Headline: Uncover the Secrets: A Comprehensive Option Trading Signals Review

Image: stock.adobe.com

Introduction:

In the fast-paced world of trading, navigating the choppy waters of options can be a daunting task. Amidst the complexities, option trading signals have emerged as a beacon of guidance, promising to light the path towards profitable trades. But before you dive into this alluring realm, it’s crucial to embark on a rigorous review to ensure your decision is well-informed and based on trustworthy sources.

Join us as we delve into the world of option trading signals, uncovering their true nature, their potential benefits, and the cautionary tales that accompany them. We’ll dissect the intricacies of these signals, providing you with a clear understanding of how they work, what they can do for you, and where they might fall short. Get ready to make an informed choice that empowers your trading strategies and positions you for success.

Understanding Option Trading Signals

Option trading signals are essentially recommendations for buying or selling options contracts based on various technical and fundamental analysis techniques. These signals are generated by algorithms or experienced traders who meticulously study market trends, historical data, and other key indicators to identify potential trading opportunities.

The primary goal of these signals is to provide traders with an edge by identifying potentially profitable trades. They leverage complex algorithms and data to spot patterns and anomalies that the human eye might miss. By subscribing to these signals, traders can gain access to potential trading opportunities they might otherwise overlook.

Types of Option Trading Signals

The landscape of option trading signals is a diverse one, with a wide range of providers offering various types of signals. From technical to fundamental signals, from free to paid services, the options available are as diverse as the strategies employed by different traders.

-

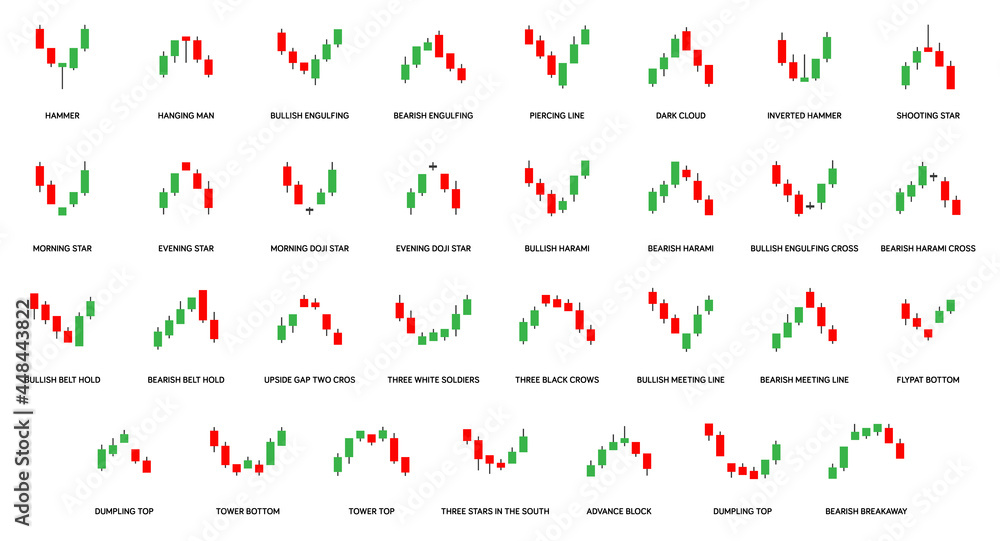

Technical Signals: These signals rely on historical price data, charting patterns, and technical indicators to identify trading opportunities. They analyze price movements, volume, and momentum to predict potential future trends.

-

Fundamental Signals: These signals delve into the company’s financial health, macroeconomic factors, and industry trends to assess the intrinsic value of an underlying asset. They provide insights into the company’s prospects, which can influence the value of its options.

-

Hybrid Signals: Combining the best of both worlds, hybrid signals leverage both technical and fundamental analysis to provide a comprehensive view of trading opportunities. They aim to strike a balance between historical patterns and the underlying company’s financial performance.

Benefits of Option Trading Signals

-

Time Savings: Signals alleviate the arduous task of manual analysis, freeing up traders’ time to focus on other aspects of their trading strategy. They provide traders with a pre-filtered list of potential trading opportunities, saving them countless hours of research.

-

Enhanced Accuracy: Well-crafted signals leverage robust algorithms and sophisticated analysis techniques to increase the accuracy of trade recommendations. By harnessing the power of big data and complex computations, signals aim to pinpoint profitable trades with greater precision.

-

Emotional Discipline: Trading can be an emotionally charged endeavor, leading to irrational decisions. Signals can help traders maintain emotional discipline by providing objective recommendations, reducing the influence of fear and greed on their trading decisions.

Cautions of Option Trading Signals

-

Over-Reliance: While signals can be a valuable tool, relying solely on them can be a recipe for disaster. It’s essential to remember that signals are not infallible, and they should be used as one piece of the trading puzzle rather than as a surefire guide.

-

Signal Fatigue: The constant flow of signals can lead to signal fatigue, making it difficult to prioritize and discern the most promising trading opportunities. Traders need to develop a strategy for filtering and evaluating signals to avoid getting overwhelmed.

-

Misinterpretation: Signals are only as good as their underlying analysis, and if that analysis is flawed, the signals will likely be misleading. Traders must fully understand the rationale behind the signals they receive to avoid incorrect interpretations.

Choosing the Right Option Trading Signals Provider

Selecting a reputable option trading signals provider is paramount to your trading success. Here are some crucial factors to consider:

-

Track Record: Look for providers with a proven track record of success over an extended period. Assess their historical performance and customer feedback to gauge their reliability.

-

Transparency: Transparency is key. Choose providers who openly disclose their trading strategy, algorithms, and performance metrics. This allows you to make an informed decision based on their actual track record.

-

Cost: Signal providers offer a range of pricing models, from free to premium subscription plans. Determine your budget and consider the value the service provides before committing to a particular provider.

Conclusion

Option trading signals can be a valuable tool for traders seeking to enhance their trading strategies. They offer the allure of saving time, improving accuracy, and maintaining emotional discipline. However, it’s essential to approach signals with a critical eye, understanding their limitations and managing expectations.

By carefully reviewing signal providers, thoroughly assessing their track records and methodologies, and incorporating signals as one element of a broader trading strategy, traders can harness the potential benefits of signals while mitigating associated risks. Remember, the path to trading success lies not in blind reliance on external advice but in leveraging them thoughtfully as part of a holistic trading approach.

Image: campus.datacamp.com

Option Trading Signals Review

Image: cryptobuz.blogspot.com