Imagine yourself amidst the dynamic world of finance, where every move holds the potential for both risk and reward. Live options trading on Robinhood offers such an exhilarating experience, empowering you to navigate the fast-paced markets with precision and agility.

Image: marketxls.com

Live options trading allows you to delve into a realm of possibilities, where calculated decisions can lead to significant returns. However, it’s crucial to remember that the pursuit of profit comes with inherent risks, demanding a thorough understanding of the market, options strategies, and risk management techniques.

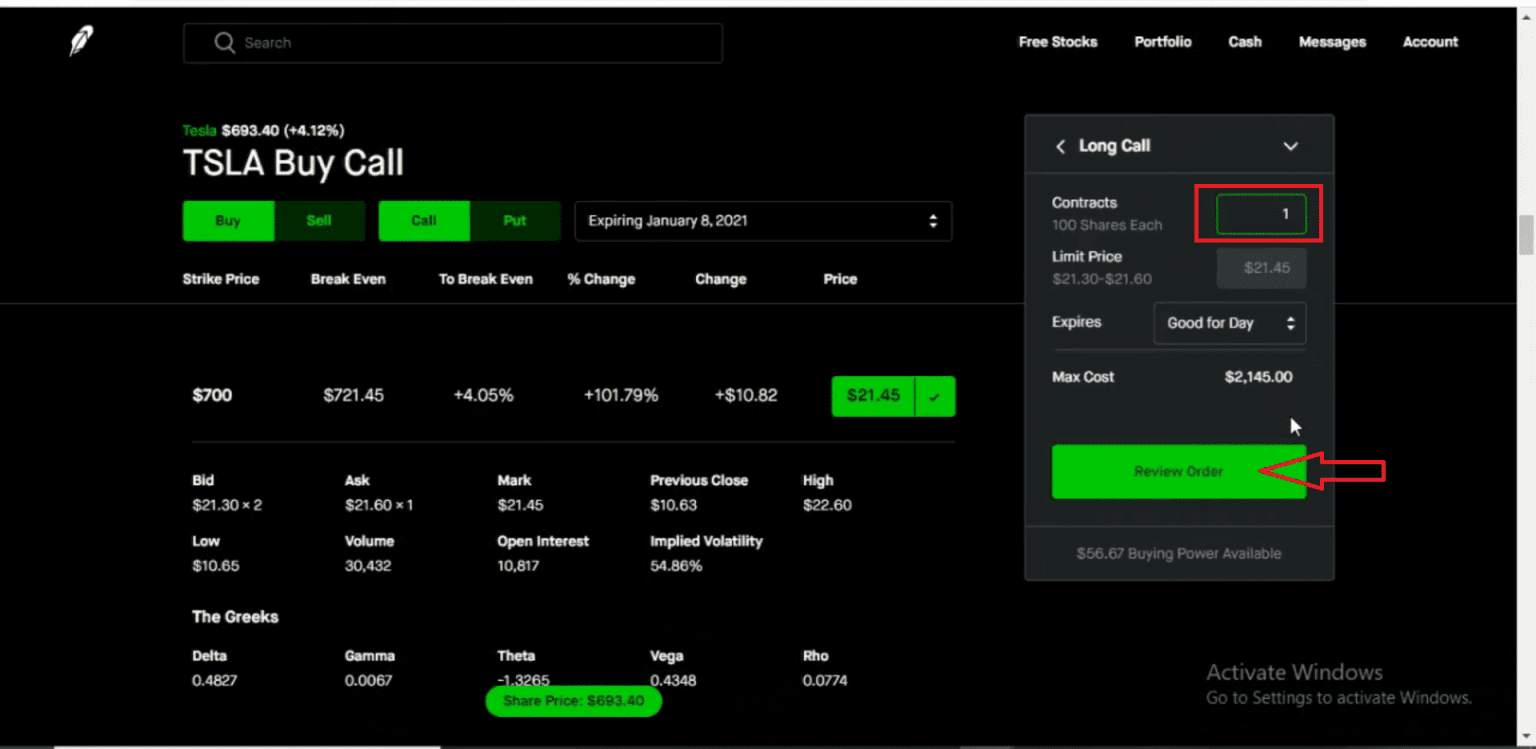

Live Options Trading: Unveiling Its Essence

Options trading involves contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Live options trading brings this concept to life, enabling you to engage with the market in real-time, monitoring price fluctuations and executing trades as opportunities arise.

