Introduction

Trading options can be a powerful tool for investors looking to enhance their returns or hedge against risk. However, understanding the associated fees is crucial to making informed trading decisions. Robinhood, a popular online brokerage platform, offers commission-free stock and ETF trading, but its fees for options trading can vary depending on factors such as contract type and exercise strategy. This comprehensive guide will delve into the intricacies of Robinhood’s options trading fees, providing investors with a clear understanding of what to expect when trading options on this platform.

Image: www.youtube.com

Understanding Options Trading Fees

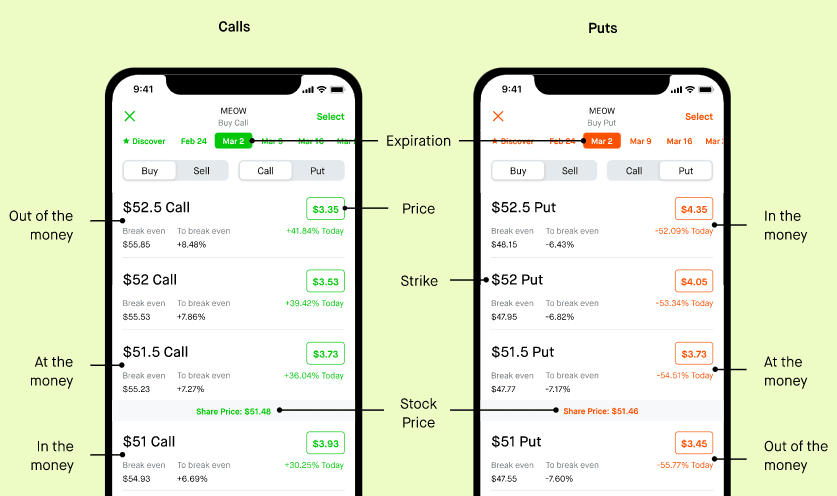

An option contract represents the right, not the obligation, to buy (call option) or sell (put option) a specified number of shares of a particular stock at a predefined price (strike price) on or before a set date (expiration date). When trading options, investors pay various fees, including:

- Option Premium: The price paid to acquire the right to buy or sell an underlying asset.

- Transaction Fee: A flat fee charged per contract traded.

- Exercise Fee: A fee charged when an option holder decides to exercise their right to buy or sell the underlying asset.

Robinhood’s Options Trading Fees

Robinhood offers both commission-free and tiered fee structures for options trading. The fee structure applicable to a particular trade depends on the type of options contract and whether it is executed during the day or outside of regular trading hours.

Commission-Free Options Trading

Robinhood allows commission-free trading of all single-leg options executed during regular trading hours (9:30 AM – 4:00 PM ET). This includes both standard single-leg calls and puts.

Image: optionstradingiq.com

Tiered Fee Structure

For options contracts that are executed outside of regular trading hours or involve more complex strategies like spreads and butterflies, Robinhood charges tiered fees. The fee structure is as follows:

| Contract Type | Number of Contracts | Fee per Contract |

|---|---|---|

| Single-Leg Options | 1-4 | $1.50 |

| Single-Leg Options | 5-9 | $1.25 |

| Single-Leg Options | 10+ | $1.00 |

| Multi-Leg Options | All | $2.50 |

Exercise Fees

In addition to trading fees, Robinhood charges an exercise fee of $0.15 per contract when an investor decides to exercise their right to buy or sell an underlying asset using their purchased option contract.

Additional Considerations

Market Liquidity: Fees for options trading can also be influenced by the liquidity of the underlying asset. Options contracts that are heavily traded tend to have lower fees due to increased competition among potential buyers and sellers.

Account Type: Robinhood offers different account types with varying levels of access to options trading features. Some account types may have different fee structures or limitations on the types of options contracts that can be traded.

Account Activity: Robinhood may charge inactivity fees if an account remains idle for an extended period. These fees can accumulate and impact the overall cost of trading options on the platform.

Fees For Trading Options Robinhood

Image: www.youtube.com

Conclusion

Understanding the fees associated with trading options on Robinhood is essential for making informed trading decisions. While Robinhood offers commission-free trading of certain options contracts, traders should be aware of the tiered fee structure for other options trades. Careful consideration of factors such as contract type, exercise strategy, and market liquidity can help investors minimize fees and optimize their options trading returns. By staying informed and utilizing the appropriate fee structure, Robinhood users can navigate the world of options trading efficiently and cost-effectively.