As I ventured into the dynamic world of option trading, I grappled with the intricacies of managing risk. Of the various strategies I stumbled upon, trailing stops emerged as a game-changer, enabling me to safeguard my profits while navigating market volatility. In this comprehensive guide, I’ll unravel the secrets of option trading trailing stops on Robinhood, empowering you with the knowledge to harness their potential.

Image: stock-investing-guide.com

Understanding Trailing Stops

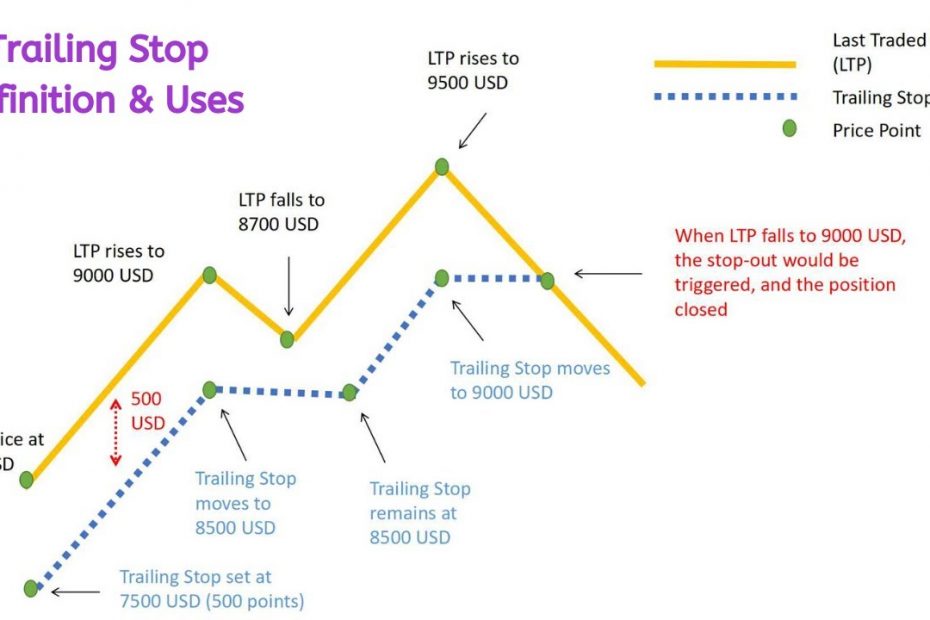

A trailing stop is a dynamic order type that automatically adjusts its stop-loss level as the price of the underlying asset moves in a favorable direction. Unlike static stop-loss orders, trailing stops provide a more tailored approach to risk management, allowing traders to lock in gains while minimizing losses.

Trailing stops can be beneficial in capturing a greater portion of market gains while reducing the risk of sudden reversals. They are particularly useful for traders seeking to maximize returns on long-term positions, as they allow for profit-taking at predetermined intervals or profit targets.

Implementing Trailing Stops on Robinhood

Robinhood offers a user-friendly interface that simplifies the implementation of trailing stops. To create a trailing stop:

- Place an order for your desired option contract.

- Click on the “Edit” button associated with the order.

- Scroll down to the “Trailing Stop” section.

- Enter the desired percentage or dollar amount by which you want to trail the stop.

- Verify the stop-loss level, which should adjust in real-time as the underlying asset price fluctuates.

Robinhood’s trailing stop feature is designed to prevent stop-loss executions from being filled at unfavorable prices. It ensures that the stop price adjusts incrementally, moving in tandem with the asset’s price.

Advantages of Using Trailing Stops

- Enhanced Profit Protection: Protect unrealized profits by automatically adjusting stop-loss levels as the underlying asset appreciates.

- Reduced Market Impact: Avoid triggering large stop-loss orders that may move the market against you.

- Increased Efficiency: Automate stop-loss management, freeing up time for other trading activities.

- Minimize Psychology Impact: Remove the temptation to manually adjust stop-loss levels, reducing emotional decision-making.

![How To Setup A Stop Loss On Robinhood? [Complete Guide] - AiM Tutorials](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhRHTRIQFezDXPVF8IBt8z-S6ZMYUdegsr5EskY0D7a8CZb2eOtBvysoVWIHF9dueNAIdVc-k-oaJWQVdRq1I07B6HQK-6n-zlta2Mjlkb1JSck0pvijvSCPHSMxl_K2KuwABlwd-fKU08-f6pdE0VqRb_XvvGV6A6zFcQ3NKoqmOeFNppEuuKgX1lt/s16000/How to Setup Stop Loss On Robinhood.webp)

Image: www.aimtuto.com

Tips for Effective Trailing Stops

Expert advice and tips for maximizing the effectiveness of trailing stops:

- Consider Your Risk Tolerance: Determine the appropriate trailing stop percentage that aligns with your risk appetite.

- Avoid Chasing Moving Averages: Setting trailing stops too tightly (e.g., below 5%) can lead to premature exits and missed opportunities.

- Be Mindful of Trend Changes: Monitor market trends and adjust trailing stop levels accordingly to avoid getting caught in significant downturns.

- Avoid Overtrading: Use trailing stops judiciously, particularly in highly volatile markets, to prevent unnecessary trades and potential losses.

Option Trading Trailing Stop Robinhood

Image: medium.com

FAQ

- What is the difference between a trailing stop and a stop-limit order?

Trailing stops adjust dynamically with the asset price, ensuring a more flexible approach. In contrast, stop-limit orders remain static until the specified stop price is met. - How can I monitor the status of my trailing stop on Robinhood?

Open the “Positions” tab in the Robinhood app. The real-time stop-loss level for your trailing stop will be displayed beneath the corresponding order.