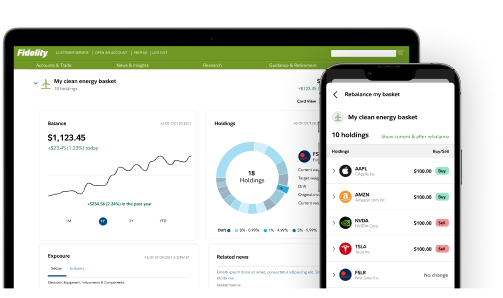

Unlock the power of options trading with Fidelity. This time-tested brokerage has been a trusted partner for investors for over 75 years, now empowering you to trade options seamlessly. Whether you’re a seasoned pro or just starting, this in-depth guide will walk you through every step of activating options trading on Fidelity. Get ready to expand your trading horizons and capitalize on the exciting world of options.

Image: www.reddit.com

Understanding Options Trading

Options are financial instruments that give you the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time frame. With options trading, you have the potential to enhance your returns or hedge against risk. However, it’s crucial to understand that options trading involves significant risk and should only be engaged in by knowledgeable investors.

Requirements for Options Trading on Fidelity

Before activating options trading on Fidelity, ensure you meet the following requirements:

- Have an active Fidelity brokerage account

- Complete the options trading knowledge assessment

- Have a minimum account balance (varies depending on account type)

- Meet certain trading experience requirements

- Log in to your Fidelity account: Access your Fidelity account online or through the mobile app.

- Complete the options trading knowledge assessment: This assessment gauges your understanding of options trading concepts. You can find it under “Accounts & Trade” > “Trade Options.”

- Fund your account: Ensure you have sufficient funds to cover your potential trading losses.

- Request options trading activation: Contact Fidelity customer service by phone or initiate a request online. Provide the necessary information and meet the experience requirements.

- Wait for approval: Fidelity will review your application and notify you of the approval status.

- Choose an option strategy: Determine which options strategy aligns with your trading goals.

- Select the underlying asset: Decide on the stock, ETF, or index you wish to trade options on.

- Set the strike price and expiration date: Specify the price at which you can buy or sell the underlying asset and the time frame for the option.

- Place your order: Enter your trade details, including the number of contracts and the price you’re willing to pay.

- Monitor and adjust: Keep track of your options positions and make adjustments as needed based on market conditions.

- Educate yourself: Continuously expand your knowledge of options trading concepts and strategies.

- Use risk management tools: Employ stop-loss orders and other risk management techniques to protect your capital.

- Learn from experienced traders: Engage with industry professionals, attend webinars, and read reputable sources to gain valuable insights.

- Be mindful of trading costs: Factor in the commissions and fees associated with options trading.

- Practice in a simulated environment: Utilize Fidelity’s paperMoney platform to test your strategies before trading real money.

Activating Options Trading on Fidelity

To activate options trading on Fidelity, follow these simple steps:

Image: rafacaturrofiasih.blogspot.com

Trading Options on Fidelity

Once your options trading is activated, you can start trading options on Fidelity’s platform. Here’s a quick overview of the process:

Maximize Your Options Trading Potential

To get the most out of options trading on Fidelity, consider these expert insights:

How To Activate Options Trading On Fidelity

Conclusion

Activating options trading on Fidelity is a straightforward process that empowers you to explore the exciting world of options. By following the steps outlined in this guide, you can unlock the potential to enhance your returns or hedge against risk. Remember to approach options trading with knowledge and caution, and always seek professional guidance when needed. Fidelity provides a robust platform and resources to support you on your options trading journey. Embrace the opportunities and navigate the markets with confidence.