In the ever-dynamic world of finance, understanding the intricacies of options trading is crucial for savvy investors looking to navigate the markets with finesse. Among the various options available, those tied to the Dow Jones Industrial Average (DJIA) offer a unique opportunity to tap into the pulse of the US stock market. In this comprehensive guide, we delve into the world of DJIA options trading, providing you with a clear understanding of its mechanics, strategies, and potential risks.

Image: finance.yahoo.com

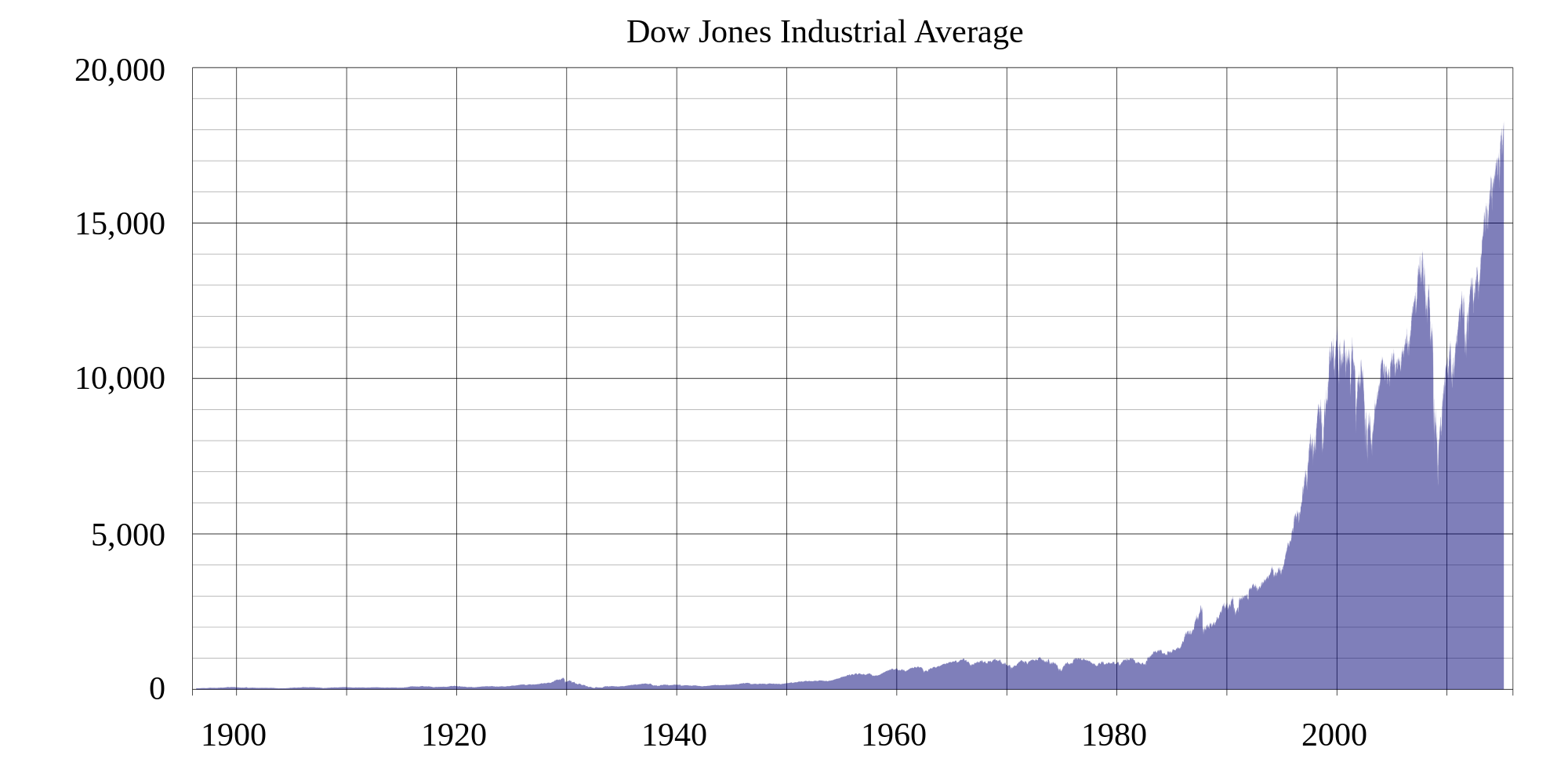

The Dow Jones Industrial Average: A Market Barometer

The Dow Jones Industrial Average (DJIA) is a celebrated stock market index that gauges the performance of 30 prominent companies listed on the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. Its long history dating back to 1896 makes it one of the most recognized and widely followed market indicators. DJIA options grant investors the right, but not the obligation, to buy or sell the underlying index at a specified price on a predetermined date. By leveraging these options, traders can speculate on the future direction of the DJIA, potentially profiting from market movements without having to own the underlying stocks.

Decoding DJIA Options Trading

Trading DJIA options involves understanding a few key concepts. The underlying asset is the DJIA itself, representing the value of the 30 blue-chip companies that constitute it. The strike price is the price at which the trader can buy or sell the index, while the expiration date determines when the option contract expires and becomes worthless. Option premiums, paid by the buyer to the seller, reflect the market’s perceived likelihood of the option being exercised. Understanding these elements is essential for effective DJIA options trading.

Bearish vs Bullish Options Strategies

Whether you anticipate market gains or declines, DJIA options offer strategies to align with your outlook. Bullish options, such as calls, allow you to profit if the DJIA rises above a specific strike price before the expiration date. In contrast, bearish options, known as puts, provide the potential for gains when the DJIA falls below a set strike price. Choosing the right strategy hinges on your market expectations and risk tolerance.

Image: introducingtradestops.com

Benefits and Risks of DJIA Options Trading

