Introduction: Unlocking the World of Options Trading with Fidelity

In today’s dynamic investment landscape, the ability to trade options has become an indispensable tool for savvy traders. Options provide a versatile way to navigate market volatility, hedge against risk, and enhance portfolio returns. For those looking to venture into the realm of options trading, Fidelity Investments stands out as a reputable provider offering a comprehensive suite of services. In this article, we delve into the world of options trading with Fidelity, exploring the platform’s features, benefits, and what it takes to get started.

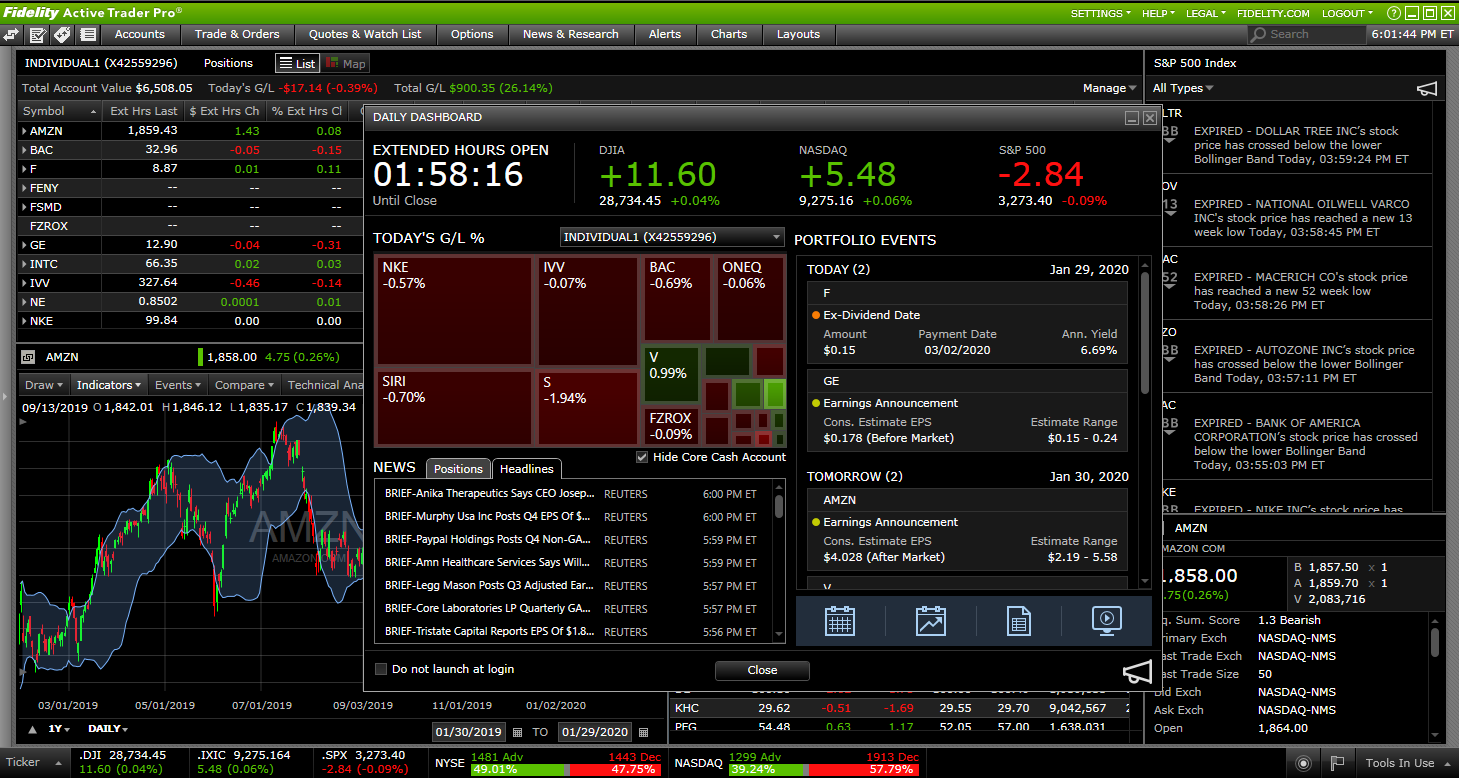

Image: tradingplatforms.com

Understanding Options Trading: The Basics

Options represent contracts that grant the buyer (holder) the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). These contracts offer potential advantages for both conservative investors seeking risk mitigation and aggressive traders aiming for higher returns.

