Options trading has emerged as a magnetic force in the dynamic crypto realm, captivating countless investors with its allure of substantial returns. Like a skilled navigator charting a course through uncharted waters, I embarked on my own crypto options trading journey, eager to unravel its intricacies.

Image: www.cryptoraptus.com

An Enticing Gateway to Crypto Profits

Options Trading: Demystified

Options are essentially financial instruments that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a preset price on or before a specified date. In the crypto sphere, these assets can range from prominent cryptocurrencies like Bitcoin and Ethereum to altcoins promising exponential growth potential.

Deciphering Options Terminology

Understanding the nuances of options trading is crucial for burgeoning traders. Key terms to grasp include:

- Premium: The price paid to acquire an option contract.

- Strike Price: The price at which the underlying asset can be bought (call) or sold (put).

- Expiration Date: The date on which the option contract expires and becomes worthless.

Navigating the Crypto Options Landscape

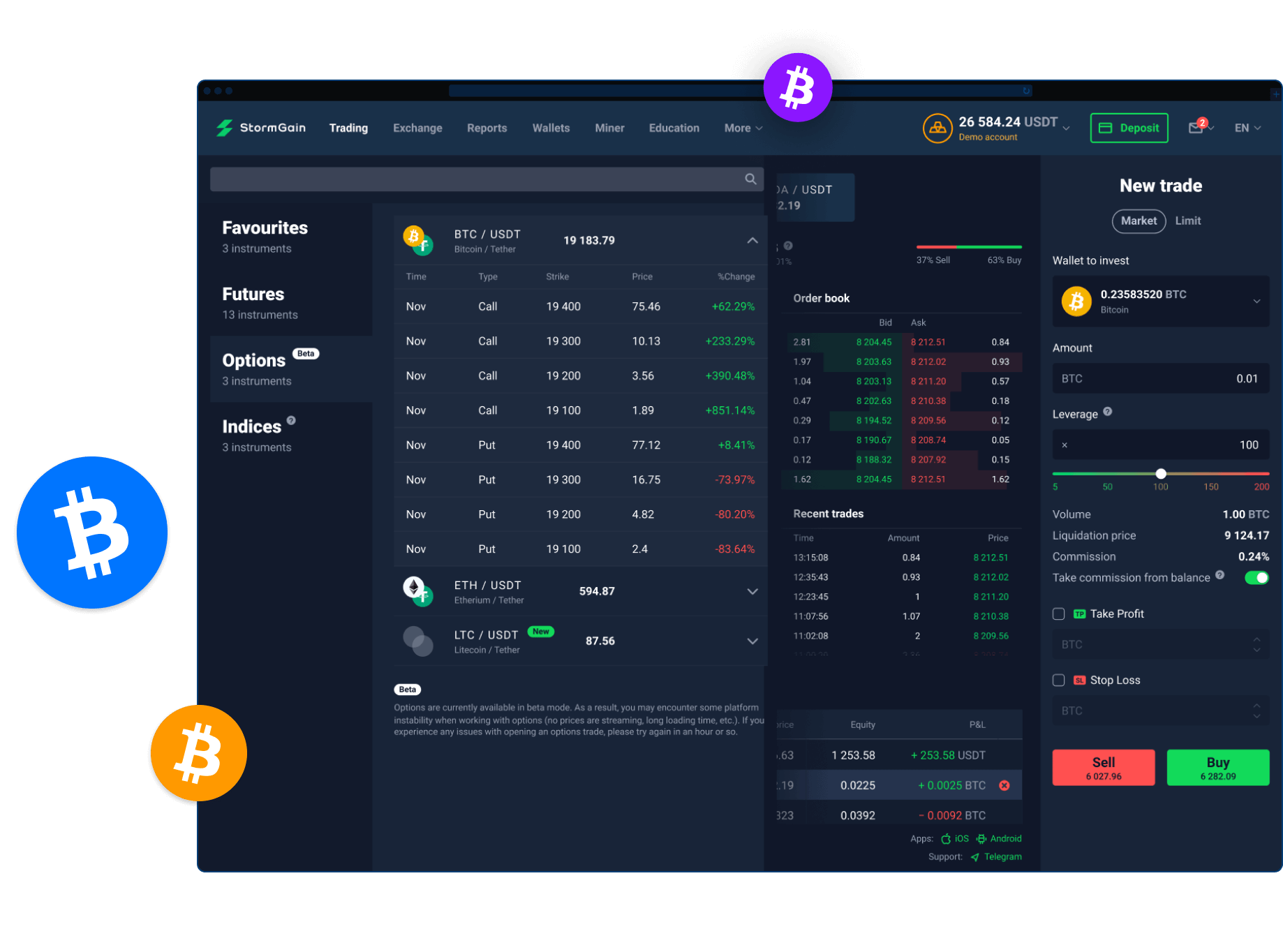

Image: stormgain.com

Options Trading In Crypto

Prospering in the Options Trading Arena

Venturing into crypto options trading can yield lucrative rewards, but it also demands a prudent approach. To maximize returns, consider the following tips gleaned from seasoned traders:

- Master Fundamental and Technical Analysis: Thorough market research and technical charting skills are invaluable in identifying promising opportunities.

- Manage Risk Prudently: Options trading carries inherent risks. Implement sound risk management strategies to minimize potential losses.

- Choose Reliable Platforms: Select reputable exchanges offering diverse options products and robust security measures.

Expert Insights and Advice for Enhanced Profits

Renowned experts in the field emphasize the significance of leveraging market sentiment and social media trends to gauge market direction. By closely monitoring news, updates, and discussions on social media platforms, traders can gain valuable insights.

Illuminating FAQ: Crypto Options Unveiled

Q: What is the primary distinction between call and put options?

A: Call options grant the right to buy, while put options provide the right to sell.

Q: Can options trading yield greater returns than direct cryptocurrency investing?

A: Options offer the potential for magnified returns, but they also carry higher risks.

Conclusion: Embracing the Crypto Options Revolution

Options trading in the crypto realm presents a tantalizing avenue for maximizing profits. By mastering its fundamentals, embracing expert advice, and navigating the landscape with finesse, investors can harness the full potential of this financial instrument. The tantalizing allure of crypto options beckons, inviting you to voyage into the uncharted depths of this thriving market. Embark on this adventure and witness the transformative power of options trading in the dynamic crypto arena.