The potential benefits of DJIA options trading include the ability to speculate on market movements with limited capital outlay compared to stock ownership. Moreover, options provide flexibility, allowing traders to customize their positions based on their risk appetite and market outlook. However, it is vital to recognize the inherent risks associated with options trading. Fluctuations in the underlying DJIA can result in significant losses, and the time-sensitive nature of options contracts adds another layer of risk that traders must carefully consider.

Industry Insights and Expert Tips

Staying abreast of the latest trends and developments in DJIA options trading is crucial for informed decision-making. Industry forums, social media platforms, and reputable news sources offer valuable insights into market dynamics. Seeking guidance from experienced traders and financial advisors can also be highly beneficial. Their insights, combined with your research and risk assessment, can empower you to make informed trades that align with your financial objectives.

Navigating DJIA Options Trading with Precision

To maximize your chances of success in DJIA options trading, consider these expert tips. Conduct thorough research on market conditions and the underlying index to make informed decisions. Diversify your portfolio to mitigate risks, and use limit orders to control potential losses. Additionally, focus on understanding the profit and loss dynamics of different strategies, and exercise caution when trading during periods of high market volatility.

Frequently Asked Questions on DJIA Options Trading

To clarify any lingering questions, here is a curated list of frequently asked questions about DJIA options trading:

-

What is an option premium?

It is the price paid by the buyer for the right, but not the obligation, to buy or sell the underlying asset at a specific price on a specified date.

-

What is the difference between a call and a put option?

A call option gives the buyer the right to buy, while a put option gives them the right to sell the underlying asset at the strike price on or before the expiration date.

-

Can I lose more money than I invested in options trading?

Yes, if the market moves against your position and the value of your option contract drops to zero before the expiration date.

-

When is the best time to trade DJIA options?

The best time to trade depends on your market outlook and trading strategy. Research market conditions, monitor news and economic indicators, and choose a trading time that aligns with your risk tolerance.

