risk management strategies such as stop-loss orders and position sizing to limit potential losses.

-

Consider Time Factor: Time decay erodes an option’s value as expiration approaches. Factor in the time value when making trading decisions.

-

Stay Updated: Regularly monitor market trends, economic data, and corporate news to make informed trading decisions.

Options Basics Trading

Image: blog.achievable.me

Conclusion: Unveiling the Power of Options Basics Trading

Options basics trading offers a versatile and potentially lucrative avenue for investors seeking enhanced returns and risk management. By grasping the fundamental concepts, exploring diverse strategies, and embracing prudent risk management practices, you can unlock the potential of this dynamic financial instrument. Remember, knowledge is power, and a continuous pursuit of it will serve you well in the ever-evolving world of options trading. Embrace the learning journey, stay informed, and make informed decisions to navigate the financial markets with confidence and success.