Introduction

Navigating the complex world of options trading requires a comprehensive understanding of how returns and margin requirements are measured. Whether you’re a seasoned pro or just starting to delve into this exciting field, mastering these concepts is paramount to achieving long-term success. In this comprehensive article, we’ll unravel the intricacies of measuring returns and margin requirements, providing you with a solid foundation for informed decision-making.

Image: libraryoftrader.net

But before diving into the specifics, let’s first define the key terms. An option contract represents a right to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a certain date (expiration date). Understanding these core concepts will pave the way for a clearer grasp of how returns and margin requirements are calculated.

Calculating Returns in Option Trading

Measuring returns in option trading is crucial to assess the profitability of your strategies. There are two primary methods for calculating returns: absolute return and annualized return.

Absolute Return

Absolute return measures the total gain or loss on an option trade, regardless of the holding period. It is simply calculated by subtracting the purchase price (or cost of the option) from the eventual sale price (or proceeds received). Positive returns indicate a profitable trade, while negative returns represent losses.

Formula: Absolute Return = Sale Price – Purchase Price

Annualized Return

Annualized return provides a standardized measure of return over a specific time period, typically one year. It is calculated by first converting the absolute return to a rate of return, which is the percentage change in the investment value. Then, the rate of return is multiplied by the number of years over which the return was achieved. This method is particularly useful for comparing the performance of different option strategies over various time horizons.

Formula: Annualized Return = (Rate of Return / Holding Period in Years) x 365

Image: www.interactivebrokers.com

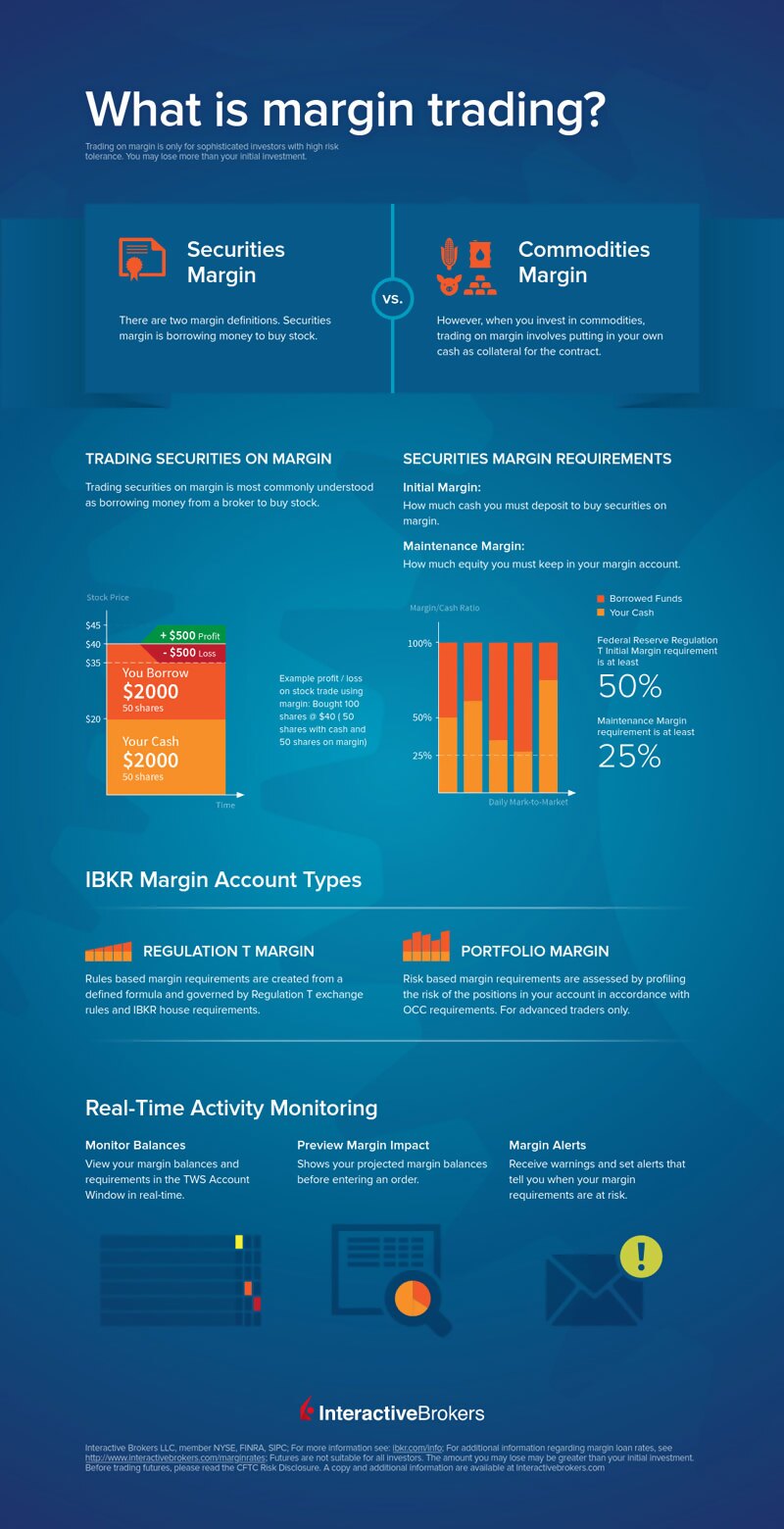

Understanding Margin Requirements

In option trading, margin requirements play a crucial role in managing your capital and risk. Margin refers to the amount of money you are required to deposit with your broker to secure an option trade. This deposit acts as collateral in case the trade moves against you and helps protect the broker from potential losses.

Margin requirements vary depending on the type of option contract, the underlying asset, and the specific broker’s rules. Regulators, such as the Securities and Exchange Commission (SEC), set minimum margin requirements to ensure financial stability and mitigate systemic risk.

Calculating Margin Requirements

The formula for calculating margin requirements is as follows:

Formula: Margin Requirement = Initial Margin + Maintenance Margin

Initial Margin

Initial margin is the upfront deposit you are required to put up when you open an option position. It serves as a buffer against potential losses in case the trade goes against you. The initial margin varies depending on the type of option contract and the underlying asset’s volatility.

Maintenance Margin

Maintenance margin is an ongoing requirement that you must maintain throughout the life of the option position. It acts as a protective cushion and ensures that you have sufficient capital to cover any adverse price movements in the underlying asset. If your account balance falls below the maintenance margin requirement, the broker may issue a margin call, requiring you to deposit additional funds or liquidate the position.

How Do Option Trading Pros Measure Returns And Margin Requirement

Image: haipernews.com

Conclusion

Measuring returns and margin requirements accurately is essential for option trading success. Absolute return and annualized return provide valuable insights into the profitability of your strategies. By understanding margin requirements and the role they play in managing risk, you can navigate the complexities of option trading with confidence.

Remember, while this article provides a comprehensive overview of the topic, it is strongly recommended to conduct further research, consult with financial experts, and carefully consider your risk tolerance and investment objectives before making any trades. The world of option trading offers immense potential for both rewards and risks, and a sound understanding of return and margin measurements will empower you to make informed decisions and maximize your trading outcomes.