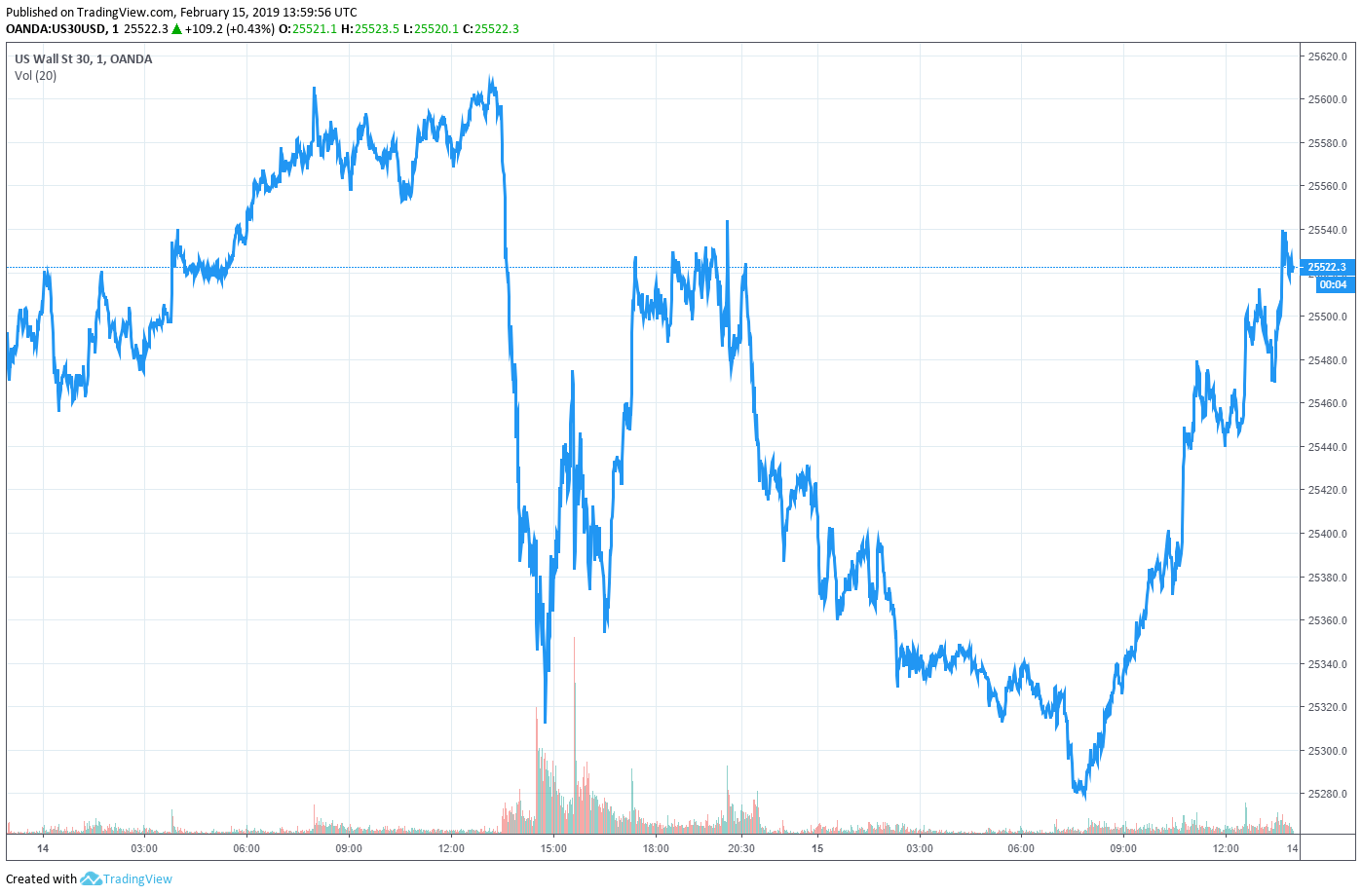

Dow Jones Industrial Average Options Trading

Image: www.howthemarketworks.com

Conclusion

In the realm of financial markets, DJIA options trading presents an exciting yet nuanced opportunity for investors. By understanding the mechanics, strategies, and potential risks associated with this dynamic asset, traders can make informed decisions that align with their financial goals. Remember, the key to successful trading lies in continuous learning, strategic planning, and conscious risk management. Are you ready to embark on the journey of DJIA options trading?