Introduction

Are you ready to embark on a thrilling adventure in the world of options trading? As you set sail on this financial voyage, you’ll need a trusty guide to navigate the ever-changing seas of fees and commissions. Join us as we venture into the uncharted depths of eTrade options trading fees, uncovering the hidden treasures and treacherous currents that await you.

Image: thebrownreport.com

Options, like precious gems, offer the allure of substantial returns, but they come with their share of risks. To maximize your chances of seizing those hidden treasures, you need a clear understanding of the expenses associated with each trade. eTrade, a renowned brokerage firm, offers a diverse range of options trading services. But before you dive in headfirst, let’s delve into the intricate tapestry of their fees to equip you with the knowledge you need to chart a successful course.

The Ecliptic of eTrade Options Trading Fees

eTrade’s options trading fees are a complex constellation of rates and charges that vary depending on the type of option contract, the number of contracts traded, and even the time of day. To simplify your journey, we’ll break down these fees into easy-to-comprehend categories:

-

Base Fees: These are the non-negotiable fees that apply to every options trade. They include the contract fee ($0.65 per contract) and the regulatory fee (a small additional charge per contract).

-

Activity-Based Fees: The more you trade, the more you’ll be charged. These fees are based on the number of contracts you buy or sell within a given period. For instance, the standard fee for trading up to 10 contracts is $0.75 per contract. If you’re a high-volume trader, you can negotiate reduced rates with eTrade.

-

Tiered Pricing: eTrade offers a tiered pricing structure that rewards larger orders. If you trade significant volumes, you’ll be eligible for discounted rates.

-

Options Exercise and Assignment Fees: These fees come into play when you decide to exercise or assign your option contracts. The fee for exercising an option is $15, while the fee for assigning an option is $20.

-

Margin Interest: If you’re trading options on margin, you’ll be charged interest on the borrowed funds. The interest rate varies based on the current market rate.

Expert Insights: Navigating the Fee Labyrinth

To unlock the true potential of options trading, listen to the wisdom of the masters. Our team of seasoned experts has distilled their insights into three guiding principles:

-

Understand Your Options: Before placing a trade, thoroughly research the different types of options contracts and their associated risks. This knowledge will empower you to make informed decisions and avoid costly mistakes.

-

Plan Your Trades: Don’t let emotions sway your trading strategy. For each trade, determine your entry and exit points, as well as your risk parameters. This disciplined approach will enhance your chances of success.

-

Seek Professional Guidance: Don’t hesitate to consult with a qualified financial advisor if you need assistance navigating the complexities of options trading. Their expertise can save you time, money, and unnecessary stress.

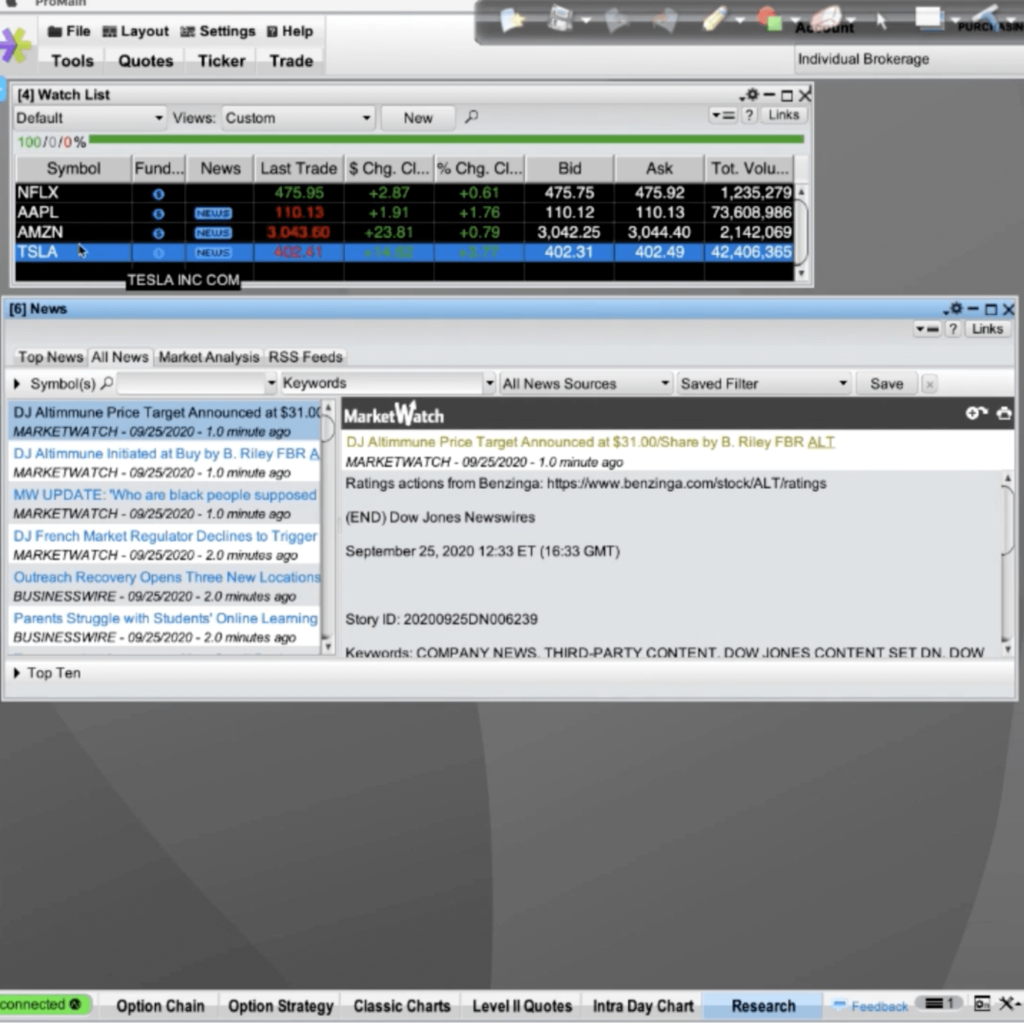

Image: www.youtube.com

Etrade Options Trading Fees

Image: thebrownreport.com

Conclusion

Armed with this newfound knowledge of eTrade options trading fees, you’re ready to embark on your financial odyssey. Remember, the path to success is paved with calculated risks and informed decisions. As you navigate the choppy waters of options trading, embrace the wisdom of our experts, and never stop seeking opportunities to expand your knowledge. May your journey be filled with profitable treasures and countless victories.