Dive into the World of Technical Analysis

Candlestick patterns, technical indicators, chart patterns, and the Elliott Wave Theory are fundamental pillars of technical analysis, a powerful tool that empowers traders to decipher market trends and price movements by examining historical data. Wedge patterns, a prominent chart pattern, offer valuable insights into potential market shifts and present opportunities for astute option traders.

Image: www.cmcmarkets.com

Traders can gain a competitive edge by staying abreast of market trends and leveraging the latest insights from industry experts. Forums and social media platforms are vibrant hubs of knowledge, providing real-time updates and thought-provoking discussions that can enrich your trading strategies.

Unveiling the Secrets of Wedge Patterns

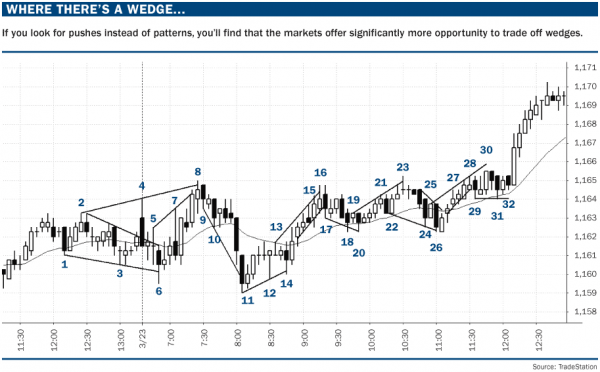

Wedge patterns are characterized by a price movement that forms a triangle with converging trendlines. Ascending wedges, with upward-sloping trendlines, indicate potential bearish reversals, while descending wedges, featuring downward-sloping trendlines, hint at bullish breakouts.

The power of wedge patterns lies in their ability to predict future price movements. When a price breaks through the wedge’s trendlines, it often signals a substantial move in the direction of the breakout. Understanding how to recognize and trade these patterns can significantly enhance your option trading profitability.

Trading Wedge Patterns: A Comprehensive Guide

To effectively trade wedge patterns, it’s crucial to master the following steps:

- Identify the Wedge: Begin by identifying a clear wedge formation with converging trendlines.

- Determine the Breakout Direction: Study the direction of the breakout to anticipate the future price movement.

- Plan Your Entry: Choose an optimal entry point near the breakout point, ensuring you enter at a favorable price.

- Set Take-Profit and Stop-Loss Orders: Define your exit strategy by setting take-profit and stop-loss orders. These orders will automatically close your position, protecting your gains and limiting potential losses.

- Manage Your Risk: Risk management is paramount. Never invest more than you can afford to lose, and carefully calculate position size based on your risk tolerance.

Expert Advice for Wedge Pattern Trading

Seasoned traders advocate the following tips for successful wedge pattern trading:

- Confirmation is Key: Look for confirmation of the breakout by confirming the price movement with additional technical indicators or candlestick patterns.

- Trade the Longer Timeframes: Timeframes of 4 hours or more offer more reliable wedge patterns.

- Avoid False Breakouts: Be wary of false breakouts, which can lead to costly trades. Wait for a clear and decisive breakout before entering.

Image: ar.inspiredpencil.com

Frequently Asked Questions on Wedge Patterns

- Q: What is the difference between an ascending and descending wedge?

A: Ascending wedges indicate potential bearish reversals, while descending wedges suggest bullish breakouts. - Q: How can I confirm a wedge breakout?

A: Confirmation comes from corroborating the price movement with additional technical indicators or candlestick patterns. - Q: What is a false breakout?

A: False breakouts occur when the price briefly breaks through a wedge’s trendline but fails to sustain the breakout and reverses back within the wedge.

Youtube How To Use Wedges In Option Trading

Image: www.brookstradingcourse.com

Conclusion: Embracing Wedge Patterns

Wedge patterns are powerful chart patterns that provide valuable trading opportunities. By understanding how to identify, trade, and manage wedge patterns, you can enhance your option trading strategies and stay ahead in the dynamic financial markets.

Are you intrigued by the fascinating world of wedge patterns and eager to embark on a journey of profitable option trading? If so, I encourage you to deepen your exploration by seeking further educational resources.