Fidelity’s Options Trading Platform: A Trader’s Haven

Fidelity’s options trading platform is meticulously designed to cater to the diverse needs of traders of all levels. Whether you’re a seasoned pro or a novice explorer, Fidelity empowers you with a user-friendly interface, robust trading tools, and dedicated educational resources.

1. Intuitive Interface: Simplicity at Your Fingertips

Fidelity’s platform boasts a remarkably intuitive design, ensuring seamless navigation and effortless order placement. The clean layout and customizable screens allow you to tailor the workspace to suit your preferences, providing a personalized and efficient trading experience.

Image: www.stockbrokers.com

2. Advanced Trading Tools: Precision and Control

For traders seeking greater precision in their options strategies, Fidelity offers an array of advanced trading tools. The platform’s option chain analysis feature enables you to quickly identify potential trading opportunities based on various parameters. Additionally, the volatility and Greeks calculators help gauge market sentiment and quantify potential risk and reward.

3. Comprehensive Education Center: Knowledge is Power

Fidelity recognizes the significance of education in empowering traders. The platform’s comprehensive education center features an extensive library of articles, webinars, and videos covering all aspects of options trading. Whether you’re seeking a refresher on the basics or delving into advanced concepts, these resources provide valuable insights to enhance your understanding and decision-making.

Benefits of Options Trading with Fidelity

Trading options with Fidelity comes with a myriad of advantages that cater to both beginners and seasoned traders:

1. Low Trading Fees: Cost-Effective Access to Options

Fidelity offers highly competitive trading fees that make options trading accessible to a wider pool of investors. The platform’s tiered pricing structure rewards active traders with reduced rates, allowing them to maximize their profits while keeping costs low.

2. Margin Trading: Enhanced Buying Power

For traders seeking to amplify their returns, Fidelity provides access to margin trading. Margin trading allows you to borrow funds to purchase additional securities, effectively increasing your buying power. However, it’s crucial to use margin responsibly, understanding the potential risks involved.

3. Tax-Advantaged Accounts: Optimizing Returns

Fidelity allows you to trade options within tax-advantaged accounts such as IRAs and 401(k)s. These accounts offer potential tax savings, enabling your investments to compound over time with fewer tax implications.

Getting Started with Fidelity’s Options Trading Platform

Embarking on your journey of options trading with Fidelity is a straightforward process:

1. Open an Account: Join the Fidelity Family

To access Fidelity’s options trading platform, you’ll need to open an account. Fidelity offers a range of account types to cater to your individual needs. Simply visit their website and select the account that best aligns with your financial goals.

2. Fund Your Account: Fuel Your Trading

Once your account is open, you’ll need to fund it in order to begin trading. Fidelity offers various funding options, including bank transfers, wire transfers, and check deposits. Choose the method that best suits your preference and ensure your account is sufficiently funded to execute your trades.

3. Place Your Order: Dive into Options Trading

With your account funded, you’re all set to start trading options. Navigate to the options trading platform and browse the available options contracts. Select the underlying asset, strike price, and expiration date that align with your trading strategy. Enter the desired quantity and price, preview your order, and execute the trade with confidence.

Does Fidelity Have Options Trading

Image: zulassung-pieske.de

Conclusion: Unlocking Your Trading Potential with Fidelity

Fidelity offers a comprehensive and accessible platform for traders of all levels looking to explore the world of options trading. With its user-friendly interface, advanced trading tools, and dedicated education center, Fidelity empowers you to make informed decisions and navigate the complexities of options trading effectively. Whether you’re seeking to mitigate risk, enhance returns, or expand your investment horizons, Fidelity’s options trading platform provides a gateway to unlock your full trading potential. Embark on your options trading journey today with Fidelity and discover the endless possibilities of this dynamic investment strategy.