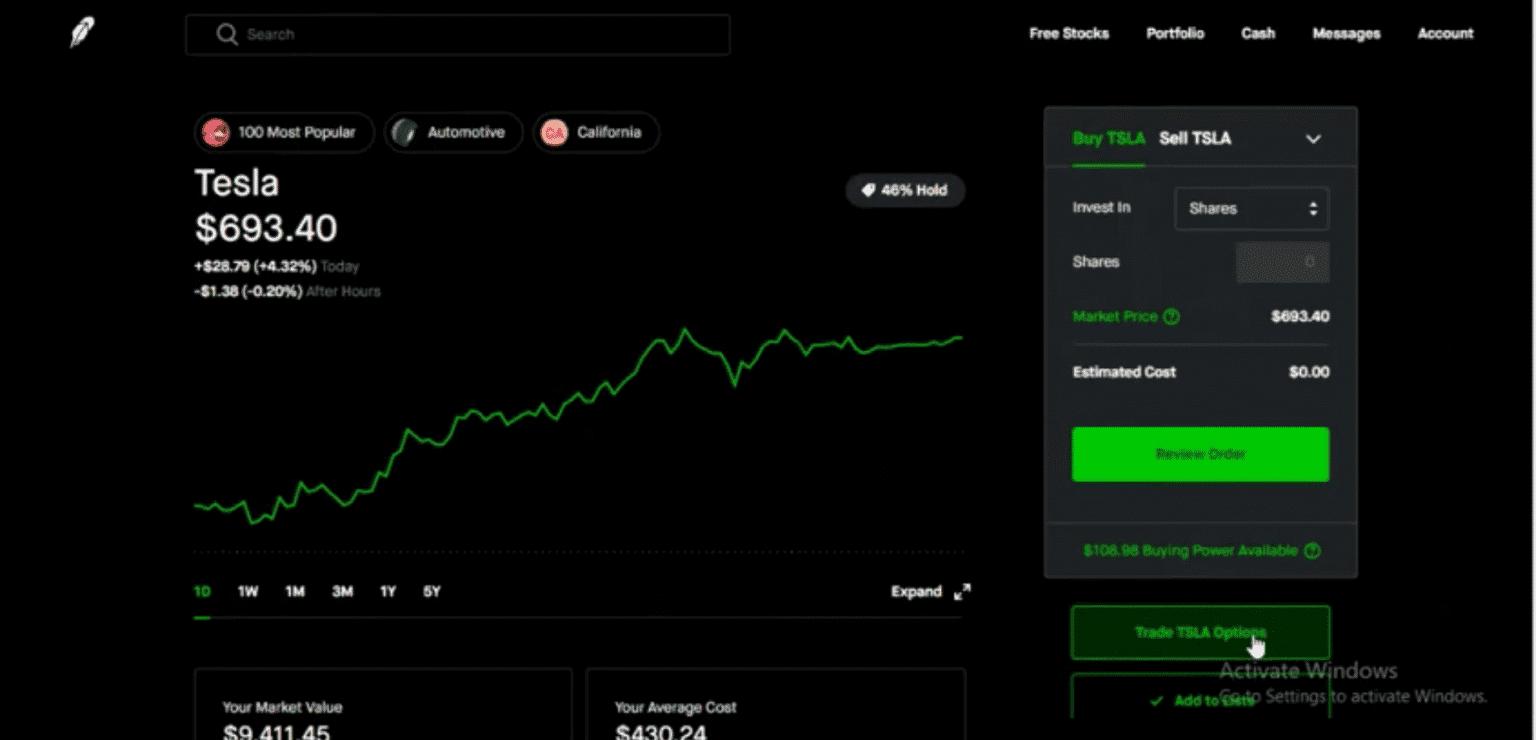

As a participant in live options trading, you assume the role of a speculator, attempting to predict the directional movement of the underlying asset. By exercising your option contracts, you can capitalize on potential price fluctuations, benefiting from your foresight and timing. Robinhood, a cutting-edge financial technology platform, provides a user-friendly interface that streamlines the live options trading process.

Unleashing the Power of Options Strategies

The options market offers a diverse array of strategies, each tailored to specific market conditions and risk appetites. Covered calls, cash-secured puts, bull call spreads, and bear put spreads are just a few examples of commonly employed techniques.

Covered calls involve selling a call option while owning the underlying asset, aiming to generate additional income through premiums. Cash-secured puts, on the other hand, entail selling a put option with cash collateral, providing income if the underlying asset price remains above the strike price. Bull call spreads combine the purchase of a lower-strike call option and the sale of a higher-strike call option, allowing for limited profit but reduced risk compared to buying outright calls. Bear put spreads, in contrast, involve the purchase of a higher-strike put option and the sale of a lower-strike put option, providing limited profit but reduced risk versus buying outright puts.

Navigating the Market: Risk Management and Education

While live options trading presents lucrative opportunities, it’s essential to approach the market with astute risk management practices. Understanding your risk tolerance, implementing stop-loss orders, and diversifying your portfolio can mitigate potential losses and preserve your capital.

Education plays a pivotal role in live options trading success. Continuous learning through online courses, webinars, and industry publications empowers you with the knowledge and insights necessary to make informed decisions. Robinhood offers educational resources and live support to assist you in your trading endeavors.

Image: www.youtube.com

Expert Insights and Strategies for Success

Seasoned options traders emphasize the importance of developing a disciplined trading plan that aligns with your risk appetite and financial goals. They recommend thoroughly researching available strategies, practicing with paper trading accounts, and seeking guidance from experienced mentors or financial advisors.

Effective options trading involves understanding the underlying asset’s volatility, liquidity, and catalysts driving price movements. Monitoring the options chain and identifying key support and resistance levels can provide valuable insights for timing trades.

FAQ on Live Options Trading

Q: What is the minimum account balance for live options trading on Robinhood?

A: $2,000, which includes the value of any existing options positions.

Q: Can I trade all types of options on Robinhood?

A: Yes, Robinhood allows trading of various option types, including calls, puts, and spreads.

Q: What are the risks involved in live options trading?

A: Options trading carries substantial risks, including the potential for significant losses exceeding your invested capital.

Live Options Trading Robinhood

Image: marketxls.com

Embark on Your Live Options Trading Journey

Live options trading on Robinhood offers a dynamic and potentially lucrative avenue for financial growth. By embracing risk management principles, pursuing continuous education, and implementing effective strategies, you can navigate the market with confidence. As you delve deeper into the intricacies of options trading, ask yourself if this extraordinary realm aligns with your financial aspirations. Embrace the thrill of live options trading, but always prioritize a prudent approach to maximize your chances of long-term success.