Navigating the complex world of options trading can be daunting, especially for beginners trying to decipher the vast amount of market data. One crucial aspect is identifying stocks with large trading volume in options contracts, as it provides valuable insights into potential price movements and market sentiment. This comprehensive guide will empower you with the knowledge and strategies to effectively identify large volume trading options, enabling you to make informed investment decisions.

Image: www.investorsunderground.com

Understanding Options Trading Volume

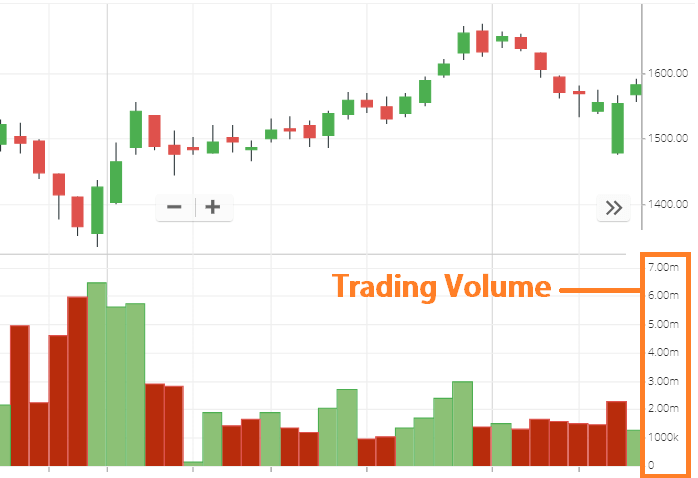

Options trading involves the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. The volume of options traded reflects the number of contracts bought and sold, indicating market activity and interest in a particular stock. High volume can signal heightened speculation, potential price volatility, and increased liquidity.

Identifying High-Volume Options

Several methods can be employed to identify stocks with large volume options trading:

-

Option Chain Analysis: Option chains display all available options contracts for a specific stock, including volume data. Look for contracts with significantly higher volume compared to others in the same series.

-

Market Depth Tool: Trading platforms often provide market depth tools that show the volume of orders at different price levels. Stocks with a high concentration of volume at specific strike prices may indicate potential support or resistance levels.

-

News and Sentiment Analysis: Pay attention to news, earnings reports, and company announcements that can trigger high volume in options trading. Positive or negative sentiment around a stock can drive increased option activity.

Interpreting Volume Data

Once you’ve identified high-volume options, it’s essential to interpret the data effectively:

-

Rising Volume: Increasing volume often indicates growing market interest and potential price momentum.

-

Falling Volume: Decreasing volume can suggest waning interest or a consolidation phase.

-

Spike in Volume: A sudden spike in volume could signal a significant market event or a change in sentiment.

Image: earnfo.com

Leveraging Volume Data for Trading Decisions

Understanding large volume trading options can enhance your trading strategies:

-

Identify Support and Resistance Levels: High volume at specific strike prices can indicate potential support or resistance levels, which can guide trading decisions.

-

Gauge Market Sentiment: Volume can reflect market sentiment and provide insights into how other traders are positioning themselves.

-

Anticipate Price Movements: Large volume can sometimes precede significant price moves, helping you prepare for potential market shifts.

Expert Insights on Volume Trading

Renowned options trader Mark Sebastian advises, “Large volume is often a sign of strong conviction in a stock’s direction. However, it’s crucial to consider other factors like volatility and open interest.”

Seasoned investor Warren Buffett emphasizes, “Volume can be a valuable tool, but it’s not a foolproof indicator. Always conduct thorough due diligence before making any investment decisions.”

How To Know Large Volume Of Trading Option

Image: www.babypips.com

Conclusion

Unlocking the insights hidden within large volume trading options empowers you to navigate the options market with greater confidence. By incorporating the strategies and insights outlined in this guide, you can identify stocks with high options activity, interpret market sentiment, and make informed trading decisions. Remember, options trading involves risk, so always consult with a financial advisor and thoroughly research before committing any capital.