Introduction

Options trading has emerged as a powerful tool for investors seeking to navigate the volatile landscape of financial markets. One of the most iconic indices in the realm of options trading is the Dow Jones Industrial Average (DJIA), a bellwether of the U.S. stock market. Whether you’re a seasoned trader or a novice looking to venture into this dynamic world, this comprehensive guide will provide you with invaluable insights and strategies to empower your options trading endeavors in relation to the DJIA.

Image: www.learntradingwithjd.com

What Are Options and How Do They Work?

An option is a financial instrument that gives its holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a particular date (expiration date). The buyer of an option pays a premium to the seller of the option in exchange for this right. The underlying asset can be stocks, indices like the DJIA, commodities, or other financial instruments.

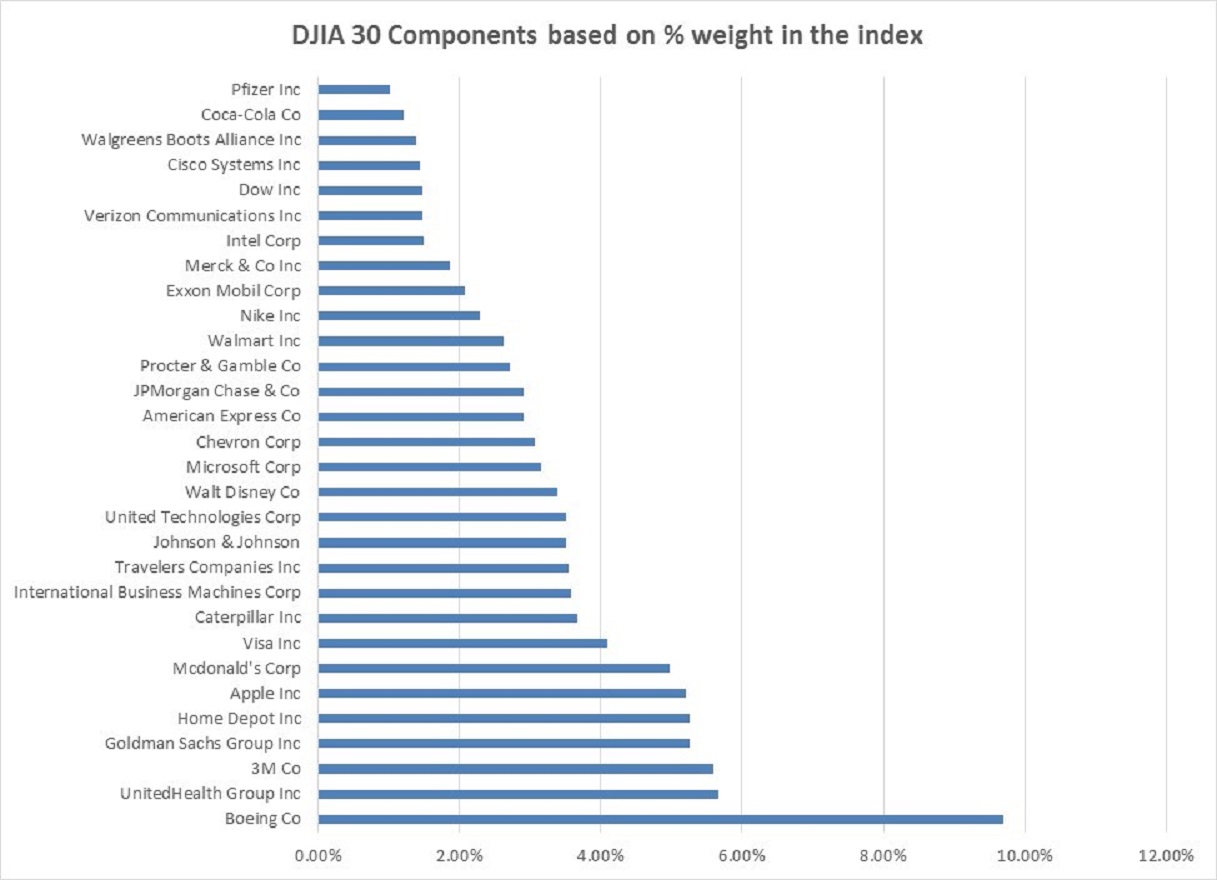

The Anatomy of the DJIA

The Dow Jones Industrial Average is a market-capitalization-weighted index that comprises 30 blue-chip American companies. Established in 1896, the DJIA serves as a barometer of the health and direction of the overall U.S. stock market. Companies included in the DJIA represent various industries, ranging from technology to manufacturing, finance, and healthcare.

Options Trading and the DJIA

Options trading provides investors with a versatile toolset for speculating on the price movements of the DJIA. By using options, traders can express their views on the market’s direction, hedge against risk, and enhance the potential returns on their investments. Some common strategies include:

Image: www.withum.com

1. Buying Call Options:

Traders buy call options when they expect the DJIA to rise. If the DJIA surpasses the strike price before the expiration date, the trader can exercise the option to buy the index at the strike price, potentially profiting from the price appreciation.

2. Selling Call Options:

Traders sell call options when they believe the DJIA will remain stable or decline. If the index remains below the strike price, the trader keeps the premium received from selling the option. However, they may have to deliver the underlying asset if the DJIA rises above the strike price before expiration.

3. Buying Put Options:

Traders buy put options when they anticipate a drop in the DJIA. If the index falls below the strike price, the trader can exercise the put option to sell the index at the strike price, profiting from the price decline.

4. Selling Put Options:

Traders sell put options when they expect the DJIA to rise or remain steady. In this scenario, the trader receives the premium from selling the option but is obligated to buy the asset if the DJIA falls below the strike price.

Factors Influencing the Dow Jones Industrial Average

A multitude of factors can impact the price movements of the Dow Jones Industrial Average, including economic indicators, geopolitical events, interest rate decisions, and technological advancements. By monitoring these factors, traders can make informed decisions about their options trading strategies.

1. Economic Indicators:

Economic data, such as GDP growth, inflation, unemployment, and consumer spending, can provide insights into the overall health and direction of the economy, which in turn can influence the performance of the DJIA.

2. Geopolitical Events:

Global events, like political instability, trade disputes, or wars, can introduce volatility into the financial markets and impact the value of the DJIA.

3. Interest Rate Decisions:

Interest rate changes by central banks can affect stock prices and market sentiment. Higher interest rates can slow economic growth, while lower interest rates tend to stimulate it.

4. Technological Advancements:

Technological breakthroughs and disruptions can significantly impact the performance of individual companies and, by extension, the overall DJIA.

Options Trading Dow Jones

Image: www.colibritrader.com

Conclusion

Options trading in relation to the Dow Jones Industrial Average offers a plethora of opportunities for investors to capitalize on market movements and hedge against risk. By comprehending the fundamental concepts, strategies, and factors influencing the DJIA, traders can navigate the markets with greater confidence and potentially achieve their financial goals. Engage in thorough research, seek advice from financial professionals, and continue your pursuit of knowledge to become a proficient options trader in the dynamic realm of the Dow Jones Industrial Average.