Unveiling the Path to Empowering Financial Decisions

In the ever-evolving landscape of financial markets, options trading stands out as a potent instrument that empowers investors to refine their investment strategies, potentially amplifying returns and hedging risks. Options, financial contracts that confer the right but not the obligation to buy or sell an asset at a predetermined price on a specific date, have gained immense traction among sophisticated investors seeking to navigate market complexities. If you’ve been contemplating a foray into the realm of options trading, this comprehensive guide will illuminate the path, guiding you through the intricacies of this sophisticated financial arena.

Image: www.projectfinance.com

Delving into the Options Trading Lexicon

Before embarking on the journey of options trading, it’s imperative to familiarize yourself with the fundamental concepts that underpin this dynamic realm. Options come in two primary flavors: calls and puts. Call options grant the holder the right to buy an underlying asset at a specified price on or before a set date, while put options confer the right to sell. The underlying asset can encompass stocks, bonds, currencies, commodities, or even indices. Understanding these core concepts will provide a solid foundation for your options trading endeavors.

Choosing the Right Options Trading Strategy: A Balancing Act

Options trading encompasses a diverse spectrum of strategies, each tailored to specific investment objectives. Whether you’re seeking income generation, capital appreciation, or risk management, the choice of strategy is paramount. Covered calls, for instance, involve selling call options against stocks you own, offering a potential source of income while limiting upside potential. Cash-secured puts, on the other hand, entail selling put options, accompanied by the commitment to buy the underlying asset if the option is exercised, providing downside protection in exchange for capped收益率. Exploring the nuances of various options strategies will empower you to tailor your trading approach to align with your unique investment goals.

Decoding Options Terminology: Unveiling the Language of the Market

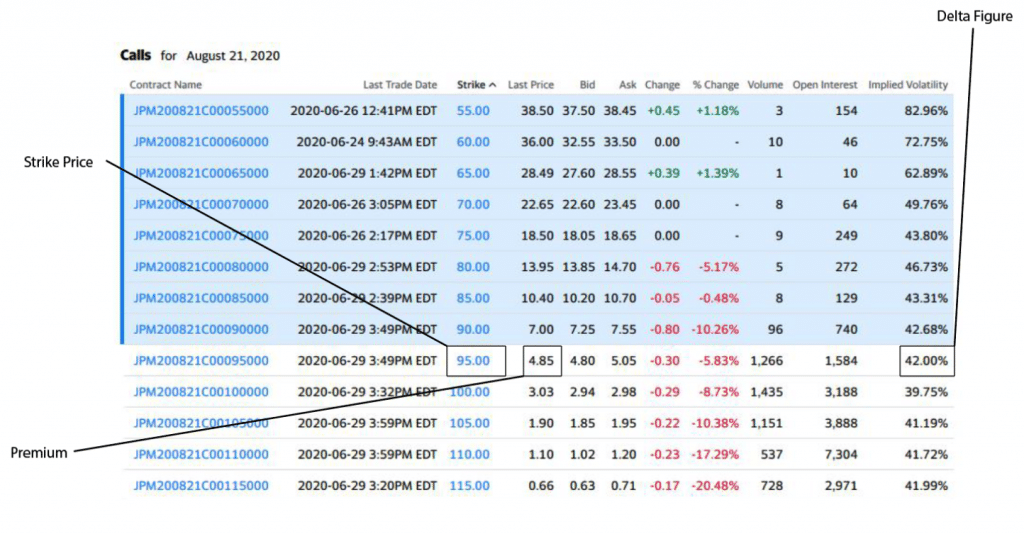

The options trading lexicon is replete with specialized terminology that may initially appear daunting. However, unraveling the meaning behind these terms is crucial for successful navigation of this financial landscape. Premiums, strike prices, expiration dates, and option chains are but a few of the key terms you’ll encounter. Premiums represent the price paid to acquire an option contract, while strike prices dictate the predetermined buying or selling price of the underlying asset. Expiration dates mark the day when options contracts cease to exist, influencing the time-sensitive nature of options trading. Familiarizing yourself with these terms will enable you to engage with options trading with greater confidence and comprehension.

Image: club.ino.com

Mastering Options Trading: A Gradual Ascension to Proficiency

Venturing into options trading doesn’t necessitate an all-or-nothing approach. Consider starting with paper trading, a risk-free simulation that allows you to hone your trading skills without the fear of financial loss. Paper trading platforms provide a valuable environment to test different strategies, gauge market reactions, and refine your understanding of options trading dynamics. Once you’ve gained a solid footing in paper trading, you can transition to live trading with a small account, gradually increasing your involvement as you gain experience and confidence. This progressive approach will mitigate risks and foster a deeper understanding of the market’s intricacies.

Embracing Education: An Investment in Your Trading Success

Continuous learning forms the cornerstone of successful options trading. Immerse yourself in educational resources, including books, online courses, and webinars, to expand your knowledge base. Attend seminars and workshops conducted by experienced options traders to glean insights from their实战经验. The more you invest in your education, the better equipped you’ll be to make informed trading decisions and navigate the ever-changing market landscape.

How Do I Get Into Options Trading

Image: www.youtube.com

Conclusion

Options trading presents a multifaceted realm of opportunities for investors seeking to amplify returns and manage risks. By grasping the fundamental concepts, exploring trading strategies, deciphering options terminology, and embracing continuous education, you can equip yourself to venture into options trading with confidence and reap its potential rewards. Remember, the journey to options trading mastery is an ongoing process that requires patience, dedication, and a commitment to lifelong learning. As you embark on this exciting path, leverage the resources available to