Investing in the stock market can be a daunting task, especially for those new to the world of finance. However, option trading offers an accessible and potentially lucrative way to increase your portfolio’s returns. In this article, we will delve into the world of option trading with Charles Schwab, one of the leading brokerage firms in the United States. We will explore the basics of option trading, its benefits and risks, and how to get started with Charles Schwab.

Image: www.bestreviewguide.com

Understanding Option Trading

Option trading involves the buying and selling of options, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Options come in two main types: calls and puts.

-

Calls give the holder the right to buy an underlying asset at a specified price (strike price) on or before a certain date (expiration date).

-

Puts give the holder the right to sell an underlying asset at a specified strike price on or before a certain expiration date.

Options are traded on exchanges, such as the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE).

Benefits of Option Trading

Option trading can offer several benefits for investors:

-

Increased returns: Options can provide the opportunity for higher returns than traditional stock investments, especially during periods of market volatility.

-

Reduced risk: Options can be used to hedge against losses from other investments or market fluctuations.

-

Flexibility: Options offer flexibility in terms of how and when they are exercised, allowing investors to tailor their strategies to their investment goals and risk tolerance.

Risks of Option Trading

It is essential to understand the risks associated with option trading before getting started:

-

Potential losses: Options can result in significant losses, especially if the underlying asset’s price moves against your expectations.

-

Time decay: Options lose value over time as the expiration date approaches. Therefore, it is crucial to monitor the time decay of your options and adjust your strategy accordingly.

-

Complexity: Option trading can be complex and requires a solid understanding of the financial markets and option trading mechanics.

Image: www.forexfees.com

Getting Started with Option Trading on Charles Schwab

Charles Schwab is a reputable and user-friendly brokerage firm that offers a comprehensive suite of option trading tools and resources. To get started with option trading on Charles Schwab, follow these steps:

-

Open an account: You will need to create a brokerage account with Charles Schwab to start trading options.

-

Fund your account: Before you can trade options, you will need to deposit funds into your brokerage account.

-

Learn about options: Take some time to research and educate yourself about option trading before placing any trades.

-

Use Schwab’s tools and resources: Charles Schwab provides various educational materials, trading tools, and research reports to help you make informed decisions.

-

Start trading: Once you have a solid understanding of option trading and have done your research, you can start placing option trades through Charles Schwab’s trading platform.

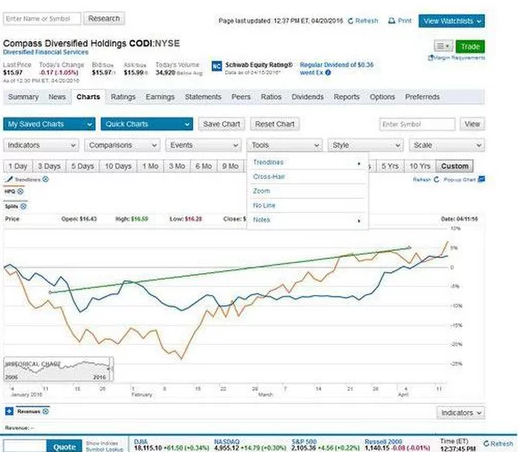

Option Trading Charles Schwab

Image: www.youtube.com

Conclusion

Option trading can be a valuable tool for investors looking to diversify their portfolios and increase their returns. Charles Schwab provides a user-friendly platform and educational resources to help you get started with option trading. However, it is important to approach option trading with a solid understanding of the risks involved and to carefully consider your investment goals and risk tolerance before placing any trades.