Options contracts have emerged as indispensable tools in the financial realm, presenting a unique blend of risk and reward for savvy investors. Embarking on a journey into options trading unlocks a vast array of strategies and opportunities, empowering individuals to navigate market volatility and enhance their portfolios. However, the path to options mastery demands a comprehensive understanding of their intricate nature and the intricate dynamics that govern them. In this comprehensive guide, we delve deep into the world of options trading, deciphering its intricacies and equipping you with the knowledge and strategies to harness its potential.

Image: peherik.web.fc2.com

Unveiling the Options Trading Landscape

Options contracts, essentially, bestow upon the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specified date. This flexibility endows options with their distinctive appeal, enabling investors to tailor their strategies to specific market conditions and risk tolerance. Options trading has gained widespread recognition as a versatile instrument for hedging against market fluctuations, speculating on price movements, and generating potential income through premiums collected.

Diving into the Options Basics

Options trading revolves around a few core concepts that lay the groundwork for successful navigation. First and foremost, we have the underlying asset, which can be a stock, index, currency, or commodity. The strike price denotes the predetermined price at which the buyer can exercise their right to buy (call option) or sell (put option) the underlying asset. The expiration date specifies the cut-off point beyond which the option contract expires, becoming worthless if unexercised.

Premiums are the lifeblood of options trading, representing the price paid by the buyer to acquire the option contract. This premium encompasses the intrinsic value, reflecting the difference between the strike price and the current market price of the underlying asset, and the time value, which captures the remaining time until expiration. The intrinsic value is tangible and can be exercised immediately, while the time value gradually erodes as the expiration date approaches.

Navigating the Options Strategies Kaleidoscope

Options trading offers a rich tapestry of strategies, each catering to specific investment objectives and risk profiles. Covered calls, a popular choice, involve selling (writing) a call option against an underlying stock that you own, generating premium income while limiting potential upside. Protective puts, on the other hand, serve as a safety net for long stock positions, safeguarding against unexpected price declines by purchasing (buying) a put option.

For those seeking more aggressive strategies, bull and bear spreads beckon. Bullish strategies, exemplified by call spreads, anticipate price increases, while bearish strategies, such as put spreads, capitalize on price declines. Iron condors, a more complex strategy, involve selling (writing) both call and put options at different strike prices, aiming to profit from a narrow trading range.

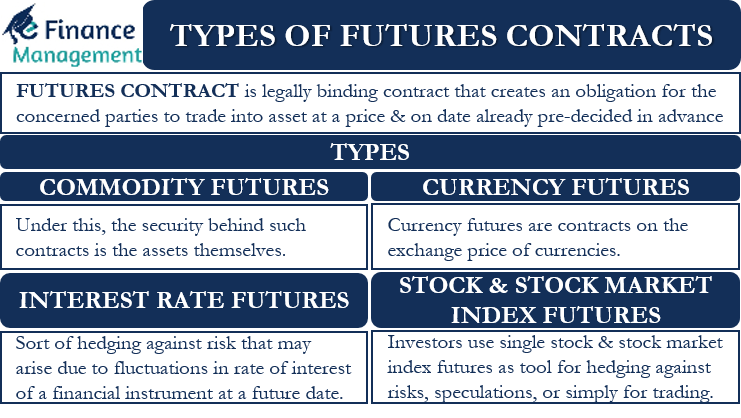

Image: efinancemanagement.com

Surveying the Options Trading Landscape

Options trading venues encompass a diverse array of exchanges and platforms catering to distinct trading styles and needs. The Chicago Board Options Exchange (CBOE), a venerable institution, stands as the birthplace of options trading, specializing in standardized options contracts. Other notable exchanges include the International Securities Exchange (ISE), the largest electronic options exchange, and the American Stock Exchange (AMEX), renowned for its extensive options offerings.

Understanding Stock Options and Employee Stock Options

Stock options, granted by companies to employees as part of their compensation package, present a unique opportunity for ownership stake and potential financial gains. Stock options bestow the right to purchase company stock at a predetermined price, typically below the current market value, within a specified time frame. Employee stock options serve as a powerful incentive for employee retention and alignment with company goals.

Make Trading Options Contracts

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

Image: www.kingdavidsuite.com

Conclusion: Unlocking the Potential of Options Contracts

Options trading, with its inherent flexibility and vast array of strategies, empowers investors to navigate market complexities and pursue their financial objectives. Embracing a thorough understanding of options concepts, strategies, and venues is paramount for successful participation in this dynamic market. Options trading offers a potent toolset for hedging, speculation, and income generation, expanding the horizons of financial possibilities for savvy investors. So, embark on this journey of options mastery, harness the potential of these versatile contracts, and unlock the gateway to informed and rewarding financial endeavors.