Introduction

In the realm of investment strategies, covered options trading stands out as a compelling tool for investors seeking to generate income while managing risk. By combining stock ownership with options contracts, covered options traders aim to capitalize on market fluctuations and enhance their portfolio returns. TD Ameritrade, a leading online brokerage firm, offers a comprehensive platform that caters to the needs of options traders, making it an ideal choice for those exploring covered options trading. This guide delves into the fundamentals of covered options trading with TD Ameritrade, empowering you to harness this strategy effectively.

Image: binary.mxzim.com

Understanding Covered Options Trading

Covered options trading involves selling a call option (an option to buy) against a corresponding number of shares that the trader already owns. By doing so, the trader receives a premium (payment) from the option buyer. In return for this premium, the trader assumes the obligation to sell the underlying shares at the strike price (agreed-upon price) should the option buyer exercise their right to buy. The trader retains ownership of the shares throughout the option’s life.

The primary advantage of covered options trading lies in the income generation potential. By selling call options, the trader generates a premium income while maintaining the potential upside of the underlying shares. If the stock price appreciates, the trader can still benefit from the increase in share value. However, if the stock price declines, the potential losses are limited to the initial investment minus the premium received.

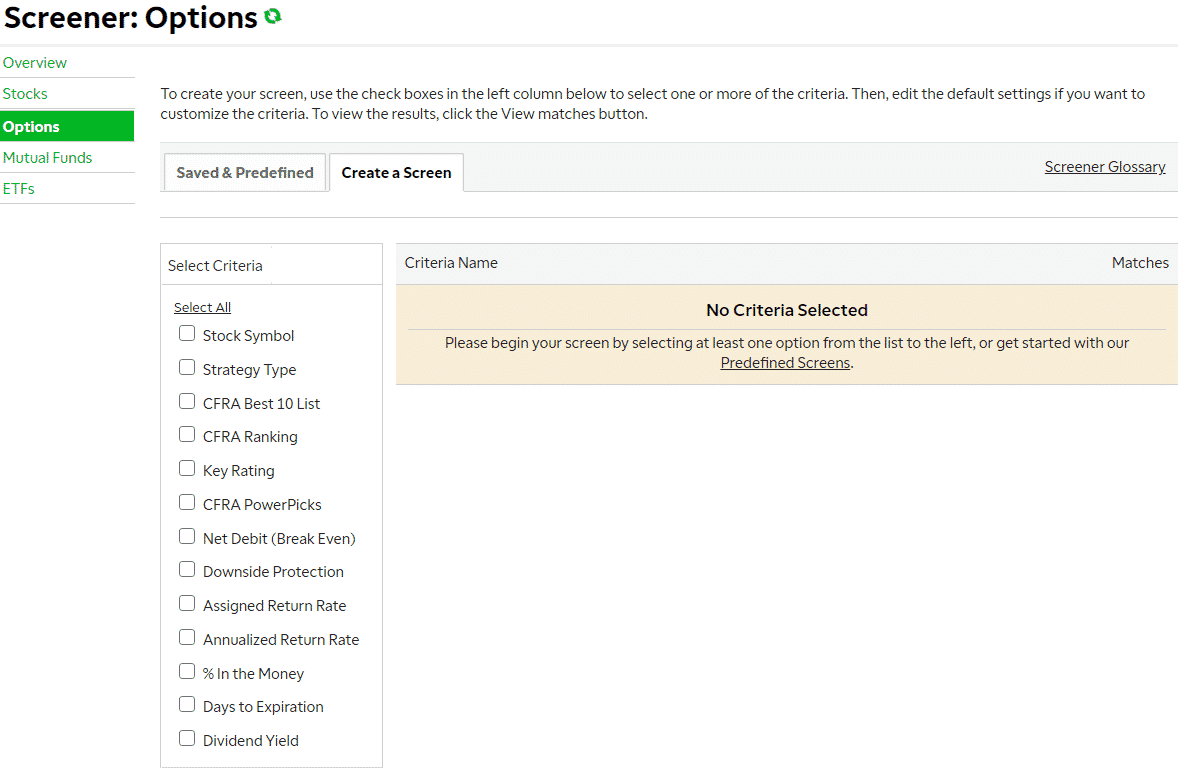

Covered Options Trading with TD Ameritrade

TD Ameritrade provides a user-friendly trading platform that seamlessly integrates options trading capabilities. The platform offers an intuitive interface, comprehensive charting tools, and advanced order types, empowering traders with the necessary tools for effective covered options trading.

TD Ameritrade’s thinkorswim platform is particularly noteworthy for its advanced options trading features. This platform provides detailed option chain analysis, allowing traders to evaluate different strike prices and expiration dates to optimize their strategies. Additionally, the platform offers real-time market data and customizable alerts, ensuring that traders can stay informed and make informed decisions.

Step-by-Step Guide to Covered Options Trading with TD Ameritrade

-

Open an Account: Begin by opening a TD Ameritrade brokerage account. This account will serve as your gateway to the trading platform and its various features.

-

Select Underlying Asset: Determine the stock or ETF that you wish to trade. Consider factors such as industry outlook, earnings reports, and technical analysis.

-

Choose an Expiration Date: Select the expiration date for your options contract. This date determines the period for which you are obligated to sell the shares if assigned.

-

Determine Strike Price: The strike price represents the price at which the option buyer has the right to purchase your shares. Consider the current market price of the underlying asset and your expectations for future price movements.

-

Sell the Call Option: Enter an order to sell a call option against the underlying shares you own. Specify the contract details, including strike price, expiration date, and quantity.

-

Monitor and Adjust: Once you have sold the call option, monitor the market performance closely. You may adjust your position if necessary, such as closing the option early or rolling it over to a different expiration date.

Image: tradingbrokers.com

Advanced Considerations

While covered options trading offers numerous benefits, it is essential to be aware of potential risks. Stock market fluctuations can impact the profitability of your trades. Additionally, the premium received may not always offset potential losses if the stock price declines significantly.

To mitigate these risks, consider adopting a conservative approach by selling call options with strike prices above the current market price. Additionally, maintain a diversified portfolio and avoid over-concentrating your trades in a single underlying asset.

Covered Options Trading Td Ameritrade

Image: optionstradingiq.com

Conclusion

Covered options trading with TD Ameritrade can be a powerful strategy for generating income while managing risk. By understanding the fundamentals of covered options trading and utilizing the advanced features offered by TD Ameritrade, investors can enhance their portfolio returns. Remember to approach this strategy cautiously, with a thorough understanding of the potential risks and benefits involved. By doing so, you can harness the power of covered options trading to achieve your financial goals.