Options trading has emerged as a popular investment strategy for both seasoned veterans and novice traders alike. With its ability to provide both income and risk management opportunities, options trading offers a versatile approach to enhancing portfolio returns. However, understanding the associated fees is crucial for making informed decisions and optimizing your trading outcomes. In this article, we delve into the world of option trading fees on Robinhood, exploring the costs involved in executing, exercising, and assigning options contracts.

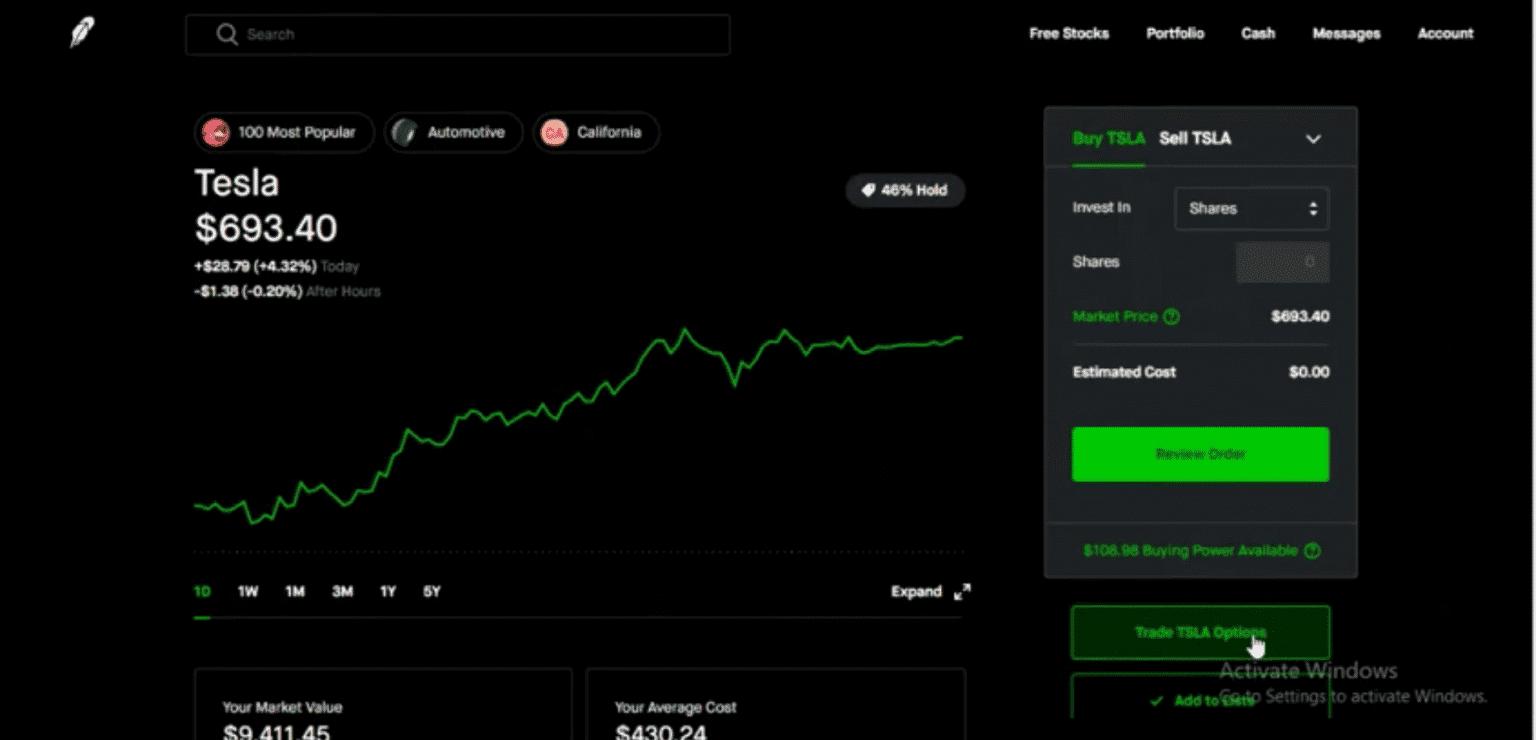

Image: www.youtube.com

Understanding Option Trading Fees

When engaging in option trading, it is imperative to factor in the associated fees, which can vary depending on the platform you use. Robinhood, a popular online brokerage, offers a range of trading options, each with its own fee structure. Option trading fees typically include:

- Per-contract fee: A fee charged for each option contract traded. This fee is usually a flat rate, regardless of the number of shares underlying the option.

- Exercise fee: A fee charged when the holder of an option decides to exercise their right to buy or sell the underlying asset.

- Assignment fee: A fee charged when an option is assigned by the option writer to the option holder.

Robinhood’s Fee Structure for Option Trading

Robinhood’s fee structure for option trading is straightforward and transparent. The platform charges a flat per-contract fee of $0.65 for all option contracts. This fee is applied to both the buyer and the seller of the option.

- Example: If you buy an option contract on Robinhood with 100 underlying shares, you will pay a total fee of $1.30 ($0.65 for the buy transaction and $0.65 for the sell transaction).

Robinhood does not charge any exercise or assignment fees. This eliminates additional costs associated with executing and fulfilling option contracts.

Additional Fees to Consider

While Robinhood’s fee structure for option trading is relatively low, there are some additional fees to consider that may impact your profitability:

- Trading platform fees: Some trading platforms may charge additional fees for access to market data, trading tools, and research.

- Regulatory fees: Various regulatory bodies may impose fees on option trades, including the SEC and FINRA.

- Clearing fees: Clearinghouses, which facilitate the settlement of option trades, typically charge a fee for their services.

It is important to research and compare the fee structures of different trading platforms before choosing one for your option trading activities.

Image: marketxls.com

Option Trading Fees Robinhood

Image: www.youtube.com

Conclusion

Understanding the fees associated with option trading on Robinhood is essential for developing an effective trading strategy. Robinhood’s competitive fee structure, offering a flat per-contract fee of $0.65 with no exercise or assignment fees, makes it an attractive choice for traders looking to minimize costs. However, it is crucial to take into account additional fees such as trading platform fees, regulatory fees, and clearing fees, which can impact your overall profitability. By carefully considering all fees involved, you can make informed decisions and maximize your returns from option trading.