Navigating the volatile waters of options trading demands a solid mathematical foundation. From Greeks to Black-Scholes, quantitative analysis lies at the heart of making informed decisions in this complex financial realm. Join us as we delve into the world of math for options trading, empowering you with the knowledge to harness its enigmatic calculations.

Image: twitter.com

Unveiling the GreekAlphabet: A Guide to Measuring Options Risk

Understanding the Greeks is paramount in options trading. These letters from the Greek alphabet quantify the sensitivity of options to underlying variables, enabling traders to evaluate risk and manage their portfolios effectively. Delta, Gamma, Theta, Vega, and Rho measure price changes in response to fluctuations in stock prices, time decay, implied volatility, and interest rates respectively.

Black-Scholes Model: Pricing Options with Precision

The Black-Scholes model, a cornerstone of options pricing, harnesses mathematical equations to determine the theoretical fair value of options contracts. This model considers factors such as the underlying asset’s price, strike price, time to expiration, risk-free rate, and implied volatility. Understanding its assumptions and limitations is crucial for traders seeking accurate estimates.

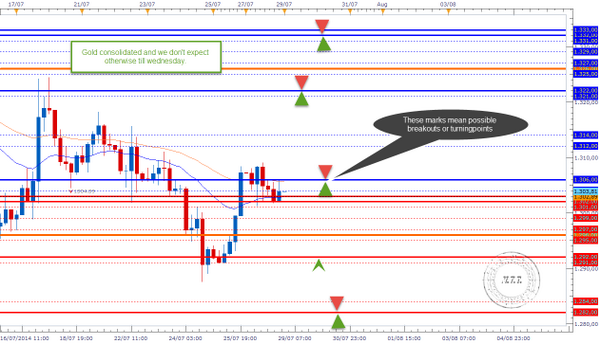

Probability and Statistics: Forecasting Market Moves

Probability theory and statistics play a vital role in options trading. Traders utilize historical data and statistical models to predict the likelihood of future market movements. Techniques like Monte Carlo simulations enable traders to assess potential outcomes and calculate probabilities of success. A strong grasp of statistical concepts empowers traders to make informed decisions based on various scenarios.

Image: www.scribd.com

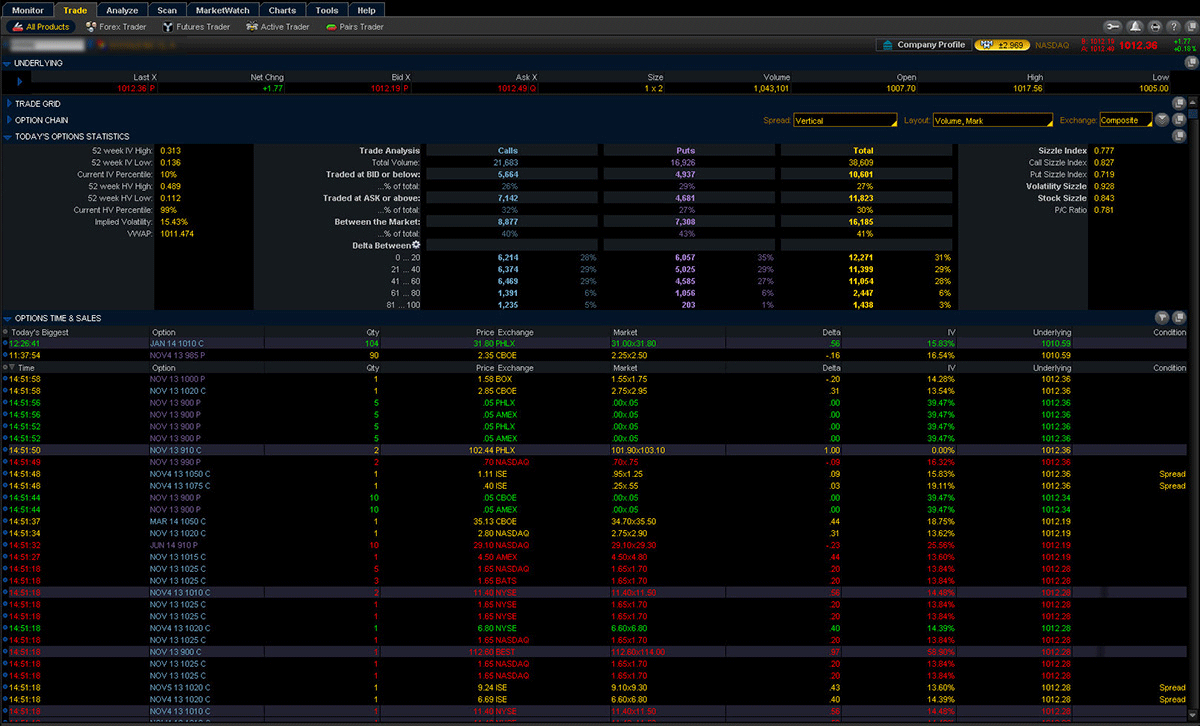

Implied Volatility: Unlocking Market Sentiment

Implied volatility is a key input in options pricing and reflects market expectations of future price fluctuations. By analyzing implied volatility, traders can gauge market sentiment and position themselves accordingly. High implied volatility indicates greater market uncertainty, potentially resulting in higher option premiums. Conversely, low implied volatility suggests a calmer market environment, leading to lower premiums.

Tips and Expert Advice for Options Traders

Seasoned options traders recommend extensive research and practice to master the complexities of this financial instrument. Immerse yourself in reputable trading forums, engage in online courses, and seek guidance from experienced mentors to hone your analytical skills and decision-making abilities.

Remember, mathematical proficiency is not a mere academic pursuit but a practical necessity in options trading. Embracing these calculations as indispensable tools empowers you to navigate market challenges and unlock the full potential of this financial asset class.

FAQ on Options Trading Math

Q: What are the most important Greek letters for options trading?

A: Delta, Gamma, and Vega are crucial Greeks for measuring risk and price sensitivity.

Q: How do I use the Black-Scholes model?

A: You can use an online calculator or software to input the necessary parameters and calculate the theoretical option value.

Q: How can probability and statistics help in options trading?

A: Statistical analysis provides insights into historical trends and enables forecasting of future market movements.

Q: What is the significance of implied volatility?

A: Implied volatility reflects market expectations of future price fluctuations, influencing option premiums.

Math For Options Trading

Image: tickertape.tdameritrade.com

Conclusion: Embracing Math in Options Trading

Math for options trading is an indispensable tool for informed decision-making and successful navigation of this complex financial landscape. By mastering the intricacies of mathematical calculations, traders can gain a competitive edge and unlock the full potential of their trading strategies. Embrace the numbers; they are not just equations but a roadmap to financial success.

Are you ready to explore the world of options trading with confidence and precision? Embark on a mathematical journey, empowering yourself to conquer market challenges and seize financial opportunities.