In the bustling financial metropolis, where fortunes are forged and lost in the flicker of a nanosecond, options trading stands as a formidable force, empowering traders with the potential for exponential returns. Among the myriad options markets, the Dow Jones Industrial Average (DJIA) options market beckons with its unique blend of volatility and tradability. But navigating this intricate terrain requires a deft hand and a comprehensive understanding of its complexities. Enter this in-depth exploration of Dow Jones options trading, where we unravel the intricacies of this dynamic market, decipher its nuances, and unveil actionable strategies to empower you in your trading endeavors.

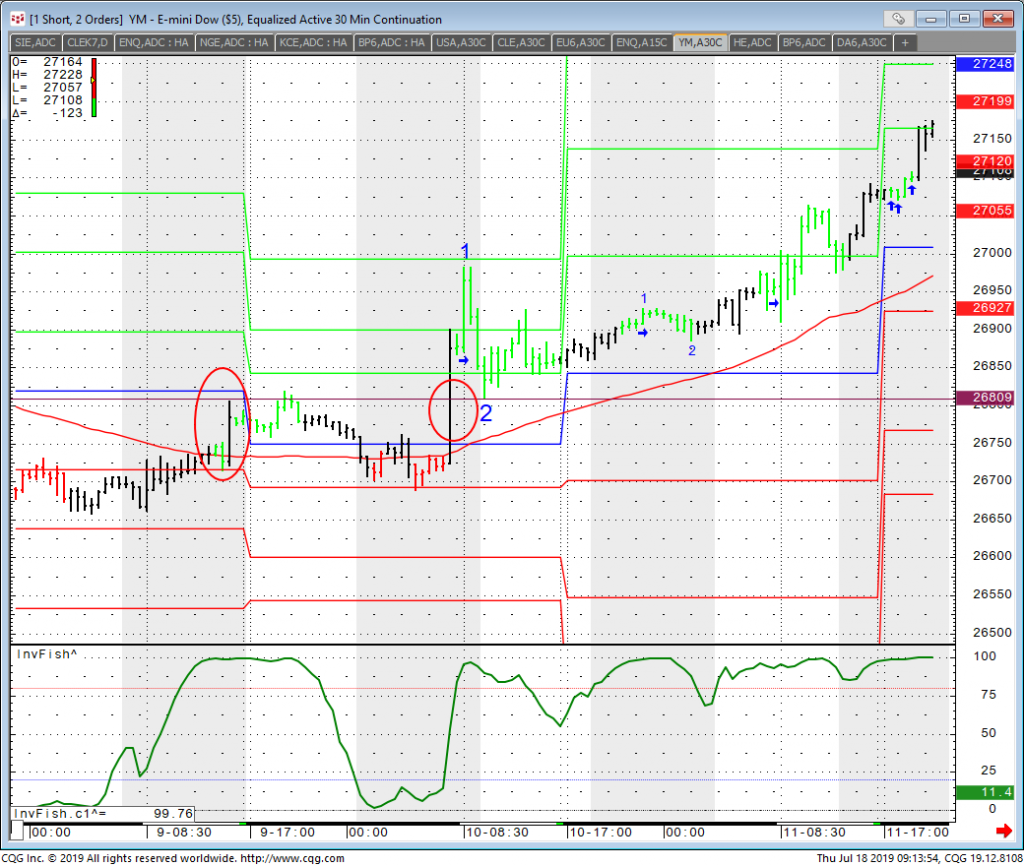

Image: www.cannontrading.com

Deciphering Dow Jones Options Trading: A Gateway to Market Mastery

Dow Jones options trading grants traders the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specified number of shares of the Dow Jones Industrial Average (DJIA) at a predetermined strike price on or before a set expiration date. This flexibility allows traders to position themselves for potential market movements while mitigating potential risks.

Understanding the dynamics of Dow Jones options trading is paramount for successful navigation. Key concepts like strike price, expiration date, and option premium lay the foundation for effective trading strategies. Strike price represents the price at which the trader can exercise the option to buy or sell the underlying asset, while expiration date signifies the deadline by which the option must be exercised. Option premium, on the other hand, is the price paid to acquire the option contract, representing the potential profit or loss.

Mastering the Art: Strategies for Profitable Dow Jones Options Trading

The art of Dow Jones options trading lies in the strategic interplay of these core concepts. Seasoned traders employ diverse strategies to harness market opportunities, each tailored to specific market conditions and risk tolerance.

Covered call writing involves selling a call option against a long position in the underlying asset, generating income from the option premium while limiting potential upside gains. Conversely, buying a call option conveys the right to purchase the underlying asset at a specified price, enabling traders to capitalize on anticipated market rallies.

For those seeking downside protection, put options offer a valuable tool. Buying a put option grants the right to sell the underlying asset at a specified price, hedging against potential market downturns. Alternatively, selling a put option obligates the trader to buy the underlying asset if the market price falls below the strike price, providing income generation opportunities.

Expert Insights: Unlocking the Secrets of Dow Jones Options Trading

To delve deeper into the intricacies of Dow Jones options trading, we sought the wisdom of industry experts, renowned for their market acumen and trading prowess.

“Understanding market trends is crucial,” advises seasoned trader Mark Douglas. “By analyzing historical data, technical indicators, and economic factors, traders can make informed decisions about market direction.”

Echoing this sentiment, options expert Dr. Richard Dennis emphasizes the importance of risk management. “Never risk more than you can afford to lose, and always set stop-loss orders to mitigate potential losses.”

Image: oviresirym.web.fc2.com

Dow Jones Options Trading

Conclusion: Embracing the Power of Dow Jones Options Trading

Dow Jones options trading offers a compelling avenue for investors seeking to amplify their market returns and manage risk. By mastering the core concepts, employing strategic trading techniques, and heeding the wisdom of experts, traders can unlock the full potential of this dynamic market. Embrace the complexities of Dow Jones options trading, navigate its challenges with confidence, and emerge as a triumphant force in the financial arena.