Introduction

In the realm of investing and finance, the world of options trading presents an intriguing and potentially rewarding avenue for generating income and managing risk. Whether you’re a seasoned investor or just starting your journey in the financial markets, understanding options trading can significantly enhance your knowledge and financial literacy. This comprehensive guide will delve into the fundamentals of options trading, providing you with clear insights into the concepts, strategies, and nuances of this captivating aspect of investing.

Image: www.entrepreneurshipsecret.com

Options contracts derive their value from underlying assets like stocks, bonds, or commodities. They offer investors the flexibility to capitalize on market movements while providing a safety net against potential losses. By understanding the interplay between risk and return in options trading, you can make informed decisions and navigate the complexities of this dynamic market effectively.

Understanding the Basics of Options

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The buyer of an option pays a premium to the seller, who in turn agrees to fulfill the terms of the contract if the buyer chooses to exercise it.

Calls confer the privilege of buying an asset if its price rises above the strike price, while puts allow selling if the price falls below the strike price. Options’ value is directly linked to the underlying asset’s price and time remaining until expiration. As the underlying asset’s price approaches or surpasses the strike price, the option’s value increases. However, as time passes towards expiration, its value decays due to the diminishing likelihood of the option being exercised profitably.

A Deeper Look into Options Strategies

Options trading offers a versatile array of strategies that cater to different market scenarios and risk tolerances. Let’s delve into some of the commonly employed options strategies to help you navigate the market:

-

Covered Call: Selling a call option when you already own the underlying asset to generate income (premium) while limiting your potential gains in case of price appreciation.

-

Protective Put: Buying a put option when you own an asset to hedge against potential losses if the price falls below a certain level, particularly useful during downward market movements.

-

Bull Call Spread: Combining a lower-strike-price call option (bought) with a higher-strike-price call option (sold) to create a bullish position with a defined risk and profit potential, suitable for markets with anticipated upward trends.

-

Bear Put Spread: Involving a lower-strike-price put option (sold) and a higher-strike-price put option (bought), this strategy creates a bearish position with defined risk and profit potential, ideal for markets expected to move downwards.

-

Straddle: Simultaneous purchase of a call option and a put option with the same strike price and expiration date, providing protection against price movements in either direction but with a higher premium cost, best employed in highly volatile markets.

Trading Options: A Step-by-Step Guide

-

Account Setup: Open an options trading account with a reputable broker that offers competitive rates and a user-friendly platform.

-

Market Analysis: Conduct thorough fundamental and technical analysis to identify potential trading opportunities, assess market trends, and stay informed about economic developments.

-

Strategy Selection: Choose an appropriate options strategy based on your market outlook, risk tolerance, and investment objectives.

-

Option Selection: Determine the type of option (call or put), strike price, and expiration date that align with your chosen strategy and market scenario.

-

Order Execution: Place an order with your broker, specifying the order type (market, limit, or stop), quantity, and price at which you wish to buy or sell the option.

-

Monitoring and Adjustment: Frequently monitor your option positions and market performance, make necessary adjustments by closing or rolling positions to maximize profits and manage risk, and stay vigilant against market shifts.

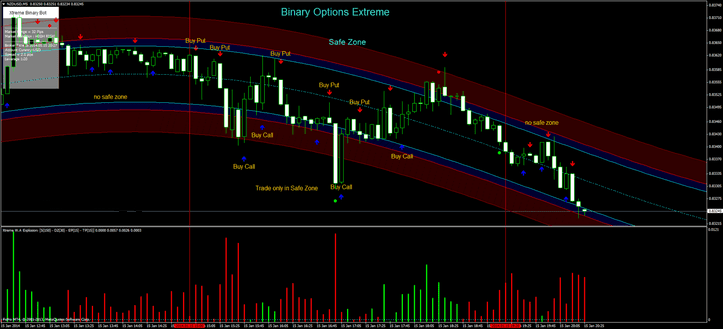

Image: howtotradecurrencys.blogspot.com

Trading Options Fo

Image: www.closeoption.com

Conclusion

Options trading, while complex, holds immense potential for those willing to dedicate time to learning its intricacies. By embracing a knowledge-based approach and armed with this comprehensive guide, you can embark on this rewarding financial endeavor with greater confidence and understanding. The world of options offers immense opportunities, and with meticulous execution and prudent risk management, you can reap its benefits while navigating the markets with newfound insight. Always prioritize due diligence and seek professional advice when necessary. Embark on this financial adventure with a sound foundation and a thirst for knowledge, and you will find that options trading can be a captivating and ultimately rewarding aspect of your investment strategies.