As an ardent day trader, my journey in the financial markets has witnessed innumerable triumphs and tribulations. One particular experience that etched itself into my memory occurred during my early days of navigating the world of options trading. I had set my sights on Apple, the tech behemoth whose iconic products have revolutionized our lives. With each passing trading session, I sought to unlock the immense potential concealed within its options.

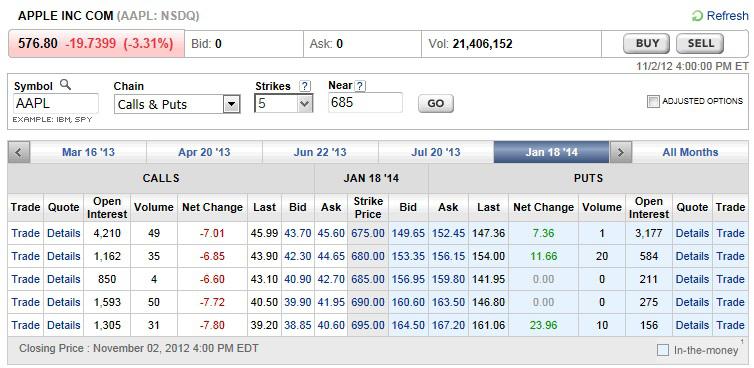

Image: seekingalpha.com

Over the years, I meticulously honed my skills, delving into the intricacies of delta, gamma, theta, and vega. The thrill of profiting from the subtle fluctuations of Apple’s stock price became an adrenaline rush that fueled my passion for day trading. However, it was not without its challenges. The market’s volatility could be unforgiving at times, but I had resolved to persevere, driven by my determination to conquer this financial frontier.

Understanding Apple Options

Apple options are financial instruments that provide the holder with the right, but not the obligation, to buy or sell Apple stock at a predetermined price on or before a specified date. Understanding the types of options is crucial for successful day trading:

- Call Options: Grant the buyer the right to buy Apple stock at a set price within a specific timeframe.

- Put Options: Give the buyer the right to sell Apple stock at a fixed price by a predetermined date.

Each option contract represents 100 shares of Apple stock. Traders can select options with varying expiration dates, ranging from weeks to months, offering flexibility in tailoring their trading strategies to market conditions.

Day Trading Strategies for Apple Options

To thrive in the fast-paced world of day trading Apple options, employing effective trading strategies is paramount:

- Scalping: Involves capitalizing on minor price movements, profiting from the bid-ask spread by rapidly entering and exiting trades throughout the trading session.

- Range Trading: Targets stocks trading within defined price channels, aiming to capture profits from price fluctuations within these boundaries.

- Event-Driven Trading: Relies on analyzing upcoming events, such as earnings announcements or product launches, that may impact Apple’s stock price.

Choosing the right strategy depends on factors such as market volatility, trader risk tolerance, and time constraints.

Tips and Expert Advice

To maximize your success as an Apple options day trader, heed the following tips and expert advice:

- Thoroughly Research Apple: Understand the company’s financial health, competitive landscape, and market sentiment to make informed trading decisions.

- Manage Risk Prudently: Always trade with defined risk parameters, using stop-loss orders to limit potential losses.

- Monitor Market News and Events: Stay abreast of breaking news, earnings reports, and economic data that may influence Apple’s stock price.

- Choose Appropriate Expirations: Consider the timeframe of your trading strategy when selecting options with suitable expiration dates.

- Paper Trade Before Trading Live: Practice your trading strategies on a demo account before risking real capital.

Remember, success in day trading requires consistent learning, disciplined execution, and a keen eye for market opportunities.

Image: www.ped30.com

Frequently Asked Questions

Q: What is the best trading platform for Apple options day trading?

A: Select a trading platform that provides low commissions, real-time data, and advanced charting capabilities.

Q: How much capital do I need to start day trading Apple options?

A: The required capital depends on your trading strategy and risk tolerance. Generally, it is advisable to start with a small account and gradually increase your capital as you gain experience.

Q: What are the potential risks of trading Apple options?

A: Day trading options involves inherent risk. It is possible to lose your entire investment, so it is crucial to manage risk effectively.

Day Trading Apple Options

Conclusion

Mastering the art of day trading Apple options requires a combination of knowledge, skill, and perseverance. By embracing effective strategies, heeding expert advice, and continually adapting to market dynamics, you can unlock the potential for lucrative returns in the fast-paced world of options trading.

As you delve deeper into this exciting domain, ask yourself: are you ready to embrace the challenges and reap the rewards of day trading Apple options?